Fed is fueling inflation

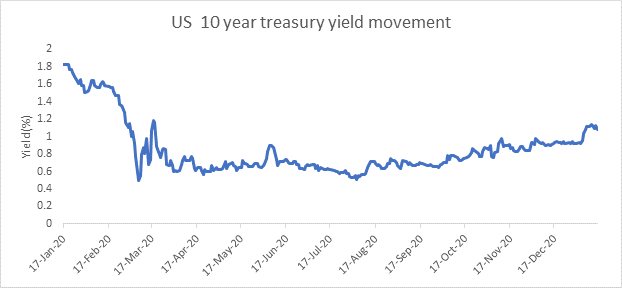

UST yield curve has steepened by around 60 bps over the last few months, with 10-year treasury yields moving by almost 70bps from lows of 0.4% to 1.1% seen in 2020 while the short end of the curve is around .10% levels. The yield curve is showing classical steepening movement on the back of inflation expectations even as the Fed fuels inflation by keeping rates at 0%. Fed is fine with inflation running at 3% levels, over its long -term target of 2%, for a period of time to fuel an economic recovery. Fed has guided for 0% rates till 2023 and continued bond purchases as of now.

The US can handle high inflation and low rates according to the Fed. The US government is going to spend USD trillions for the covid hit economy to recover and high inflation is required to bring down the overall fiscal deficit that has ballooned.

RBI baby steps for policy normalization

RBI took its first step towards policy normalization by conduction Rs 2 trillion of term reverse repos to suck out excess liquidity. The bond markets tool this opportunity to sell bonds despite CPI inflation printing lower for December 2020.

The coming budget for fiscal 2021-22 will see high borrowing for the year and with Fed fueling inflation, the spill-over effects on CPI will be strong. The last time India fiscal deficit was at 7% levels and the Fed kept rates at close to 0%, in 2008-09, inflation in India shot up to over double-digit levels post the crisis.

Concerns of Sensex at 50,00 in policy circles

RBI does not want high inflation and has a 4% target and with equity indices at record high on the back of heavy FII flows, due to Fed policy, there are concerns of overheating in the policy circles. RBI financial stability report has highlighted risks to the economy and talk by a few policy officials suggest that there are concerns over a market bubble.

Rate hike as early as 1st quarter fiscal 2021-22

RBI may start to hike rates as early as first quarter of fiscal 2021-22 to cool down inflation expectations and also overheated markets.

CPI, IIP

India retail inflation eased to 4.59% on yearly basis in December 2020 from 6.93% in previous month driven by decline in food prices. Consumer Food Price Index (CFPI) or the inflation in the food basket decreased significantly to 3.41% in the month of December from 9.50% in November.

Domestic industrial output contracted by 1.9% in November on yearly basis driven by contraction in mining and manufacturing sector as compared to 3.6% in October 2020. During the month, mining sector saw a decline of -7.3% and the manufacturing sector experienced a fall of -1.7% on yearly basis. On the other hand, the electricity sector expanded by 3.5% during the November 2020.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 12 bps to 5.95%, 5.77% 2030 yield increased by 10 bps to 5.99% while 5.79% 2030 bond yield rose by 3 bps to 5.95%. 5-year benchmark bond, 5.22% 2025, yield jumped by 23 bps to 5.24%. Long term paper 7.16% 2050 yield gained 4 bps to 6.54%.

The spread of 10-year bond over 5-year bond (5.22% 2025) declined to 71 bps from 91 bps from previous week. On the other hand, 15-year benchmark over 10-year benchmark spread rose to 36 bps from 26 bps while 30-year benchmark over 10-year benchmark spread rose to 62 bps from 59 bps.

In the SDL auction conducted last week, average 10-year SDL yield rose to 6.61% from 6.58% last week. Consequently, spread with G-sec benchmark stood came down to 69 bps from 72 bps.

On weekly basis, 1-year OIS yield rose by 13 bps to 3.80% while 5-year OIS yield increased by 19 bps to 4.75%.

We would love to hear back from you. Please Click here to share your valuable feedback