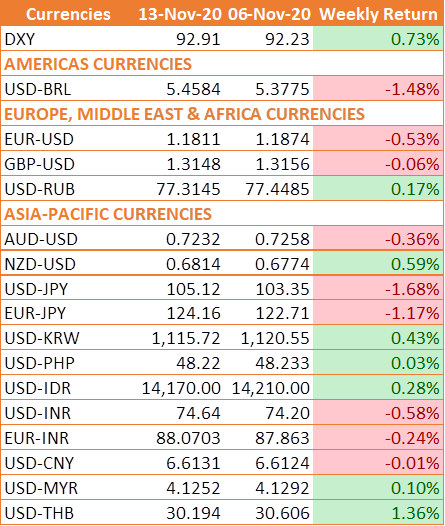

Markets took profits on shorts as USD had fallen sharply in anticipation of fresh stimulus by the new US president. This will be temporary given that Fed will pump in money to support the huge fiscal spending by the US government on resurgence of corona virus.

INR traded lower as USD surged after a clear mandate in the US presidential election eliminated political and fiscal uncertainty in the country and optimism about a potential coronavirus vaccine was offset by worries about how the drug will be delivered.

Additionally, the continuing rise of new Covid-19 cases throughout Europe and the U.S. is making traders nervous about buying riskier currencies despite the positive news of a potential vaccine.

In Europe and the United States, the second wave of infections has prompted the re-imposition of restrictions to stop the virus' spread. This has prompted caution within the foreign exchange markets despite a slew of positive news during the week of potential COVID-19 vaccines.

India’s Fiscal Stimulus

On the domestic front, India’s government has approved a proposal to spend USD 27 billion over 5 years to create jobs and boost manufacturing. The incentives, the cabinet agreed, will be handed out to manufacturers in 10 sectors including automobiles, auto parts, textiles, pharmaceuticals, and food producers among others in order to attract investment. The move is part of a broader plan to create “champion” sectors in Indian to attract investment and to help India on its path to becoming self-reliant.

Moody’s forecasts -8.9% GDP in 2020

Rating Agency Moody’s Investors Services reported that it forecasts the Indian economy will shrink by 8.9% in 2020 due to the COVID-19 pandemic hit to the economy. This is a slight improvement on the 9.6% contraction forecast just in September.

The upward revision from Moody’s comes as COVID-19 cases in India slow and as economic activity in the country picks up following a record-breaking -23.9% contraction in the April – June period amid one of the world’s strictest lockdowns.

ECB Hints at Further Easing

European Central Bank President Christine Lagarde warned that Europe could still see an acceleration of virus transmission and tighter restrictions, hinting at further easing in the near future. ECB governor Christine Lagarde said that “While all options are on the table, the pandemic emergency purchase program and targeted longer-term refinancing operations have proven their effectiveness. They are therefore likely to remain the main tools for adjusting our monetary policy."

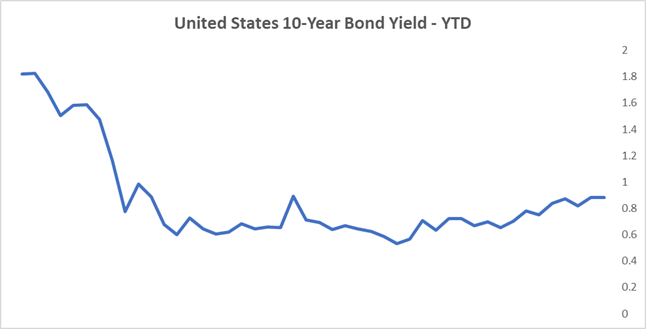

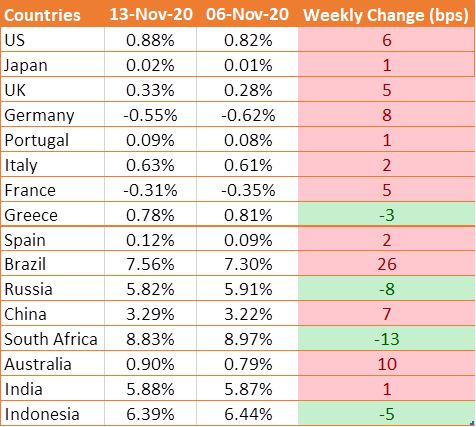

UST Yields Fall from highs seen earlier in the week

US 10-year benchmark bond yield jumped by 13 bps to 0.95% on Monday following news that a coronavirus vaccine developed by Pfizer and BioNTech is proven to be more than 90% effective in a study. However, the yield fell in the latter part of the week as investors turned cautious amid a persistent rise in coronavirus cases around the world, and data showing inflation remained benign in the U.S.

U.S. consumer prices were unexpectedly unchanged in October. Excluding the volatile food and energy components, CPI was flat after rising 0.2% the prior month.