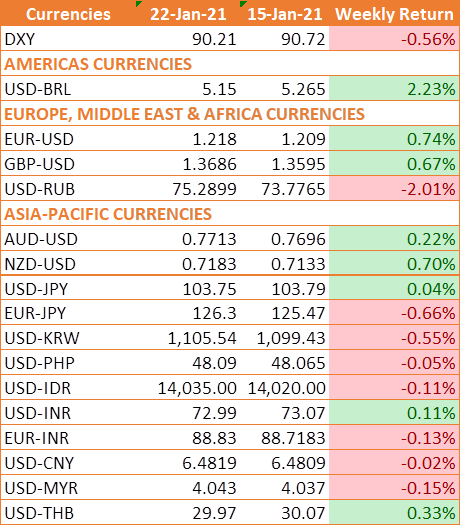

The DXY index bounced back to around 90.21 levels on Friday amid a general decrease in risk appetite as focus returned to coronavirus and general optimism over the new Biden administration cooled. In the week, however, the dollar is down near 0.7%, as President Biden is due to roll out massive spending plans that include extra USD 1400 checks for most Americans, a temporary boost in unemployment benefits, and a rise in the federal minimum wage to USD 15 per hour. Treasury Secretary Janet Yellen said 'act big' on the Covid-19 relief package, stating that the economic benefits far outweigh the leveraged Fed's balance sheet risks.

Click here to read our analysis on "Yellen Says Take U.S. Debt Rating to Junk to Push the Economy Out of Depths But…."

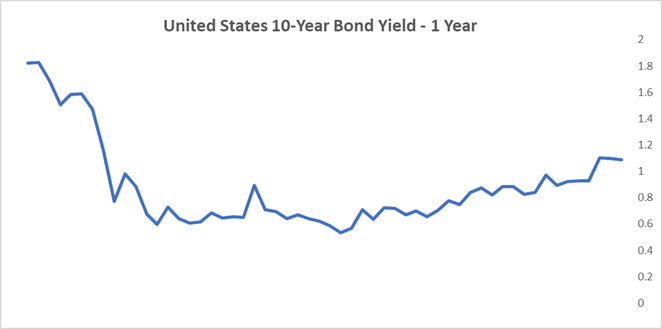

On the U.S.'s macro front, manufacturing and service activity gained in December 2020 despite higher Covid-19 cases. Fed meeting is scheduled this week, which will be watched keenly. Fed dovish stance will strengthen USD, but the gains are capped on the prospect of more stimulus and larger fiscal deficits.

In Europe, hospitalizations, deaths, tight restrictions, and travel restrictions continued as the Covid-19 cases surged. Meanwhile, the ECB kept the door open to more stimulus. Christine Lagarde warned about the risks of rising infections and new lockdowns on economic growth. Euro's recent strength is an additional drag on inflation growth.

U.K., on the other hand, saw a significant contraction in service and manufacturing activity. The Markit PMI index dropped from 50.4 levels to 40.6 levels, the lowest level since June 2020. This deterioration was driven by weakness in the manufacturing and service sectors.

Japanese Yen depreciated 0.20% on Friday against the USD amid a surge in Covid-19 cases. Bank of Japan Governor Haruhiko Kuroda warned of downside risks to the economy hit by another state of emergency over the novel coronavirus. Its outlook for the current business year was slightly cut. Japan's consumer prices declined 1.2% (Y-o-Y) in December 2020, after falling 0.9% in the previous month, as the pandemic continued to drag consumption heavily.

INR closed at 72.99 per U.S. dollar, lowest levels since March 2020. Hopes of a quicker economic recovery and additional fiscal stimulus in the U.S strengthened INR., India launched one of the world's most effective Covid-19 vaccination programs. New Delhi is planning to vaccinate 300 million people, or more than 20% of its 1.3 billion population, in the first phase of the exercise.

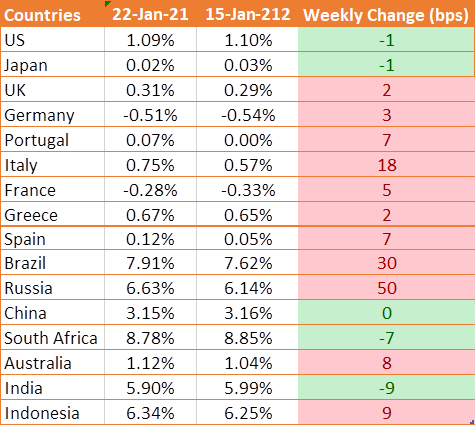

P.I.G.S Yields Jump Amid Covid-19 Cases & Bleak Economic Outlook

Christine Lagarde warned about the risks of rising infections and new lockdowns on economic growth. Euro's recent strength is an additional drag on inflation growth, which spooked investor sentiment. Italy's benchmark bond witnessed 18 bps jump in yields as the country is going through a political crisis amid the pandemic. Former Italian Premier Matteo Renzi is testing his already low popularity by provoking a political crisis that could bring down Italy's coalition government at a critical juncture. IHS Markit Germany Services PMI edged down to 46.8 in January of 2021 from 47 in December, showing weakness in the service sector.

We would love to hear back from you. Please Click here to share your valuable feedback