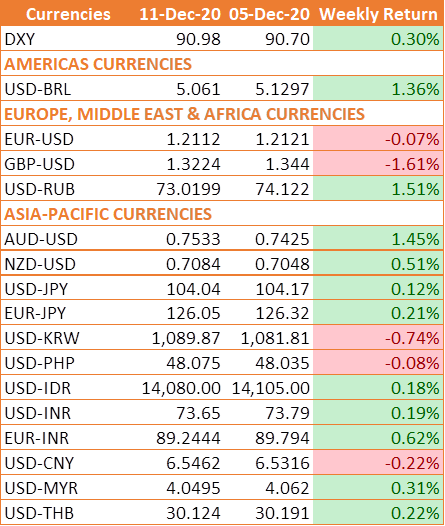

Safe-haven USD fell against the INR, but it was trading higher versus its major peers on fading hopes for Brexit and U.S. stimulus deals. U.S. lawmakers are expected to pass a one-week spending bill to fund the government, but the House has indicated that anything beyond that would require agreement to a broader fiscal stimulus plan. Unfortunately, little progress has been made and Senate Republicans say they do not have majority support for the current bill. If agreements cannot be reached in the next week or two, there could be a sharp rise in volatility in currency markets.

At the same time, the market players continue to remain jittery about the surge in new COVID-19 cases in the US, which prompted California to impose lockdown measures for travel and business activities. With hospitalizations in the US hitting record highs, other major states such as New York might also have to resort to restrictions.

BREXIT - No Deal Is Very Possible

During most parts of the year market participants believed that the UK would eventually agree to an orderly exit out of the European Union. However, with only a few weeks before the deadline, the final rounds of Brexit talks are failing quickly, with both sides preparing contingencies.

Johnson admitted that there is a very strong possibility that Britain exits the bloc with no deal. He stated:

“I do think that we need to be very, very clear there’s now a strong possibility, a strong possibility, that we will have a solution that’s much more like an Australian relationship with the EU, than a Canadian relationship with the EU. It doesn’t mean it’s a bad thing.”

The Bank of England meets next week, but the biggest story will still be Brexit.

INR strengthens on foreign fund inflows

Persistent foreign portfolio inflows remain a dominant factor in driving INR higher as abundant liquidity in the global financial system due to accommodative measures by major central banks to revive economic growth has underpinned the market sentiment. However, fresh concern over tensions between the US and China kept investors on edge.

A slew of Indian companies are seekong to raise funds from overseas investors by way of stake sale, qualified institutional placement of shares, initial public offer among other means. To name a few, Canara Bank aims to raise Rs 20 billion through a qualified institutional placement that opened on Monday. At the prevailing exchange rate, the amount stands at USD 270 million.

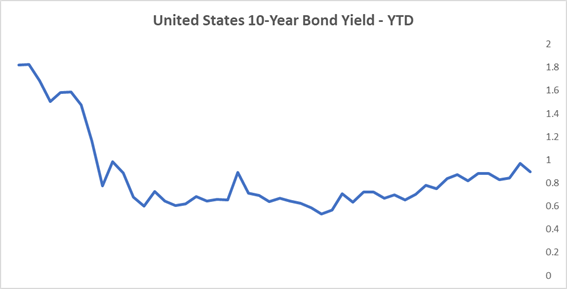

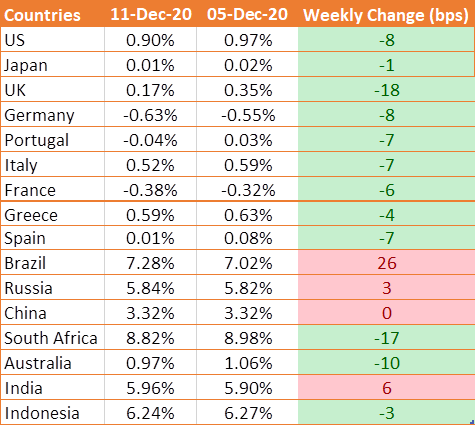

UST yields fall from a 3-week high after U.S. jobs report

US 10-year benchmark bond yield fell by 8 bps to 0.90% as congress remains at an impasse over a coronavirus stimulus package. Republican Senate leaders rejected a USD 908 billion aid package, proposed by a group of lawmakers. Additionally, the continued surge in coronavirus cases and renewed lockdowns in several U.S. states and around the world weakened the sentiment to drive yields higher.

The long-end yields continued to fall, with investors mulling the prospect that the Federal Reserve could extend purchases to longer-dated maturities, in an upcoming Fed meeting.

On Thursday’s U.S. labor-market data underlined the need for further fiscal relief, following a weaker-than-expected employment report in November. New applications for U.S. jobless benefits in the seven days ended Dec. 5 jumped to around a 3-month high.

We would love to hear back from you. Please Click here to share your valuable feedback.