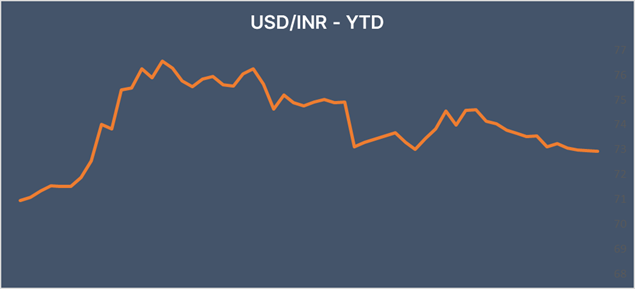

INR shrugged off 2 major negative factors to close last week on a stronger note. The government showed a high fiscal deficit in its budget for fiscal 2021-22 while the RBI hiked the CRR of banks to sterilise excess liquidity. Markets focused on the growth optimism on the Indian economy, as it bought into the INR.

The RBI governor Shakitikanta Das in the lastest concluded MPC meet, sounded optimistic about the outlook for the Indian economy and the prospects for a strong recovery. The central bank sees the country’s GDP rebounding by 10.5% in the fiscal year 2021-22. The RBI sees this recovery as front-loaded with as much as a 26% surge in GDP in H1.

The RBI, as expected kept the policy rate unchanged at 4%. There was no change in the policy stance of the central bank which remains accommodative and has been since the start of the pandemic. However, CRR rate was hiked by 1%, as the central bank took baby steps to normalise policy.

Upbeat service sector PMI report also underpinning the INR. India’s service sector expanded in January, hitting an 11 month high. The service sector PMI rose from 52.3 in December to 52.8 in January. Even though the pace of growth accelerated it remains below 53.3 the long-run average pace of expansion.

INR was under pressure post-budget announcement on Monday after Finance Minister said that the fiscal deficit for the current fiscal year would likely rise to 9.5% compared to the previous budget estimate of 3.5%. She added that the government would likely borrow a further Rs 800 billion from the market by the end of March.

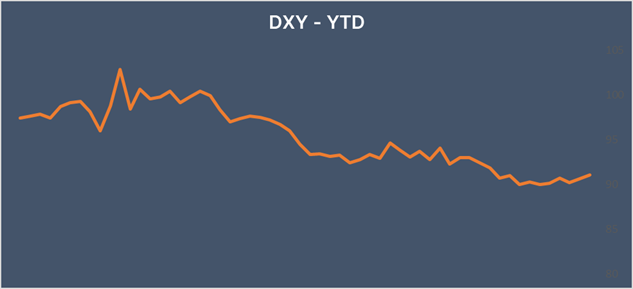

USD trends higher against majors

USD traded higher on optimism surrounding the accelerating vaccine program and progress towards the passing of the Biden Administration’s USD 1.9 trillion fiscal stimulus packages. Combined, these two factors are boosting the prospects for economic growth in the US this year and the potential for tighter monetary policy.

Additionally, the USD is being boosted by the weak Euro. Concerns over the Eurozone’s coronavirus situation and its slow vaccine rollout is dragging on demand for the euro boosting the USD.

49,000 jobs created unemployment rate falls to 6.3%

The headline figure from the closely watched US Labour Department’s job report revealed 49,000 jobs were created in the US in January, this was roughly in line with the expectation of 50,000. Meanwhile, the unemployment rate was a bright spot, dropping to 6.3%, down from 6.7%.

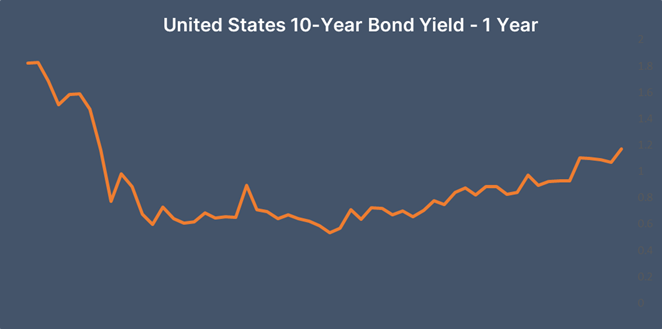

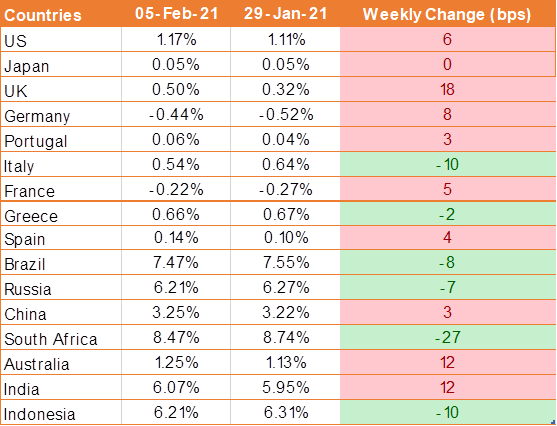

U.S 10-year treasury yields rise on stimulus

US 10 year benchmark bond yields edged higher by 6 bps to 1.17% last week after a report showed employment growth rebounded less than forecast in January, strengthening expectations of more stimulus spending from Washington. There were downward revisions to job gains in November and December, indicating the labor market’s health had soured as the pandemic worsened at the end of last year.

The Senate passed a budget resolution on Friday as Democratic lawmakers moved towards passing a USD 1.9 trillion fiscal relief bill without receiving Republican support.

We would love to hear back from you. Please Click here to share your valuable feedback