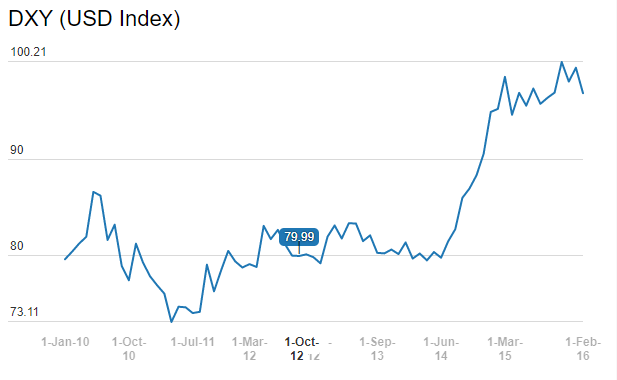

USD last week ended lower as markets cut long positions on expectations of the Fed maintaining status quo on rates this year. USD has seen a sustained rally over the last three years and the market has been long USD. Chart 1. USD bulls are cutting positions on worries that a strong USD could hurt US economic growth leading the Fed to maintain an accommodative policy stance.

Currency markets last week, continued to digest BoJ surprise move of adopting negative interest rates, which has increased the possibility of a delayed interest rate hike by the Fed. Oil prices remained volatile during the week as it declined sharply on Tuesday amid fears that a massive supply glut is coinciding with slowing global growth. Iran said that it planned to increase crude exports to 2.3 million barrels per day in its next fiscal year and weak data from China added to the ongoing concerns over global economic growth. Data showed that manufacturing activity in China contracted for a sixth straight month in January as Chinese manufacturing PMI fell to 49.4 from 49.7 in December.

On Tuesday, at an address before the Council of Foreign Relations in New York, Fed vice chair Stanley Fischer said that further declines in oil prices and a persistently strong dollar could suggest that inflation will remain lower than what the Fed previously anticipated. Inflation has remained under the Federal Open Market Committee’s (FOMC) targeted objective of 2% for every month over the last three years.

USD Index (DXY), which tracks the movement of the USD against six major currencies, declined by 2.59% on weekly basis and closed at levels of 97.03.

Institute for Supply Management on Monday reported that its index of purchasing managers inched up to 48.2 in the month of January from a reading of 48.0 in December against the expectation of PMI to rise to 48.1.

U.S. Commerce Department reported that U.S. personal spending remained flat in the month of December against the expectation of a gain of 0.1%, followed by 0.5% in November. Personal income rose by 0.3% in the month of December against the expectation of a gain of 0.2%, followed by a rise of 0.3% in November.

USD continued to remain under pressure despite better-than-expected data on U.S. private sector hiring. Data showed that U.S. private sector added 205,000 jobs in the month of January against the expectation of 195,000.

U.S. Labour Department on Friday reported that U.S. economy added 151,000 jobs in the month of January, against the expectations for an increase of 190,000 followed by 262,000 jobs in December. U.S. unemployment rate ticked down to 4.9% in January from 5.0% in December against the expectation of an unchanged reading.

Euro appreciated by 3.02% against USD last week, the gain largely came on the expectation that Fed will delay interest rate hikes amid weak U.S. economic data and weak global growth outlook.

Russian Ruble sharply depreciated by 2.57% against USD last week. Ruble came under pressure as oil prices remained volatile on the worries of increase in global supply of oil. Brent crude oil price last week, declined by 2% to 34.06 USD/bbl from 34.7 USD/bbl after declining by more than 5% in the early part of the week.

Asian currencies were largely higher against the USD last week. Australian Dollar depreciated by 0.24%, New Zealand Dollar appreciated by 2.24%, Japanese Yen sharply appreciated by 3.65% as demand for safe heaven assets was high amid weak market sentiment, South Korean Won appreciated by 0.13%, Philippines Peso appreciated by 0.14%, Indonesian Rupiah appreciated by 1.13%, Indian Rupee appreciated by 0.21% against USD and depreciated by 2.93% against Euro, Chinese Yuan appreciated by 0.03%, Malaysian Ringgit depreciated by 0.13% and Thai Baht appreciated by 0.3%.