The 5.85% 2030 bond will see a period of uneasy calm before there is a sudden sharp rise in yields, most probably before budget in February 2021. High government spending coupled with huge liquidity flows will raise inflation expectations sharply and this will prompt markets to reset yields to higher levels.

Certainty in Uncertainty

What is certain in such an uncertain world and markets is that the Fed will pump money and keep rates low for at least 2 more years. Given the huge amount of USD floating in the world at 0% rates, the impact on world financial markets are already being felt with equities rallying to record highs, currencies appreciating against the USD and credit spreads falling sharply.

The world will search for yields, and with India at the top rung of higher yielding currencies, the USD flows are already very high, driving up fx reserves to record highs and with RBI infusing liquidity through USD purchases, there is a huge surplus liquidity in the domestic economy.

How will these flows affect the yield on the benchmark 10 year government bond, the 5.85% 2030 bond?

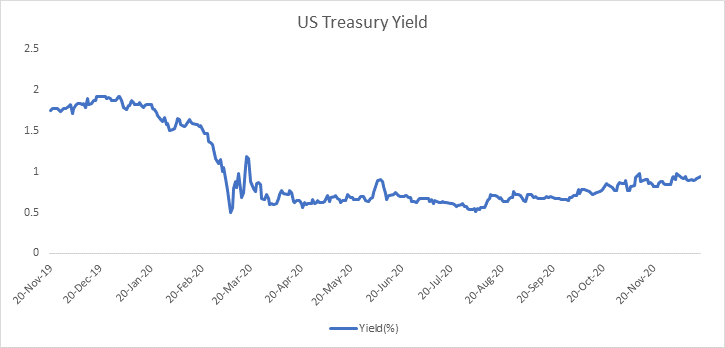

RBI governor, Shaktikanta Das said in his December policy speech that hardening US treasury yields that saw the 10 year UST rise by around 40bps from lows, is driving flows into India. Given high liquidity flows, there is a general unease in policy circles on its effect on inflation. RBI will have to sterilize the flows through issue of MSS bonds to keep inflation expectations from rising.

There is a tussle between raising rates to bring down inflation expectations and keeping rates down to spur growth in the covid hit Indian economy. Government borrowing is very heavy to fund rising fiscal deficit and this is also keeping RBI’s hands tied on rate hikes. At the same time, RBI is also protecting the yield curve from rising on inflation expectations.

The 5.85% 2030 bond will see a period of uneasy calm before there is a sudden sharp rise in yields, most probably before budget in February 2021. High government spending coupled with huge liquidity flows will raise inflation expectations sharply and this will prompt markets to reset yields to higher levels.

US Fed kept benchmark rates unchanged as per market expectation with a projection of 0% rate at least until 2023 2023 in its meeting concluded on 16th December. Further it would continue to buy at least $120 billion of bonds each month in order to support economy.

India’s retail inflation declined to 6.93% in November 2020 from 7.61% in previous month. During the month, consumer food price index (CFPI) also came down to 9.43% from 11.00% in October.

Domestic industrial output rose by 3.6% in October 2020 as compared to 0.2% growth in Sep 20 and -6.6% during October 2019. During April-October 2020-21, IIP has contracted by 17.5% as compared to a 0.1% growth in the corresponding period in previous year.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 2 bps to 5.91%, 5.77% 2030 yield remained unchanged at 5.96% while 5.79% 2030 bond yield gained 1 bps to 5.96%. 6.45% 2029 bond yield remained steady at 5.99%. 5-year benchmark bond, 5.22% 2025, yield decreased by 4 bps to 5.05%. Long term paper 7.16% 2050 yield declined by 1 bps to 6.57%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 91 bps from 86 bps previous week. On the other hand, 15-year benchmark over 10-year benchmark spread came down to 28 bps from 29 bps. 30-year benchmark over 10-year benchmark spread declined to 61 bps from 62 bps.

In the SDL auction conducted last week, average 10-year SDL yield came down to 6.55% from 6.58% last week. Consequently, spread with G-sec benchmark declined to 60 bps from 63 bps.

On weekly basis, 1-year OIS yield rose by 1 bps to 3.78% while 5-year OIS yield increased by 6 bps to 4.67%.

.

We would love to hear back from you. Please Click here to share your valuable feedback