Like many other countries around the world, Turkey is also at odds with the Trump administration and has been hit with the U.S. sanctions. A worsening dispute between the United States and Turkey reverberated through the global economy on Friday, escalating a broad flight of money from emerging markets and making global financial market nervous amid fear that the emerging-market troubles could spillover to the rest of the world. The fear of market contagion was somewhat justified after reports surfaced that the European Central Bank was assessing its exposure to Turkey.

The European Central Bank is worried about non-hedged exposure of European banks to Turkish companies and if Turkish banks fail, there’s no question that it will affect markets around the world. Data from the Bank for International Settlements showed that banks in Spain, France and Italy had the highest exposure to the Turkish economy at the end of the first quarter, adding up to USD 81 billion, USD 35 billion and USD 18 billion respectively.

The recent crisis in Turkey erupted after President Donald Trump on Friday tweeted that he had authorized the doubling of steel and aluminium tariffs “with respect to Turkey.” Trump said the tariffs on aluminium imports would be increased to 20% and those on steel to 50% as the Turkish Lira “slides rapidly downward against our very strong Dollar!”. He also wrote that “Our relations with Turkey are not good at this time!”.

However. On Friday President Recep Tayyip Erdogan declared his refusal to bow to U.S. political demands and market pressures forcing Turkey to enter full-blown financial meltdown. The lira plunged as much as 17% on Friday alone, bringing its loss for the year to 45%. The currency drop is particularly painful for Turkey because the country finances a lot of its economic growth with foreign money.

As the currency drops, Turkish companies and households with debt in foreign currencies see the cost of repaying loans rising, which coupled with an inflation rate of nearly 16% could cause severe damage to the local economy. Foreign investors will try to pull their money out, reinforcing the currency drop and potentially leading to financial instability.

The USD rose to fresh 2018 highs against major world currencies on Friday after the euro slumped on concerns about European banks’ exposure to Turkey as the country’s currency crashed. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 1.26% on a week on week basis and is at a level of 96.36. However, USD was lower against the safe-haven yen, with Japanese Yen appreciating by 0.38% against USD last week. In times of uncertainty, investors tend to invest in the Japanese yen, which is considered a safe asset during periods of risk aversion.

USD started the week on a high note amid investor worries about an escalating U.S.-China trade tensions and a slump in the pound to an 11-month low. British pound fell after the comments made by officials about a no-deal Brexit raised fears that Britain would leave the European Union without securing a trade agreement.

U.S. Trade Representative’s office said on Tuesday that the U.S. would begin collecting 25% tariffs on another USD 16 billion of goods it imports from China later this month. The move is the latest by Washington to pressure China into negotiating trade concessions after it imposed tariffs on USD 34 billion of goods in July.

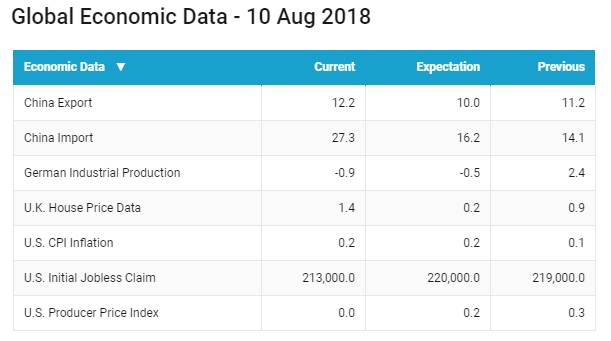

However, the Chinese trade data released on Tuesday showed that the Chinese exports jumped 12.2% in July, while imports surged 27.3%, beating expectations and providing some calm despite the fact the first round of U.S. tariffs were implemented last month.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 8 bps as turmoil in Turkey increased safe-haven demand for UST. Yields also fell after U.S. government reported that producer prices rose less than expected in July, one possible sign of anemic inflation in the economy.

The Turkey crisis started after the detention of US pastor Andrew Brunson in Turkey, US President Donald Trump called the Brunson detention a total disgrace. Recently US government announced turkey duty-free access to the US market is being reviewed, which could hit $1.66 billion of annual Turkish imports. On Friday, Donald Trump tweeted he is doubling steel tariffs on Turkish steel imports and our relations with Turkey are not good at this time.

After the Trump tweet, Turkey finance minister Berat Albayrak rolled out the government new economic plan, promising central bank independence and tighter budget discipline. Turkey 10-year bond yield is trading at 20.67% the highest level since Turkey first issued debt of this maturity in 2010.

The U.S. Labor Department said that its U.S. producer price index was unchanged in July 2018, against the market expectations of a 0.2% increase. The producer price index minus volatile food, energy and trade components, rose 0.3% after a similar gain in June 2018.

UST yields came under pressure after Chinese Ministry of Commerce announced a 25% charge on $16 billion worth of U.S. goods. The 333 goods being targeted by China include vehicles such as large passenger cars and motorcycles. Various fuels are on the list, as well as fiber optical cables.

Germany 10-year yields fell by 9 bps, Germany industrial output in June 2018 fell 0.9% month-on-month basis, following a rise of 2.4% in May 2018, with consumer goods production down 1.6% and capital goods falling 0.6%. Overall manufacturing dipped 0.8%. Germany trade surplus also narrowed slightly in June 2018, as exports stayed flat while imports jumped 1.2%, June 2018 industrial production and trade figures suggest that the German economy is already feeling the effects of trade tensions.

Italy 10-year benchmark bond yields rose by 7 bps, Italy anti-establishment coalition government, which took office in June 2018, has ambitious spending plans that have raised concerns on financial markets. Italy Deputy Prime Minister Luigi Di Maio said he is confident that in coming months the country will win EU backing for greater budget leeway.

Spain 10-year benchmark bond yields fell by 2 bps, Portugal 10-year benchmark bond yields were flat, Greece 10-year benchmark bond yields rose by 14 bps.

Japan 10-year benchmark bond yields were flat.

Emerging economies 10-year benchmark bond yields were mixed last week.

Indonesia 10-year benchmark bond yields fell by 15 bps after data showed Southeast Asia’s largest economy grew the fastest in 4½ years in Q2 2018, Indonesia’s economy grew 5.27% from a year earlier in the second quarter, helped by robust consumption and above market estimate of 5.16%.

Brazil, Russia, South Africa 10-year benchmark bond yields rose sharply as global trade tensions sparked selling pressure

Russia 10-year benchmark bond yields rose by 47 bps, South Africa 10-year benchmark bond yields rose by 17 bps.

Brazil 10-year benchmark bond yields rose by 71 bps, as per the IMF preliminary note to its final report, Brazil economy is performing below its potential, public debt is high and rising and even more importantly, medium-term growth prospects remain uninspiring. Brazil economy could grow by about 1.8%, supported mainly by domestic consumption and investment. The forecast is much lower than the 2.3% that the IMF itself had predicted in May.

US high-yield bond yields fell by 2 bps to 6.22% and Eurozone high-yield bond yields fell by 5 bps to 3.31%.