Indian Rupee (INR) touched a new all-time low of Rs 69.13 against the USD as the Modi government faced its first no-confidence motion, tabled by opposition parties in Parliament on Friday. However, INR staged a sharp recovery on the same day by surging 28 paise to end at Rs 68.85 against the USD on suspected RBI intervention. INR depreciated last week by 0.63% against the USD and by 0.55% against the euro.

INR, throughout the week, was under pressure largely due to rising crude oil prices, USD strength and higher inflation worries. The sustained capital outflows by foreign institutional investors (FIIs) from domestic equities and bond market also pressured the INR. Global uncertainty shocks could continue to keep the INR under pressure in the near term.

The fall in the Chinese currency, Yuan, also affected the currency market sentiment. Chinese Yuan depreciated by 1.52% against the USD on a weekly basis to CNY 6.7697 after touching its lowest level in a year amid worries over trade war. The People’s Bank of China dropped the USD reference rate to 6.7671 yuan, the most since 2016. The move came just hours after President Donald Trump threatened to slap tariffs on USD 500 billion worth of Chinese goods.

The devaluation of the yuan could be the first signs signalling that the ongoing trade war is descending into a currency war. The cheaper yuan will make Chinese exports less expensive and has the potential to boost sales overseas.

USD exhibited high volatility last week after President Donald expressed concerns over a stronger USD, which he said was “taking away U.S. big competitive edge.” Also, he criticized the Fed and other central banks approach to monetary policy as he claimed that they were “manipulating their currencies and interest rates lower.”

St. Louis Federal Reserve Bank President James Bullard responded to Trump’s comments, saying the Fed would not be impacted. He said that “The Fed has a mandate to keep inflation low and stable and obtain maximum employment for the U.S. economy, so people can comment, including the president and other politicians, but it’s up to the committee to try to take the best action we can to achieve those objectives,”.

Trump’s remarks came amid renewed focus on U.S. trade war tensions after the president said he was “ready” to slap USD 500 billion worth of tariffs on Chinese goods imported to the U.S. The rising concern pushed up the demand for safe-haven currencies such as the yen and Swiss Franc. Japanese Yen appreciated by 1.06% against the USD last week.

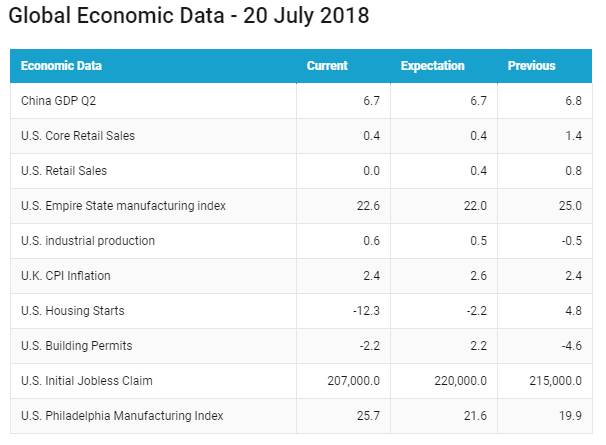

USD started the week on a lower note as trade talks between the European Union and China helped ease investor concerns over growing international trade tensions. The data released on Monday showed that China’s economy slowed in line with expectations in the second quarter, indicating that the trade dispute with the U.S. may be acting as a drag on growth. Chinese GDP rose at an annual rate of 6.7% in the three months to June, down from 6.8% in the first quarter.

USD turned higher on Tuesday before falling sharply in the later part of the week as Federal Reserve Chairman Jerome Powell presented a positive assessment of the U.S. economy during his semi-annual congressional testimony, in which he downplayed the impact of uncertainty over U.S. trade policy on the outlook for additional rate hikes. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.46% on a week on week basis and is at a level of 94.48.

Powell said in his testimony that the central bank is on track to gradually raise interest rate and added that protectionism could potentially hinder economic growth. He added that “In general, countries that have remained open to trade, that haven’t erected barriers including tariffs, have grown faster. They’ve had higher incomes, higher productivity,”.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 5 bps, recent testimony by Fed Chairman Jerome Powell and improvement in unemployment data suggest that Fed remains on track to raise rates once or twice more in 2018, after raising rates twice already this year.

Fed Chair Jerome Powell said, Federal Reserve will continue to raise interest rate as the economic outlook remains strong despite uncertainty over trade policy. The number of Americans filing for unemployment benefits unexpectedly fell last week, hitting its lowest level in more than 48-1/2 years. Initial claims for state unemployment benefits dropped 8,000 to a seasonally adjusted 207,000 for the week ended July 14, the lowest reading since early December 1969.

However, President Donald Trump said he is not pleased that the Federal Reserve is raising rates, which is eroding the effects of fiscal stimulus by his administration. Trump also said that higher interest rates will strengthen the US dollar too much, putting the United States at a disadvantage while central banks in Europe and Japan are keeping rates low.

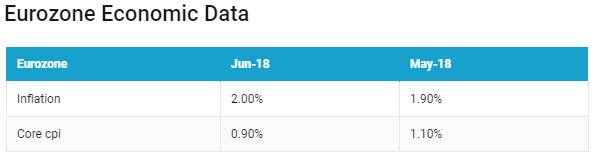

Eurozone inflation for June 2018 came at 2%, close to ECB target rate inflation. The biggest contribution came from energy, followed by services, and food, alcohol, and tobacco. However, core inflation fell in June 2018.

UK 10-year yields fell by 5 bps, gilt yields sank to their lowest level since May 2018, pressured by political uncertainty and lackluster economic data, due to which market is skeptical about a rate rise from the Bank of England next month. Official data showed UK inflation rate was unchanged at 2.4% in June 2018 from previous month. Despite the fact that Prime Minister Theresa May won some crucial parliamentary votes about the direction of Brexit, questions remain over the stability of her government. (British Foreign Secretary Boris Johnson resigned after the resignation of Brexit Secretary David Davis, the government top Brexit official.)

Italy 10-year benchmark bond yields rose by 3 bps. Rating agency DBRS confirmed Italy rating at BBB (High) and said that expected deviations from current fiscal targets under the new coalition government were unlikely to materially undermine its public debt sustainability.

Spain 10-year benchmark bond yields rose by 5 bps, Portugal 10-year benchmark bond yields rose by 2 bps. Greece 10-year benchmark bond yields rose by 2 bps.

Japan 10-year benchmark bond yields fell by 1 bps, as markets had largely shrugged-off the improvement in the Japan core consumer price inflation data for the month of June 2018, although the non-core CPI remained unchanged.

Emerging economies 10-year benchmark bond yields were mixed last week.

Indonesia 10-year benchmark bond yields rose by 37 bps, Indonesia central bank left its benchmark interest rate unchanged after three hikes in a row helped to stabilize the currency. Governor Perry Warjiyo said the policy stance remains hawkish with the central bank focus on economic stability.

South Africa 10 year bond yields rose by 2 bps South Africa central bank left its benchmark repurchase rate at 6.50% but noted the deteriorating outlook for inflation and raised its implied path of policy rates to five rate hikes by the end of 2020 from four hikes. The South African Reserve Bank, which cut its rate by 25 basis points in late March 2018, lowered its forecast for headline inflation this year to 4.8% from a previous 4.9%.

Russia 10-year benchmark bond yields rose by 20 bps, China 10-year benchmark bond yields fell by 1 bps.

US high-yield bond yields fell by 4 bps to 6.33% and Eurozone high-yield bond yields fell by 7 bps to 3.32%.