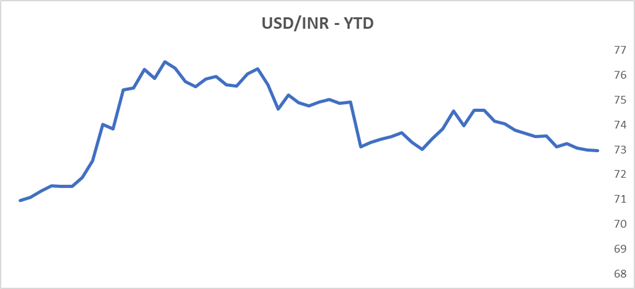

The cost of higher growth will drive INR going forward

The Economic Survey 2021 has forecast India real GDP growth at 10% to 11% and nominal GDP growth at 15%, largely due to base effect on the back of negative grpwth seen in fiscal 2020-21 due to Covid pandemic. Trend grpwth after fiscal 2021-22 js seen at 6.5% to 7%. Inflation too is expected at over 6% for fiscal 2021-22. Given that India GDP growth is seen at higher levels while US Fed and ECB keep rates at lows and pump in liquidity, capital flows can be strong and drive up the INR in the near term. However, the cost of growth will drive the INR value over the longer term as high fiscal deficit can lead to higher inflation that might drag sustainability of economic growth.

INR exihibited great resilience last week despite a steep selloff in domestic equities. Indian shares ended at their lowest level in over a month on Thursday.

India on Friday announced that it expects a rebound in economic growth of 11% for the coming fiscal year in its annual economic survey following a huge vaccination programme and a rebound in consumer demand.

India’s government has promised game changing plans to boost economic growth in the 2021/22 budget. Healthcare spending, privatization drive and import duties are expected to be in focus.

Earlier in the week the IMF upgraded Indian’s GDP forecast to 11.5% in 2021, reclaiming the status of the world’s fastest growing economy. This will mean India is the only major economy to register double digit growth this year.

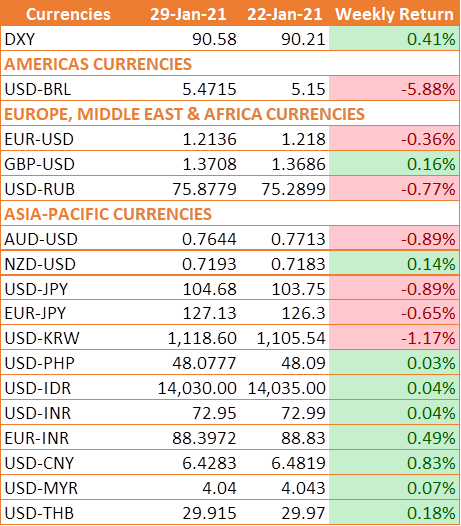

USD gains on market volatility

USD pushed higher last week, as safe haven demand surged after risk sentiment took a hit on the back of turmoil in equity markets. Also helping the USD was the release of some positive U.S. economic data on Thursday, with the weekly initial jobless claims falling more than expected. Fourth-quarter GDP, meanwhile, slowed sharply but stayed positive, growing at annualized rate of 4.0%.

The Federal Reserve left monetary policy unchanged on Wednesday as expected. Federal Reserve Chair Jerome Powell expressed his concerns over the health of the US economic recovery. His downbeat comments dragged on sentiment and lifted demand for the safe haven USD.

Meanwhile market participants are also awaiting news of U.S. President Joe Biden’s fiscal spending package, with the delay in its approval suggesting that the proposed USD 1.9 trillion deal will not end up being as large as expected.

US Personal Expenditure Price Index (PCE) the Federal Reserve’s preferred measure of inflation edged higher to 1.3% from 1.1% in November. On a monthly basis the PCE index rose 0.4% from 0%. More importantly, the core PCE rose to 1.5%, up from 1.3%.

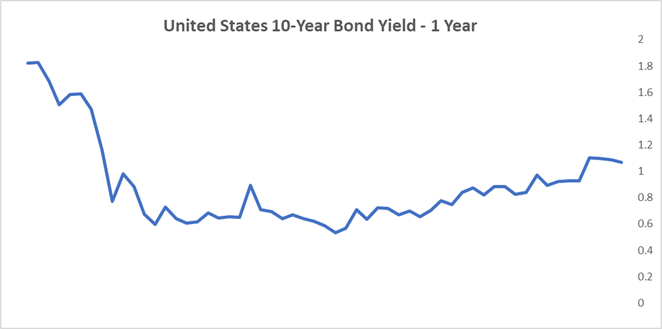

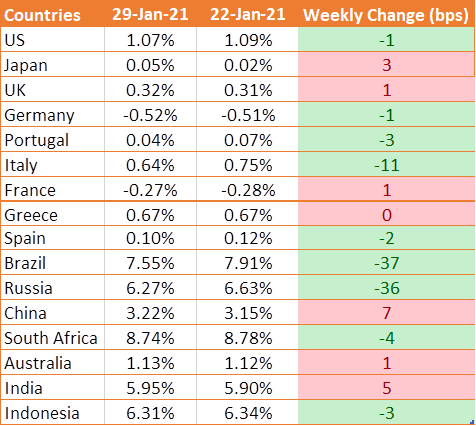

U.S Treasury yields rise following key economic data

US 10 year bonchmark bond yields edged higher by 1 bps to 1.11% last week after the Commerce Department reported on Thursday that the country’s gross domestic product grew by 4% in the fourth quarter.

The Federal Reserve kept rates and its pace of bond purchases unchanged on Wednesday, saying that the strength of the recovery had moderated due to the COVID-19 pandemic. Fed Chairman Jerome Powell said the Fed would be patient on inflation, and that any rising prices this year would prove to be “transient.”

We would love to hear back from you. Please Click here to share your valuable feedback