The G-sec bond auction for Rs 310 billion held last week saw very low demand for bonds and RBI had to devolve more than Rs 200 billion to the bond auction underwriters, close to 70% of the total auction was given to the underwriters. RBI also gave high commission to the underwriters, much more than what they normally pay, in order for the auction to be underwritten.

The auction devolvement shows that the market has very low appetite for government bonds at RBI held levels of yields. The bond supply is also humongous, with both states and centre together borrowing over Rs 500 billion a week. Bond market just does not have space to absorb such high supply.

Going into the next fiscal year, supply will be heavy and RBI will have to come up with a plan to push the supply. The first step is to let yields rise so that market gets more comfortable to absorb supply at market determined yields.

Spike in SDL cut—off yield

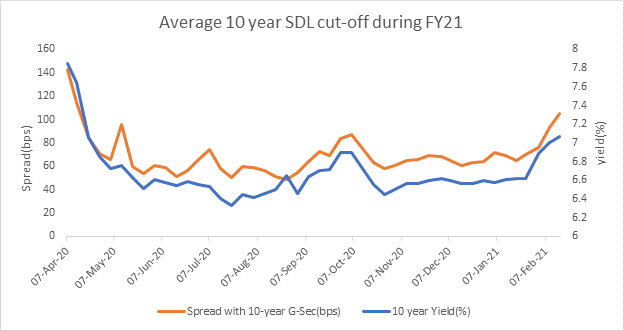

On the SDL auction conducted on 16th Feb 2021, average 10-year SDL yield spiked to 7.05% having a spread of 102 bps with benchmark gilt yield.

Prior to Union Budget 2022, average SDL auction cut-off came in at 6.62% having a spread of 70 bps on 25th Jan 2021.The significant upward movement in SDL yield is consequent to higher state government borrowing in tune with Union Government borrowing, deterioration in state fiscal position caused due to corona pandemic.

RBI Protecting Yields

RBI has been continuously conducting OMOs and special OMOs to stabilize government bond yield in the wake of a whopping fiscal deficit for current fiscal year. As result, upward movement in government bond yield is less as compared to that of SDLs which widens the spread.

Going ahead, SDL yield is likely to continue uptrend which may prompt RBI to conduct OMO for SDL purchase, as had done in 2020.

Auction of Government securities on 18th Feb 21

Rs billion | 3.96% GS 2022 | 5.15% GS 2025 | 5.85% GS 2030 | New GS 2061 |

Notified Amount | 20 | 110 | 110 | 70 |

Cut off Price / Implicit Yield at cut-off | 99.39/4.3299 | 98.18/5.5924 | 98.46/6.0596 | 6.76 |

Amount accepted in the auction | 21.45 | 3.00 | 1.062 | 35.01 |

Devolvement on Primary Dealers | Nil | 107 | 108.93 | Nil |

It can be seen from the above table that devolvement on primary dealers stood at 97% and 99% of respective notified amount for 5.15% GS 2025 and 5.85% GS 2030 respectively. Cut-off yield for 5.15% GS 2025 stood 8 bps less than its average traded yield of 5.67% while cut-off yield for 5.85% GS 2030 bond came in at 4 bps less than its weighted average traded yield on 18th Feb. This indicates how central bank is desperate to keep yields at a lower level.

The increase in devolvement on primary dealers has been in tandem with rise in underwriting commission paid by RBI, which is evident from below table.

Bond | ACU Commission Cut-off rate per Rs 100(18th Feb 21) | ACU Commission Cut-off rate per Rs 100(12th Feb 21) | % rise | |

3.96% GS 2022 | 4.70 |

| ||

5.15% GS 2025 | 44.00 | 25.00 | 76.00% | |

5.85% GS 2030 | 49.00 | 35.00 | 40.00% |

It can be observed that commission paid for 5.85% GS 2030 rose by 40% as compared to previous week.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 14 bps to 6.13%. 5.77% 2030 yield increased by 12 bps to 6.18%. 5-year benchmark bond, 5.22% 2025 yield increased by 13 bps to 5.56%. Long term paper 7.16% 2050 yield gained 11 bps to 6.79%.

The spread of 10-year bond over 5-year bond (5.22% 2025) stood at 57 bps as compared to 56 bps in previous week. The 15-year benchmark over 10-year benchmark spread came down by 2 bps to 42 bps from 44 bps while 30-year benchmark over 10-year benchmark spread declined by 3 bps to 65 bps from 68 bps.

In the SDL auction conducted last week, average 10-year SDL yield rose to 7.05% from 7% from previous week. Consequently, the spread with G-sec benchmark increased to 102 bps from 93 bps.

On weekly basis, 1-year OIS yield rose by 2 bps to 3.79% while 5-year OIS yield rose by 13 bps to 5.22%.

We would love to hear back from you. Please Click here to share your valuable feedback