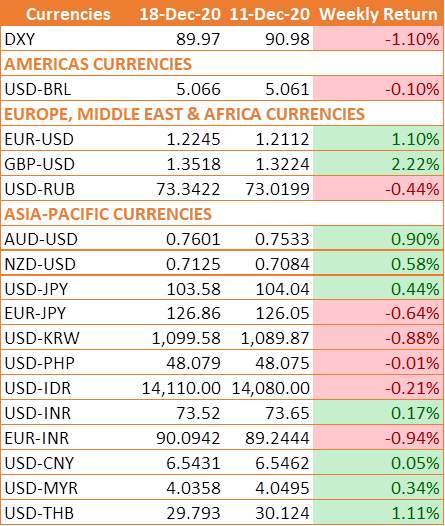

The growing prospect of a stimulus deal in the U.S., Fed dovish stance and a Brexit agreement in the UK are driving investors out of safe-have currencies like the USD and Japanese Yen. High-beta currencies rose sharply, with strong gains in British Pound, the New Zealand and Australian Dollars. USD fell to fresh 2.5-year lows on the back of mostly weaker data.

INR advances amid risk on mood

The risk on mood is boosting demand for emerging market currencies. The foreign institutional investors are net buyers with sustained portfolio inflows lifting the INR and driving domestic equities to record level. Both the Nifty 50 and the Sensex has posted weekly gains over the past 6 straight weeks.

In FY21 so far, the central bank has bought a massive USD 101.5 billion taking its forex reserve to USD 579 billion as of 4th December 2020.

Fed & US stimulus talks drive optimism

U.S. congressional negotiators still haven’t come to an agreement over a new coronavirus-relief bill, but senior members of both parties sounded more positive than they have in months on Wednesday. Talks seem to be about the small details surrounding a USD 900 billion Covid-19 aid bill, which is expected to include USD 600-USD 700 stimulus checks and extended unemployment benefits.

While fiscal stimulus seems to be arriving shortly to help the country’s battered economy, the Federal Reserve vowed to keep its monetary funding ongoing until the U.S. economic recovery is secure.

US Fed kept benchmark rates unchanged as per market expectation with a projection of 0% rate at least until 2023 2023 in its meeting concluded on 16th December. Further it would continue to buy at least $120 billion of bonds each month in order to support economy.

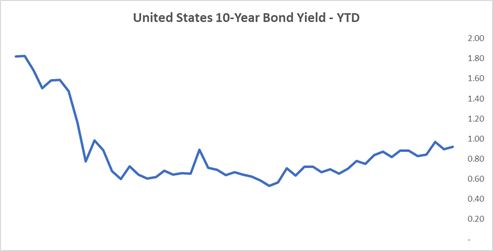

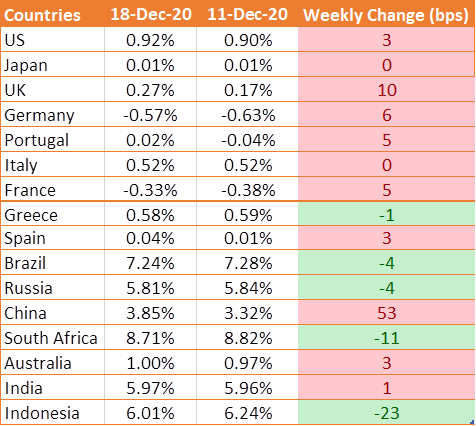

UST yields rise after the Fed pledges to keep buying bonds

US 10-year benchmark bond yield rose by 3 bps to 0.92%, steepening the treasury yield curve slightly after the Federal Reserve said that it would maintain its current bond-buying policy until significant progress in the U.S. economic recovery is made.

Fed's rate-setting committee said in a unanimous policy statement after the end of a two-day meeting that “purchases would continue until substantial further progress has been made toward the committee's maximum employment and price stability goals”.

We would love to hear back from you. Please Click here to share your valuable feedback