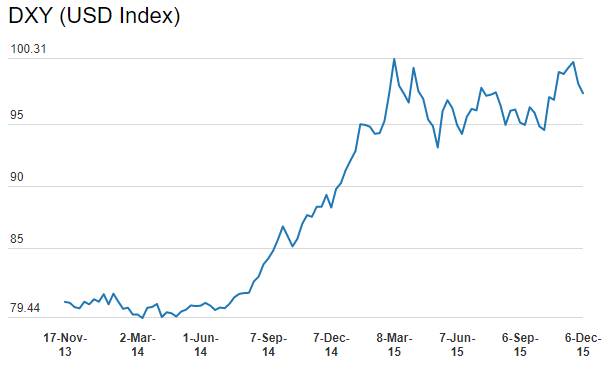

The USD that has seen sustained strength over the last couple of years could come under pressure this week. Chart 1. The USD is largely in an overbought territory given expectations of policy divergence between Fed, ECB and Bank of Japan and with signs of pressure on US junk bond yields and its knock on effect on financial markets, USD bulls could unwind long positions on the event of Fed rate hike.

US junk bond spreads rose 50bps on Friday, the sharpest rise seen since 2011. Junk bond spreads have risen 100bps over the last one week. One junk bond fund closed the fund as junk bond yields rose and liquidity thinned out. Other funds including hedge funds are likely to close the funds on worries of withdrawal of money by investors, which will further hit the junk bond market.

US junk bonds have seen yields and spreads falling to record lows before climbing higher over the last one year. Chart 2. The Fed turning policy neutral coupled with an over bought market that saw huge flows into junk bond funds, making it a USD 2 trillion market globally, had turned markets wary of low spreads and yields. Fed rate hike fears with the Fed expected to raise rates this week prompted a sell off on Friday.

USD remained volatile throughout last week ahead of Fed FOMC meet, which is scheduled on 15th – 16th December. In its meeting Fed is expected to act as upbeat U.S. economic data is making a strong case for an interest rate hike, which has been kept to the lowest level since 2009.

USD closed lower last week despite stronger than expected U.S. monthly jobs report for the month of November. USD Index (DXY), which tracks the movement of the USD against six major currencies, declined by 0.8% on weekly basis and closed at levels of 97.57.

USD came under pressure after China’s November trade data showed that Chinese exports fell for the fifth consecutive month. Chinese data released on Tuesday added to the fears of slowdown in the world’s second-largest economy. Data reported showed that exports fell 6.8% on a yearly basis in the month of November and Imports fell by 8.7%.

Weak Chinese export data has added to the worries of already anaemic global growth. Commodity prices were sharply down post data release and demand for safe heaven assets rose, which helped Yen and Euro to appreciate against USD by 1.74% and 0.96% respectively in the last week.

U.S. Department of Labour on Thursday reported that number of individuals filing for initial jobless benefits in the week ended 4th December rose by 13,000 to 282,000 from the previous week’s total of 269,000 against the expectation of a flat reading at 269,000.

U.S. producer prices rose by 0.3% in the month of November against the expectation of 0.1% decline followed by decline of 0.4% in October. Core producer prices rose by 0.3% in the month of November against the expectation of 0.1% rise, followed by decline of 0.3% in October.

U.S. retail sales rose 0.2% in the month of November against the expectation of a rise of 0.3% followed by rise of 0.1% in October. Core retail sales rose by 0.4% in the month of November against the expectation of a rise of 0.3%, followed by 0.1% rise in October.

Euro continued to appreciate against the USD after ECB measures taken in the recently concluded policy meet, fell short of market expectations. Market was expecting ECB to increase the size of its monthly quantitative easing program to 75 billion Euro from the current 60 billion Euro.

On Wednesday, ECB Governing Council member Ewald Nowotny said market expectations for additional stimulus measures had been too high and that investors should have paid more attention to economic fundamentals.

Brazilian Real depreciated by 3.11% last week against USD. The decline came after data released showed that Brazilian inflation rose to a level of 10.5% in the month of November on a yearly basis against the expectation of 10.4% followed by 9.93% rise in October.

Russian Ruble depreciated to three and half month low level against USD by depreciating 3.32% in the last week after OPEC (Organization of the Petroleum Exporting Countries) decided in its meeting on Monday that no limits will be imposed on the output of crude by oil producing nations. Crude oil after the meeting tumbled to seven-year lows on the speculation that oil prices would remain low for a long time to come.

Asian currencies were largely down against USD last week due to rise in global risk aversion after recent rout in commodity prices, which has brought commodity linked currencies under huge selling pressure. Australian Dollar depreciated by 2.04%, New Zealand Dollar depreciated by 3.17%, South Korean Won depreciated by 1.95%, Philippines Peso depreciated by 0.57%, Indian Rupee depreciated by 0.31% against USD and depreciated by 1.73% against Euro, Chinese Yuan depreciated by 0.81%, Malaysian Ringgit depreciated by 1.68% and Thai Baht depreciated by 1.00%.