Indian Rupee posted gains last week against the USD after touching its new all-time low level of Rs 69.13. INR was supported by USD selling from banks and exporters. INR will continue to gain if RBI hikes rates by 50bps in its policy meet this week.

USD continues to exhibit high volatility last week as President Donald Trump criticised the Federal Reserve and other global central bank on manipulating interest rates. However, USD staged a recovery in the later part of the week and managed to end the week on a positive territory largely due to sharp fall in Euro as ECB President Mario Draghi reiterated that interest rates would remain on hold until next year.

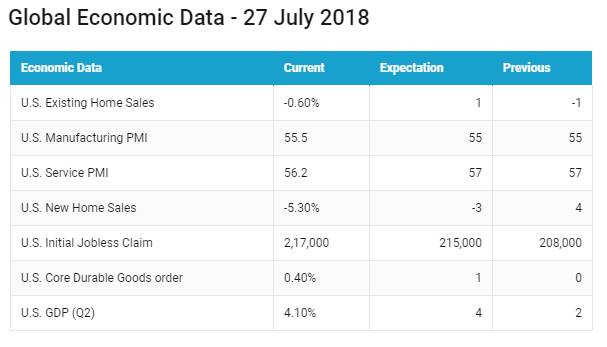

The USD also received support from the strong U.S. GDP data. The second-quarter U.S. GDP increased at a 4.1% annual rate, in line with economists’ forecast. The strong GDP data was driven by a surge in consumer spending aided by tax cuts but was partially offset by negative contributions from private inventory investment and residential fixed investment.

USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.20% on a week on week basis and is at a level of 94.67.

USD started the week on lower note on Monday after Trump launched an attack on the Federal Reserve, claiming that their plans to raise U.S. interest rates risked undermining his efforts at strengthening the economy. He ratcheted up his criticism of the Fed on Friday, taking to Twitter to claim that tighter monetary policy was penalizing the U.S. by contributing to a stronger USD. He also accused China and the European Union of currency and interest-rate manipulation that he claims has put the U.S. at a disadvantage.

USD steadied on Tuesday amid expectations that the Federal Reserve will continue hiking rates this year despite criticism from U.S. President Donald Trump about the impact of higher interest rates, but slipped lower as trade tensions eased after the U.S. and the European Union agreed on steps to avoid trade wars.

U.S. President Donald Trump reached an agreement with European Commission President Jean-Claude Juncker on Wednesday to expand European imports of U.S. liquefied natural gas and soybeans and reduce industrial tariffs on both sides.

Euro depreciated by 0.57% against USD last week largely due to sharp fall seen on Thursday after European Central Bank President Mario Draghi reiterated that interest rates will remain on hold until summer of 2019, highlighting the widening monetary policy divergence with the Federal Reserve.

Draghi said that the euro area economy still needs “significant monetary policy stimulus,” despite announcing plans last month to wind up the bank’s quantitative easing program at the end of the year. Draghi added that it is “too early” to assess the impact of the agreement between Europe and the U.S. to cooperate on trade, but said it was a good sign.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 8 bps, U.S. government bond yields rose after upbeat U.S GDP data for second-quarter. US GDP jumped 4.1% in Q2-2018, GDP reading will enable the Federal Reserve to stay on track with its current pace of rate hikes.

Market also reacted to tariff developments amid reports that the European Union and the U.S. were laying the groundwork for easing trade tensions, which had been a source of anxiety for global markets. Top EU official Jean-Claude Juncker and President Donald Trump, met at the White House, to resolve trade issues. Trump said talks had yielded an agreement to work toward zero tariffs and zero subsidies on non-auto industrial goods and included an EU pledge to import more U.S. soybeans. The news eases some concerns over the tit-for-tat trade battles between the U.S. and Eurozone.

The European Central Bank (ECB) decided to maintain the key interest rates for the euro area, expecting rates to remain at their present levels at least through the summer of 2019. The Eurozone base interest rate will remain at 0.00%, with the marginal lending rate and deposit rate remaining at 0.25% and -0.40% respectively.

ECB reaffirmed that the monthly net asset purchases will be cut to 15 billion euros from October until the end of December 2018 and that net purchases will then end.

UK 10-year yields rose by 6bps and touched nearly 1-month lows after the Bank of England (BoE) acknowledged that Brexit poses major tailwind for the country’s economic growth, in its Financial Stability Report.

Italy 10-year benchmark bond yields rose by 15 bps, Spain 10-year benchmark bond yields rose by 8 bps, Portugal 10-year benchmark bond yields fell by 5 bps.

Greece 10-year benchmark bond yields fell by 5 bps. Greek 10-year bond yields inched toward their lowest level since the end of April 2018, after S&P Global Ratings raised its outlook on Greece on Friday to positive from stable while affirming its B-plus/B ratings. Last month, S&P raised its long-term debt rating on Greece

Japan 10-year benchmark bond yields rose by 6 bps, Japan 10-year bond yields rose towards 0.1%, marking a fresh six-month high amid speculation that Bank of Japan could scale back its stimulus programme

Emerging economies 10-year benchmark bond yields were mixed last week.

China 10-year benchmark bond yields rose by 5 bps, Chinese government bond yields rose after Beijing vowed to pursue a more vigorous fiscal policy. The government is sending a clear signal that it is preparing to defend growth amid rising economic headwinds.

Australia 10-year benchmark bond yields were flat, Australia inflation is expected to rise 0.5% QoQ and 2.2% YoY. If this is realized, the inflation data will breach the lower bound of the RBA inflation target of 2-3%. This will further support the Reserve Bank of Australia (RBA) view of remaining optimistic on interest rate hikes.

Russia 10-year benchmark bond yields rose by 6 bps, Indonesia 10-year benchmark bond yields fell by 12 bps, Brazil 10-year benchmark bond yields fell by 5 bps, South-Africa 10-year benchmark bond yields fell by 15 bps.

US high-yield bond yields fell by 10 bps to 6.27% and Eurozone high-yield bond yields fell by 8 bps to 3.31%.