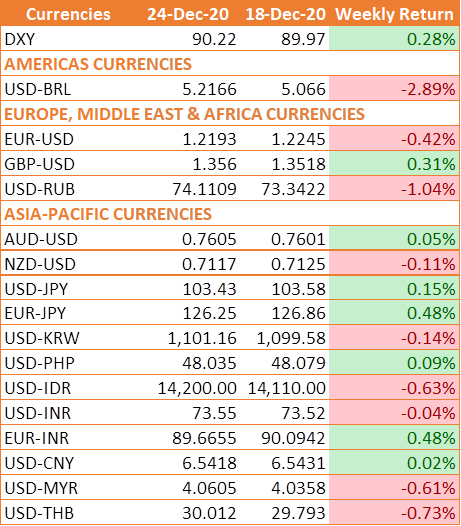

USD gained marginally from lows last week as investors turned to the safe-haven asset as many countries tightened restrictive measures against the new mutant COVID-19 virus. However, optimism over COVID-19 vaccines being effective against the new mutant strain of COVID-19 found in the UK boosted the market sentiment.

A new more infectious COVID-19 strain raised fears of tighter lockdown restrictions globally. The U.K. was the latest country to impose strict lockdowns to curb a new strain of the virus. This led to European neighbours, including France, Germany, Italy, the Netherlands, Ireland, and Belgium closing their borders to travellers, and in some cases freight from the U.K. Other countries are also mulling similar bans.

US COVID Relief Package

US Congress approved a second stimulus package worth almost USD 900 billion after months of debate. However, the optimism started to fade after incumbent President Donald Trump refused to sign the bill. He claimed that the direct payments to the unemployed were too low.

U.S. reports weak economic data

USD slid against all of the major currencies on Wednesday on the back of mostly weaker data. Although jobless claims rose less than expected, they are still running well above 800,000. Durable goods orders growth slowed, personal income and spending declined, and new home sales fell sharply in the month of November. The University of Michigan consumer sentiment index was also revised lower.

INR advances amid high volatility

Risk sentiment took a hit on Monday as investors reacted to news of a more infectious COVID-19 strain spreading across the UK. Riskier assets and currencies such as the INR came under pressure. However, the central bank said that the pace of economic recovery is accelerating beyond expectations, as the country is experiencing a decline in COVID cases.

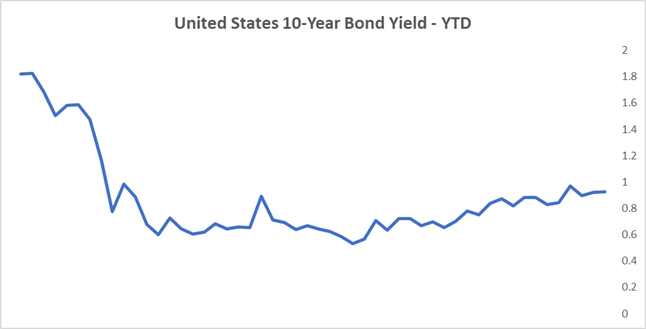

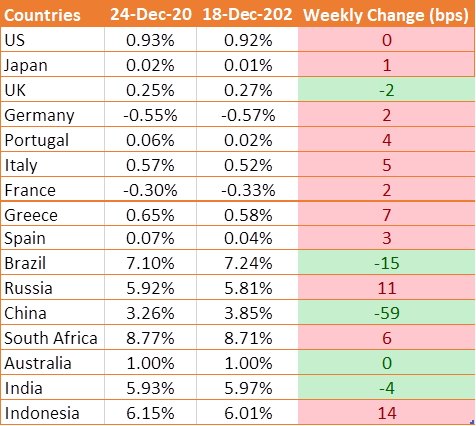

UST yields rise after Britain and EU Strike Brexit Trade Deal

US 10-year benchmark bond yield fell on Monday as fears over a new, more contagious strain of coronavirus sparked demand for the relative safety of government bonds. However, the yield rose after Britain was able to clinch a deal to leave the European Union just seven days before it exits the trading bloc.

We would love to hear back from you. Please Click here to share your valuable feedback