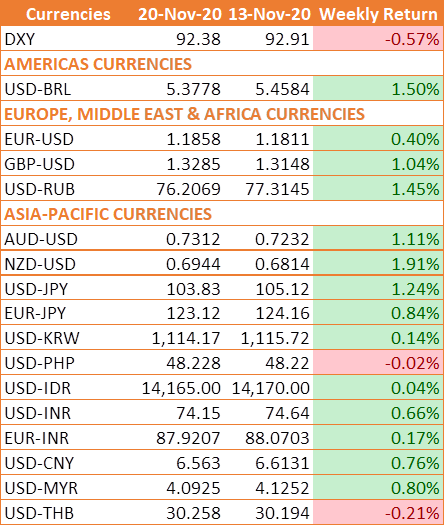

USD slipped against major world currencies last week, while riskier currencies were trading higher, buoyed by improved risk appetite following COVID-19 vaccine progress and Joe Biden's U.S. election victory. The surge in COVID-19 cases across the US and Congress remains deadlocked over an additional rescue bill h kept the USD from weakening too fast.

INR strengthened last week amid improvement in the global risk sentiment. Risk assets, in general, have been bid this month on expectations that potential coronavirus vaccines would power a swift global economic recovery in 2021.

The broad view among market participants is that breakthrough developments in potential COVID-19 vaccines as well as expectations of more accommodative measures by the US Federal Reserve to revive the world's largest economy makes a strong case for INR appreciation.

Pfizer reported that its vaccine is 95% effective in its final report

Pfizer and BioNtech say that they have now completed the final stage clinical trial of their COVID-19 vaccine. The results showed that the vaccine had 95% efficiency, up from the previously announced 90%. The news comes just days after Moderna announced that their vaccine candidate was also 94.5% effective. Pfizer added that it now has sufficient safety data and will apply for a license in the US and other countries within days.

IMF warns that global economic growth is showing signs of slowing

Market sentiment took a hit after the IMF warned that the global economy faces a difficult path back from covid-19. There are signs of slowing momentum, particularly from the countries where COVID-19 cases are rising.

Last month the IMF forecast a contraction of -4.4% in the global economy 2020 with the global economy expected to rebound by 5.2% in 2021. However, the IMF also said that the outlook for many emerging markets had worsened.

Federal Reserve likely intervention

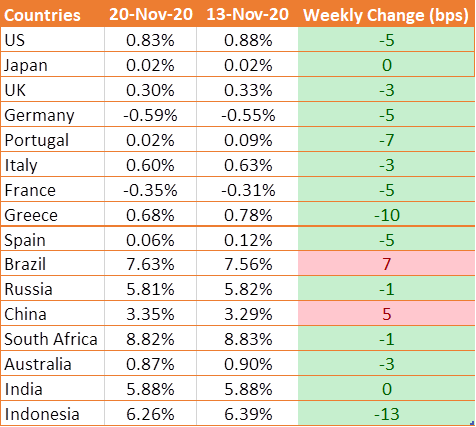

With lockdown restrictions tightening and Congress failing to make any progress over an additional fiscal stimulus bill, it is likely that the Federal Reserve will need to step in again to ease monetary policy in order to support the economy. Speculation is growing that the US central bank will expand its bond-buying program in December.

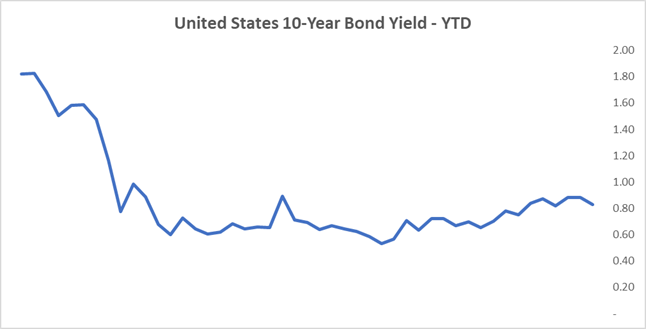

UST Yields Fall as fourth quarter looks weak

US 10-year benchmark bond yield fell 5 bps to 0.83%. The yields are down from an eight-month high of 0.975% seen last week when supply and optimism over vaccines pushed the rates higher. Yields fell after media reported that democratic and Republican senators had agreed to resume stimulus talks.

Jobless claims totalled 742,000 last week, ahead of the 710,000 estimates, according to the Labour Department. That total also represented an acceleration from the previous week’s total of 709,000.

U.S. retail sales increased less than expected in October, underscoring expectations that growth might slow this quarter. Retail sales rose 0.3% last month, below expectations of 0.5%. Spending has been restrained by spiralling COVID-19 infections and declining household income as millions of unemployed US citizens lose government financial support.