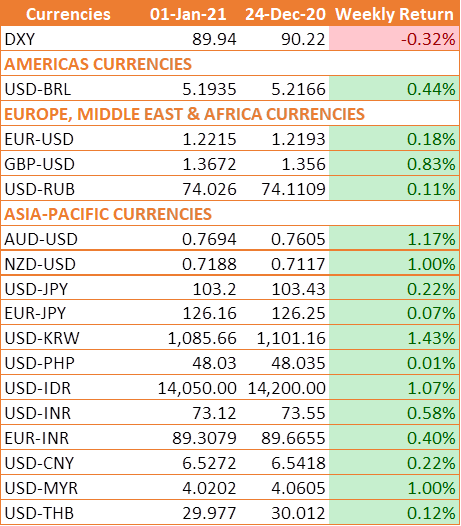

USD lost ground as US President Donald Trump signed the second stimulus package to support an economy damaged by the pandemic. The relief package is supporting risk assets and is putting pressure on the USD, which used to act as a safe haven during the crisis.

Trump initially threatened to block the USD 900 billion relief package voted by Congress at the beginning of last week. However, Democrat and Republican officials urged the incumbent president to change his mind, which he unexpectedly did. Besides the COVID relief package, Trump also green-lighted USD 1.4 trillion in government spending to fund federal agencies. Thus, the combined stimulus package is worth a massive USD 2.3 trillion.

US President-elect Joe Biden, who will take office on Jan 20, is further expected to push for larger support measures to pull the world's largest economy out of the pandemic-induced doldrums.

INR Trades Higher against USD

Prospects of economic recovery in 2021 as well as optimism over the rollout of COVID-19 vaccines provided a fillip to emerging market assets, including the INR.

Abundant liquidity in the global financial system over the last few months has led the way for heavy foreign fund inflows into domestic assets. Foreign portfolio investors purchased domestic assets worth USD 9.6 billion on a net basis in December, despite the fact that overseas investors typically pull-out funds at the end of a calendar year to close their books of accounts.

Euro & Covid19 Vaccine Update

In Europe, the sentiment was buoyed by Britain becoming the first country in the world to approve the COVID-19 vaccine developed by AstraZeneca and Oxford University. On Wednesday, the UK approved the emergency use of a vaccine developed by AstraZeneca and the University of Oxford amid a fast-spreading mutant strain of the coronavirus.

Moreover, lawmakers in the UK approved legislation, implementing the post-Brexit trade agreement with the European Union, agreed upon last week after four years of negotiations.

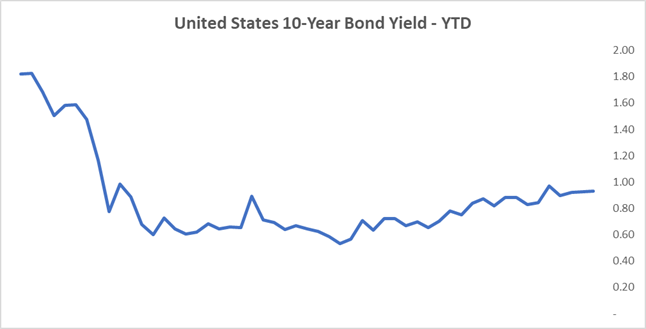

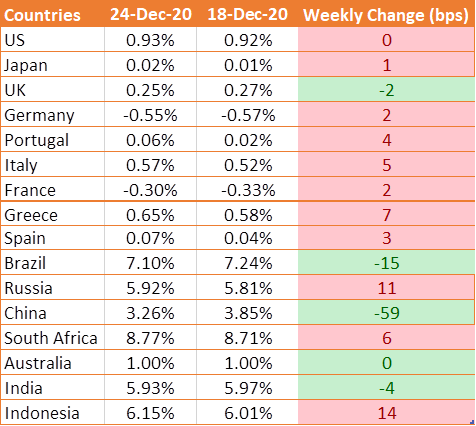

UST Yields Struggle for Direction

U.S. Treasury yields struggle for direction last week as the market focused on stimulus package while European Treasury yields jumped as Britain appeared to be close to a deal to leave the European Union, and as France reopened its border with Britain.

U.S. data showed first-time jobless benefit claims unexpectedly declined by 19,000 to 787,000 last week. While initial jobless claims fell for a second week, they remain high compared with any week before the coronavirus pandemic. The prior record of 665,000 set in 2009, was easily shattered early in the pandemic when new claims peaked at a whopping 6.87 million in the last week of March this year.

We would love to hear back from you. Please Click here to share your valuable feedback