RBI announced an operation twist for Rs 200 billion as soon as it saw the market bidding at higher yields in the auction of the new 10 year benchmark bond, the 5.85% 2030 bond. The bond yield cut off was at 5.90%, 5bps higher than the last week cut off at 5.85%. Operation twist is where the RBI sells short term bonds and purchases longer term bonds, which helps keep down the 10 year benchmark bond yield.

The market has reasons to bid for higher yields in bond auctions as inflation is running well over 7% and government borrowing is continuous and heavy and the budget for fiscal 2021-22 could show higher borrowing, as the government will continue to spend to pull up economic growth.

RBI, when it is minutely tracking and managing 10 year bond yields, is forcing long term investors such as insurance companies, banks and provident funds to invest in bonds at lower yields than what the market wants. Investors in longer maturity corporate bonds also get hurt as yields on these bonds are derived from government bond yields.

At some point of time in the near future, RBI will have to let go yields, as inflation could shoot up on demand created by government spending that is not matched by increase in supply due to lack of investment appetite for new capacities. Corporates are worried about long term slowdown in demand that has persisted for almost 10 years and hence there is reluctance to create more capacities.

Once RBI is forced to let go of yields, bond yields will shoot up leading to heavy losses for long term investors.

Government bonds, SDL and OIS yield movements.

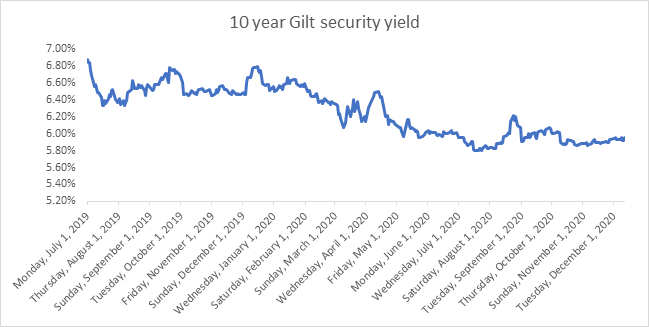

During the week, 5.85% 2030 yield rose by 7 bps to 5.89%, 5.77% 2030 yield increased by 6 bps to 5.96%, while 5.79% 2030 bond yield gained 2 bps to 5.95%. 6.45% 2029 bond yield moved up by 5 bps to 5.99%. 5-year benchmark bond, 5.22% 2025, yield increased by 6 bps to 5.09%. Long term paper 7.16% 2050 yield gained 1 bps to 6.58%.

The spread of 10-year bond over 5-year bond (5.22% 2025) decreased to 86 bps from 90 bps previous week. The 15-year benchmark over 10-year benchmark spread came down to 29 bps from 30 bps. 30-year benchmark over 10-year benchmark spread declined to 62 bps from 65 bps.

In the SDL auction conducted last week, average 10-year SDL yield remained flat at 6.58% from 6.60% last week. Consequently, spread with G-sec benchmark declined to 63 bps from 66 bps.

On weekly basis, 1-year OIS yield rose by 8 bps to 3.77% while 5-year OIS yield increased by 13 bps to 4.61%.

We would love to hear back from you. Please Click here to share your valuable feedback