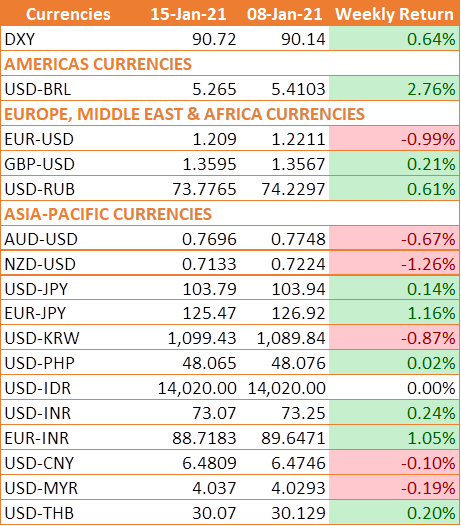

USD saw some stability at lower levels on optimism over the US economy on the back of a new large stimulus package. However, USD has been on a continuous slide over the last 8 months on the back of Fed printing money to nullify the covid impact on markets and economy.

Given the heavy short position on USD, there is bound to be profit taking but the trend for USD is still down as the US gets deeper into a fiscal hole and the Fed continues to throw money.

USD was pushed higher against major peers last week on the prospects for large stimulus measures. U.S. Treasury yields trended higher in the early part of the week on stimulus expectations. U.S. President-elect Joe Biden, who alongside his administration takes office on Jan. 20, has promised �trillions� in extra COVID-19 stimulus measures.

However, the release of details of President-elect Joe Biden's USD 1.9 trillion stimulus on Thursday failed to give the USD additional support, with the main points of the plan already reported by the media.� The stimulus plan includes a wave of new spending, more direct payments to households, an expansion of jobless benefits, and an enlargement of vaccinations and virus-testing programs. However, questions have been raised over how he and his administration plan to foot the bill.

USD gained on Friday after Fed Chair Jerome Powell adopted a very dovish tone in a live-streamed interview on Thursday, although he did not explicitly rule out a tapering of bond purchases towards the year-end. The Fed does not expect to raise interest rates until 2023 at the earliest.

INR Gains as Market Mood Improves

INR traded higher last week amid a risk-on mood in the market. Strong Chinese trade data has boosted optimism surrounding the global economic recovery. Additionally, Indian inflation eased back in December, owing to falling food prices.

Retail inflation +4.59% YoY in December

The annual retail inflation was 4.59%, down significantly from 6.93% in November. This was the lowest level of inflation since September 2019. Further, on the data front, India�s trade deficit in goods widened to USD 15.44 billion in December. Imports rose to USD 42.59 billion, boosted by a surge in gold imports.

Chinese trade data beats forecasts

Chinese exports grew by more than expected in December as COVID-19 disruptions globally fuelled demand for Chinese goods. Exports jumped 18.1% in December compared to a year earlier beating forecasts of 15%.� Meanwhile, imports rose 6.5% year on year in December, beating forecasts of 4.5% growth.

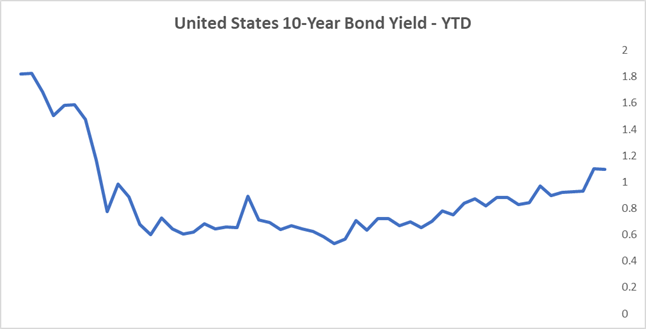

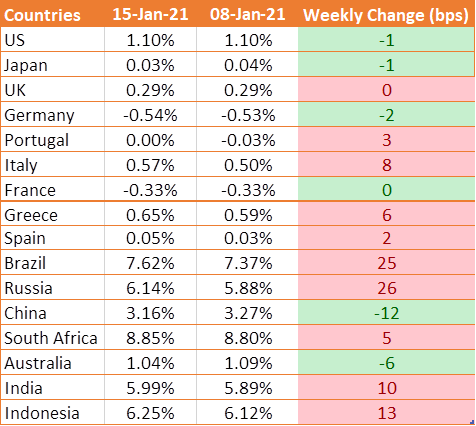

UST Yields Jump Amid Inflation Expectations

U.S. Treasury yield fell by 1 bps to 1.10% as investors digested the latest inflation data that showed a small increase.

The monthly Consumer Price Index reading for December showed a rise of 0.4% for the headline number. Core CPI, less food and energy, edged up 0.1%, also in line with estimates.

However, yields rose on Friday after dovish comments from Federal Reserve Chairman Jerome Powell boosted expectations for a jump in inflation. He said that an interest rate increase would come "no time soon" given the depth of the economic problems related to the still-raging coronavirus crisis.

The dovish comments reinforced expectations that the Fed will allow inflation to rise above the Fed's target of 2% for longer before raising rates.

We would love to hear back from you. Please Click here to share your valuable feedback