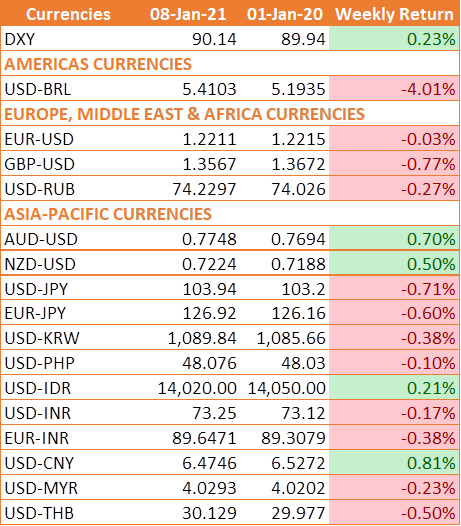

USD was pushed higher against major peers last week following a Democratic win in the Senate elections in the state of Georgia. For the first time in a decade, the Democrats will control the house of representatives, the Senate, and the Presidency in a so-called Blue wave.

A Blue wave will make it easier for President Joe Biden to push through his policies and legislation. Investors are betting on more stimulus and the prospect of additional stimulus has sent US Treasury yields higher lifting the USD.

The closely watched non-farm payroll report showed that 140,000 jobs were lost in the US across December, the first monthly loss since April in the first COVID-19 peak and lockdown. This

was down from 245,000 added in November and well below forecasts of 71,000.

.

INR trades lower against the USD

INR ended the week lower against the USD on a broad USD rally, firming crude oil prices and high fiscal deficit expectations. Oil prices rose to multi month highs on supply issues and hopes of US stimulus.India's fiscal deficit for the year ending in March is likely to be over 7% of gross domestic product, three sources told Reuters, as revenue collections suffered from a lockdown and restrictions to rein in the spread of COVID-19.

India’s factory sector ended a tough 2020 on a stronger footing. The Nikkei Manufacturing PMI rose to 56.4 in December, up from 56.3 in November. Level 50 separates expansion from contraction. Manufacturing has been one of the main factors driving the economic recovery in India following the pandemic slump after business activity contracted 23.9% in the April – June period. The latest data suggests that the Indian economy remains on the path to recovery

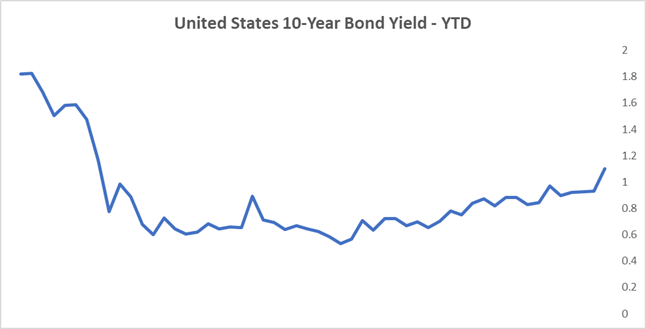

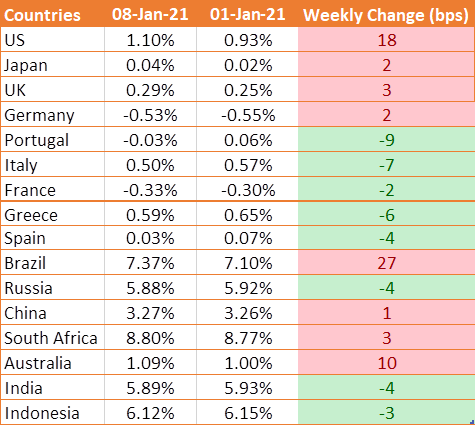

UST yield hits 1% for first Time since March 2020

U.S. Treasury yield rose by 18 bps to 1.10% and for the first-time traded above 1% since March, reflecting increased bets on additional fiscal stimulus after Georgia’s runoff Senate elections.

Increased government spending without corresponding tax increases tends to push up Treasury yields as it leads to more government borrowing and a larger supply of bonds. Depending on the type of spending, it can also drive yields higher by boosting economic growth and inflation and making it more likely that the Federal Reserve will raise short-term interest rates.

We would love to hear back from you. Please Click here to share your valuable feedback