Bond yields are treading shallow waters and can become unsustainable at these levels despite RBI protection. The 777 factor will come into play and push up the 10 year government bond yield sharply from current levels of 5.85%. Further the fact that 10 year UST yields crossed 1% levels this year on expected large scale US stimulus will further pressure the 10 year government bond yield.

The 777 factor is 7% CPI inflation, 7% government fiscal deficit and 7% states fiscal deficit. Inflation is running at 7% and while RBI predicts inflation to come down, it may not given that global crude oil prices have risen sharply, government spending is driving demand without adequate increase in supply and RBI is flooding the system with liquidity, which adds to inflationary pressures.

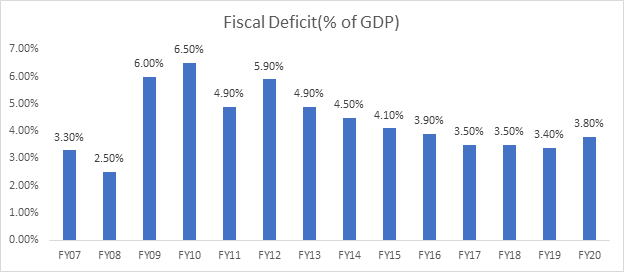

The central government fiscal deficit is expected to double to 7% or more of GDP this year and will stay high next year. Government bond supply will be high as the government borrows to fund the high fiscal deficit.

States combined fiscal deficit is also expected to more than double to 7% of GDP. States too are experiencing a huge revenue shortfall and this is likely to continue into next year. States borrowing will be high adding to the already high supply of bonds.

Bond markets will have to brace for high volatility in the coming days and post budget in February, yields can spike.

India's fiscal deficit rose to Rs 10.75 trillion at the end of November 2020, which is equivalent to 135.1% of the FY21 Budget Estimates. The fiscal deficit at the end of November 2019 had stood at 114.8% of 2019-20 budget estimates.

Union Government's total receipts stood at Rs 8.30 trillion as of November 2020, accounting for 37% of the estimates. This included Rs 6.88 trillion of tax revenue and Rs 1.24 trillion of non-tax revenue.

India’s fiscal deficit

Week | Average g-sec traded volume(billion) |

2nd-6th March | 767.05 |

9th-13th March | 679.77 |

16th-20th March | 450.52 |

23rd -27th March | 173.33 |

30th March-3rd Apr | 227.28 |

6th-10th Apr | 180.29 |

13th-17th Apr | 216.34 |

20th-24th Apr | 484.47 |

27th-30th Apr | 324.37 |

4th-8th May | 491.51 |

11th-15th May | 469.27 |

18th-22nd May | 399.64 |

25th-29th May | 319.09 |

1st-5th June | 267.43 |

8th-12th June | 291.05 |

15th-19th June | 318.76 |

22th-26th June | 274.09 |

29th Jun-3rd July | 425.84 |

6th-10th July | 503.06 |

13th-17th July | 371.76 |

20th-24th July | 304.25 |

27th-31th July | 328.58 |

3rd-7th August | 280.15 |

10th-14th August | 303.82 |

17th-21st August | 289.43 |

24th-28th August | 311.7 |

31st Aug-4th Sep | 419.9 |

7th-11th Sep | 356.77 |

14th-18th Sep | 317.98 |

21st-25th Sep | 208.89 |

28th Sep-1st Oct | 300.77 |

5th-9th Oct | 379.19 |

12th-16th Oct | 321.66 |

19th-23rd Oct | 373.51 |

26th-29th Oct | 401.2 |

2nd-6th Nov | 286.51 |

9th-13th Nov | 230.79 |

17th-20th Nov | 261.86 |

23rd-27th Nov | 285.95 |

1st-4th Dec | 289.93 |

7th-11th Dec | 279.68 |

14th-18th Dec | 200.01 |

21st-24th Dec | 212.56 |

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield stood declined by 1 bps to 5.87%, 5.77% 2030 yield declined by 1 bps to 5.89% while 5.79% 2030 bond yield rose by 3 bps to 5.92%. 5-year benchmark bond, 5.22% 2025, yield declined by 3 bps to 5.01%. Long term paper 7.16% 2050 yield lost 4 bps to 6.50%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 91 bps from 85 bps from previous week. On the other hand, 15-year benchmark over 10-year benchmark spread declined to 26 bps from 37 bps while 30-year benchmark over 10-year benchmark spread stood unchanged at 59 bps.

In the SDL auction conducted last week, average 10-year SDL yield declined to 6.58% from 6.60% last week. Consequently, spread with G-sec benchmark stood rose to 72 bps from 64 bps.

On weekly basis, 1-year OIS yield declined by 3 bps to 3.67% while 5-year OIS yield decreased by 5 bps to 4.56%.

System Liquidity

System liquidity stood surplus at Rs 5983.51 trillion as of 7th Jan 2020 as compared to Rs 6213.71 trillion in previous week.

On a review of evolving liquidity and financial conditions, RBI has decided to restore normal liquidity management operations in a phased manner. Therefore, the central bank will conduct the Variable Rate Reverse Repo auction of Rs 2000 billion on January 15, 2021, Friday under the revised Liquidity Management Framework.

We would love to hear back from you. Please Click here to share your valuable feedback