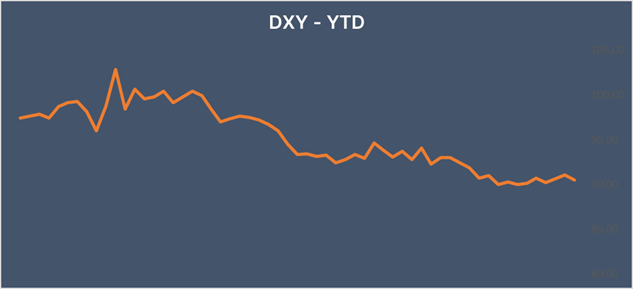

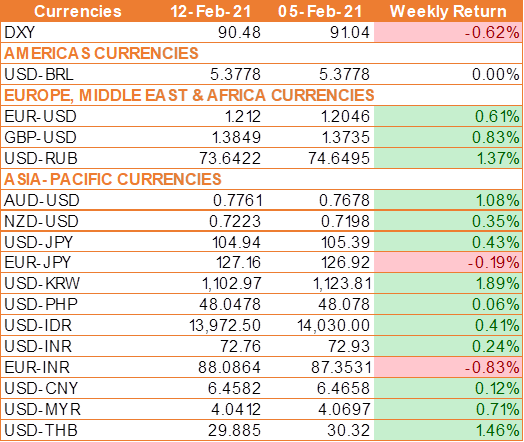

USD came under pressure last week as market participants expect that the massive US fiscal stimulus is on its way shortly and amid the release of weak inflation data. The House of Democrats released the first draft text for the legislation that will make up the covid stimulus bill, taking the USD 1.9 trillion package a step closer to approval.

US consumer price index remained unchanged in January at 0.3% for a second straight month. The Core CPI, increased by 0.2% month on month, less than the 0.3% expected.

Fed remains accommodative

Federal Reserve Chair Jerome Powell last week reiterated that the US central bank’s monetary policy will remain supportive. Speaking online to the Economic Club of New York, Fed Chair Powell said that the US jobs market was still a long way from being fully recovered. He added that the Federal Reserve isn’t considering raising interest rates from their current levels of near zero.

Weaker than expected U.S. jobless claims data

US jobless claims came in worse than expected with 793,000 U.S. citizens filing for unemployment benefits for the first time, above the 757,000 expected. Furthermore, the slight decrease from the previous week disappeared with an upward revision.

Risk-on trade lifts demand for riskier currencies

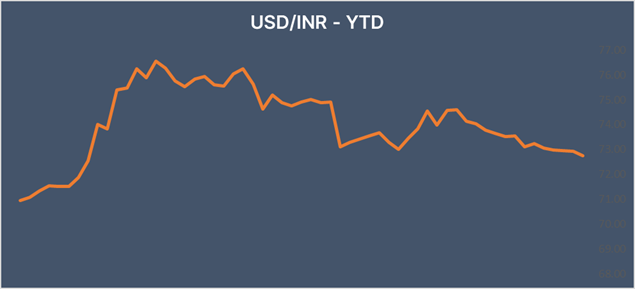

INR advances higher against the USD last week amid an upbeat mood in the broader financial markets, which supports risker assets such as equities and currencies like the INR.

However, the rising price of oil could keep INR gains in check. Oil is extending gains for an eighth consecutive session. West Texas Intermediate is currently trading at USD 58.50, boosted by US stimulus optimism, rapid vaccine deployment lifting the global demand outlook, and OPEC keeping market conditions tight.

The Consumer Price Index-based inflation stood at 4.06% in January 2021 compared with 4.59% in December, according to data released by the Ministry of Statistics and Programme Implementation.

Relations between India and China showed signs of improving after both sides agreed to pull back troops from a bitterly contested lake area in the Himalayas. The move comes in a breakthrough after months of a standoff.

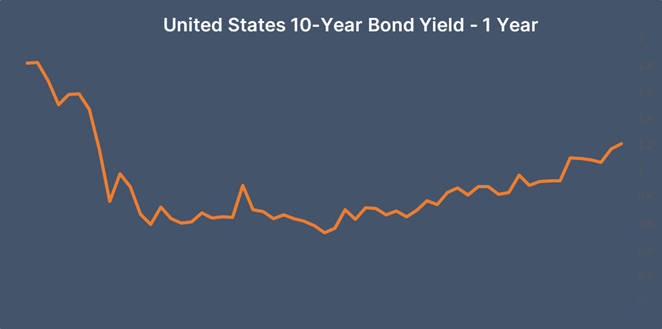

U.S 10-year Treasury yields rise on inflation concern

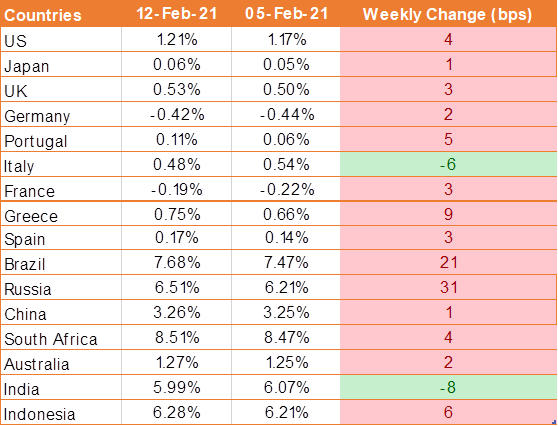

US 10 year benchmark bond yields edged higher by 4 bps to 1.21% last week on market participants concern about inflation rising on economy recovery.

Real yields, which account for inflation, have edged higher this year though they still remain in negative territory. Rising inflation expectations signal investor's confidence in the economy.

Italy’s 10-year bond yield fell last week and hovered around record lows and the closely watched gap over German Bund yields fell to its lowest since early 2015 on Friday, as Mario Draghi looked set to take office at the head of an Italian government of national unity.

We would love to hear back from you. Please Click here to share your valuable feedback