Indian rupee slumped to its lowest-ever close on Thursday at Rs 68.88 against the USD, the previous closing low was the Rs 68.81, on August 28, 2013, when the currency was in a free fall as foreign investors pulled out from emerging markets in what came to be known as the ‘taper tantrum’. On weekly basis, INR depreciated by 0.59% against the USD and by 1.16% against the euro.

INR started the week on a lower note after posting gains on Friday largely on the back of RBI interventions as data released by the RBI on 29th June showed India’s FX reserves saw erosion of USD 2.25 billion. RBI intervention continues to support INR as data released on 6th July showed that FX reserves eroded by USD 1.75 billion, and reserves for the week ended 29th June stands at USD 406.05 billion.

The INR came under pressure this week amid concerns over global trade tension, rising crude oil prices and hawkish fed stance. Further, the government’s recent decision to increase minimum support prices for farmers also weighed on INR as it is expected to add to inflationary pressures in the economy.

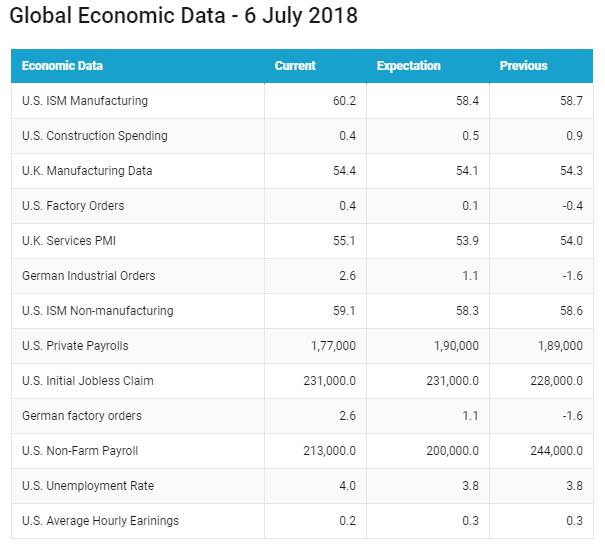

USD ended the week lower as trade tariffs between the U.S. and China officially kicks in and amid mixed monthly jobs report. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.54% on a week on week basis and is at a level of 93.96.

USD started the week on a higher note on Monday after the release of upbeat U.S. economic data pointing to underlying strength in the economy reaffirming investor expectations that the economy would be the least affected in a potential trade war with its trade partners. USD was also supported on Monday by a plunge in the euro amid fresh political uncertainty in Germany after German Chancellor Angela Merkel’s interior minister offered to quit amid a disagreement over migration policy.

USD came under pressure in the later part of the week as trade conflict between the two biggest economies in the world began in force on Friday, when U.S. tariffs on USD 34 billion worth of Chinese goods went into effect. Additional tariffs on another USD 16 billion in goods are expected to go into effect in two weeks. Meanwhile, U.S. President Donald Trump has given instructions to identify tariffs on a further USD 300 billion of Chinese goods.

China on the other hand has retaliated with tariffs on USD 34 billion of U.S. goods according to media reports. Beijing had previously said it would impose tariffs on U.S. agricultural products, crude imports, and vehicle products.

The U.S. economy added 213,000 jobs in June, against the expectations for 200,000 new jobs while the unemployment rate unexpectedly rose to 4% and Average hourly earnings grew 0.2%, against the expectation for a 0.3% increase.

The Federal Reserve’s view that a tighter labour market would lead to wage growth, increasing inflationary pressures, continues to be challenged as average hourly earnings grew slower-than-expected for the month. The weaker average hourly earnings growth scaled back expectations for two more Fed rate hikes this year.

Euro appreciated by 0.53% against the USD last week after coming under heavy selling pressure during the early part of the week due to political uncertainty and U.S. President Donald Trump claiming that the EU has treated the U.S. very badly and was “possibly as bad as China, just smaller”. The comments raised the prospect that the U.S. could impose further tariffs on EU imports, possibly on auto imports. The EU has threatened to retaliate with tariffs on up to USD 300 billion of U.S. products if the U.S. does penalize EU automakers.

However, euro recovered in the later part of the week paring its weekly losses amid upbeat economic data and easing trade worries. The U.S. ambassador to Germany reportedly said that President Donald Trump would suspend threats to impose tariffs on cars imported from the EU if the bloc axed duties on U.S. cars.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 4 bps, on worries over a potential trade war between the U.S. and other major countries.

Treasury yields were little unchanged after the Federal Reserve’s minutes from a June meeting suggests that the central bank is committed to gradual but steady rate increases. Nearly all the officials felt comfortable continuing to raise interest rates on a regular basis, even amid growing trade tensions and a flattening yield curve. However, Fed noted possible negative repercussions from the growing trade dispute between the U.S. and its economic allies. The risk of trade policy and tariffs has been identified as the one key factor that could derail the economic engine.

Germany 10-year benchmark bond yields fell by 1 bps due to political uncertainty in Germany and trade war fears. German Interior Minister Horst Seehofer offered his resignation to party colleagues, which threatens Angela Markel fragile government. Seehofer said his party’s leadership was discussing whether to accept immigration proposals Merkel brought back from Brussels.

UK 10-year benchmark bond yields fell by 1 bps, recently Bank of England Governor Mark Carney, in a speech, signaled that a possible interest-rate increase could take place sooner rather than later. Carney said inflation pressures has continued to firm, as the central bank expected and the economy’s weak start to the year mostly reflected bad weather.

Spain 10-year benchmark bond yields fell by 2 bps, Portugal 10-year benchmark bond yields rose by 4 bps. Greece 10-year benchmark bond yields fell by 2 bps.

Japan 10-year benchmark bond yields was flat, Japanese government bond prices rose, with yields on long bonds hitting their lowest levels in a year and a half, as global trade war worries stoked demand for safe-haven debt. Recently conducted 30-year auction was successful, with the bid-to-cover ratio, a gauge of demand, rising to 5.01 from 4.22 in the previous auction.

Emerging economies 10-year benchmark bond yields were mixed last week.

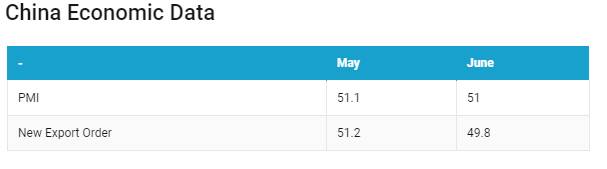

China 10-year benchmark bond yields rose by 6 bps, China Caixin manufacturing PMI for June came in slightly lower from the May reading, as new export sales fell for the third straight month. New export orders index contracted for the first time since February 2018. New export orders in contraction territory point towards a gloomy export situation amid escalating trade disputes between China and the U.S.

Russia 10-year benchmark bond yields fell by 3 bps, Brazil 10-year benchmark bond yields fell by 30 bps.

US high-yield bond yields rose by 14 bps to 6.49% and Eurozone high-yield bond yields fell by 8 bps to 3.53%.