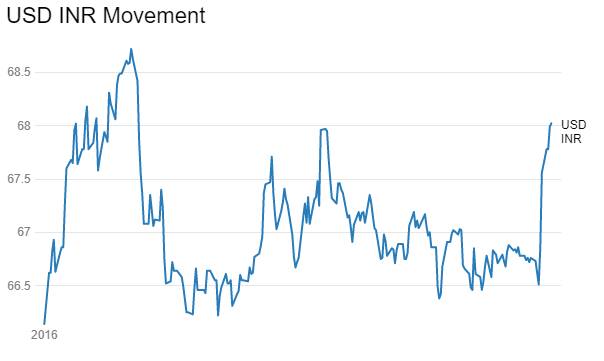

The INR fell to levels last seen in February 2016 on the back of a broad USD strength. The INR closed last week at Rs 68.13 to the USD, down close to 2.5% from highs seen pre Trump victory. Chart 1. However, the INR is not exhibiting any undue signs of volatility given that 3 to 12 months forward premia is down from over 6% levels to 4.5% levels on the back of sharp fall in bond yields due to demonetisation. Indian bond market has not followed the global bond sell off as demonetisation has improved chances of rate cut and has added strong liquidity to the banking system.

USD gained last week and is on track to post the best month in two years. USD is up over 6% against the Japanese Yen and more than 4% against the Euro this month so far. USD strength can be largely attributed to two main factors, first that the U.S. data has been stronger with inflation rising and job growth increasing and the second is the prospect of fiscal stimulus and Fed rate hike expectations.

U.S. Federal Reserve is the only major central bank planning a rate hike and this past week Janet Yellen made it clear that conditions are in place for a December tightening. Janet Yellen did not explicitly say that the Fed would act at its Dec. 13-14 policy meeting, however she told a Congressional committee that a rate hike was likely “relatively soon”.

USD started the week on a high note and ended the week at its 14-year high level on Friday. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 2.17% on a week on week basis and is at a level of 101.21.

USD on Monday rose to its 11-month high level, largely driven by the jump in U.S. bond yields as market participants bet on fiscal and trade policies under a Donald Trump administration, which would stoke inflation. U.S. 10-year treasury yield rose by 11 basis points on Monday.

The strong U.S. economic data has further helped USD to gain as it makes a strong case for U.S. Fed to hike interest rates in its December 2016 FOMC meet. Commerce Department on Tuesday reported that U.S. domestic retail sales rose 0.8% in the month of October against the expectation of 0.6% rise following a rise of 1% in September.

Commerce Department on Wednesday reported that October producer prices were unchanged from the previous month against the expectation of 0.3% rise. Year-over-year, the producer price index (PPI) rose 0.8% in the month of October against the expectations for a gain of 1.2% followed by 0.7% increase in September.

Federal Reserve on Wednesday reported that industrial production was unchanged in the month of October against the expectations for a gain of 0.2%. Manufacturing production rose by 0.2% in the month of October against the expectation for a 0.3% gain followed by an increase of 0.2% in September.

U.S. Department of Labour on Thursday reported that number of individuals filing for initial jobless benefits in the week ended 12th November fell by 19,000 to 235,000 from previous week’s total of 254,000 against the expectation of a rise of 2,000.

Euro depreciated by 2.46% against USD last week on the expectation that the European Central Bank will maintain its loose monetary policy stance to stoke Eurozone inflation while the U.S. Federal Reserve is poised to raise rates in December.

Asian currencies were under pressure against the USD on broad USD strength. Australian Dollar depreciated by 2.76%, New Zealand Dollar depreciated by 1.68%, Japanese Yen depreciated by 3.84% against the USD and by 1.42% against the Euro. South Korean Won depreciated by 1.55%, Philippines Peso depreciated by 1.42%, Indonesian Rupiah depreciated by 0.34%, Indian Rupee depreciated by 1.31% against the USD and appreciated by 1.08% against the Euro, Chinese Yuan depreciated by 1.08%, Malaysian Ringgit depreciated by 1.73% and Thai Baht depreciated by 0.5%.