The government issued a new 10 year bond, which saw the cut off yield at 5.85%, higher than the 5.77% cut off yield seen in the auction of the previous 10 year benchmark bond, a couple of months ago. The yield of 5.85% is still low as the last time government bond yields went below 6% was in 2008-09 during the global financial crisis. However, the market is showing reluctance to bring down the bond yield despite RBI’s firm commitment to keep down the long bond yields through OMO purchases of around Rs 1.4 trillion including operation twists and SDL purchases.

The second quarter fiscal 2020-21 GDP numbers released on the 27th of November showed that economic growth contracted 7.5% year on year against expectations of a contraction of 8.8% and against a contraction of 23.9% in the first quarter. Agriculture growth of 3.4% driven by government spending on the sector and manufacturing growth of 0.6% on higher production post lockdown helped cushion the growth fall. Fiscal deficit was at 126% of budget in the first 7 months of the fiscal year.

Inflation for October 2020 was well over 7% and is likely to stay above 7% for November as well given rise in food and fuel prices. Growth contraction with high inflation and fiscal deficit is unnerving bond markets but RBI is still keeping a lid on bond yields through heavy market intervention.

RBI policy review in the 1st week of December will see policy rates kept stable at record low levels and the central bank maintaining an accommodative policy on its growth thrust even as inflation stays well above its target of 4%. Bond markets will constantly question how long RBI can keep a lid on yields by keeping longer end bond yields well above repo rate of 4%.

Government bonds, SDL and OIS yield movements.

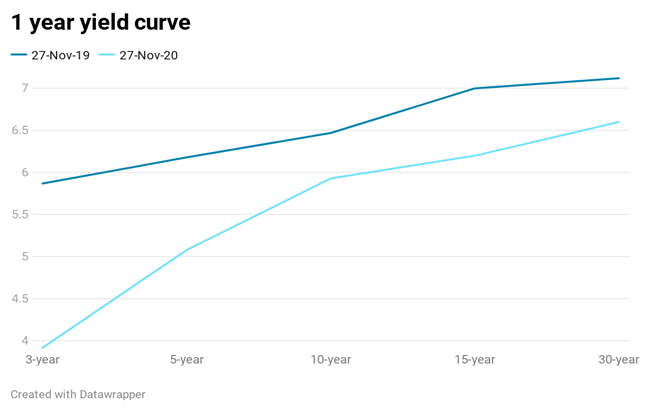

The new 10-year government bond cut off stood at 5.85% through last auction conducted by RBI. During the week, the 5.77% 2030 yield rose by 3 bps to 5.91%, while 5.79% 2030 bond yield increased by 3 bps to 5.93%. 6.45% 2029 bond yield moved up by 2 bps to 5.96%. 5-year benchmark bond, 5.22% 2025, yield increased by 2 bps to 5.08%. On the other hand, long term paper 7.16% 2050 yield declined by 4 bps to 6.59%.

The spread of 10-year bond over 5-year bond (5.22% 2025) stood at 85 bps as compared to 84 bps previous week. The 15-year benchmark over 10-year benchmark spread decreased to 27 bps from 33 bps. 30-year benchmark over 10-year benchmark spread declined to 67 bps from 76 bps.

In the SDL auction conducted last week, average 10-year SDL yield remained stable at 6.55% as compared to previous week. Consequently, spread with G-sec benchmark declined marginally to 64 bps from 65 bps.

On weekly basis, 1-year OIS yield rose by 5 bps to 3.63% while 5-year OIS yield increased by 9 bps to 4.44%.