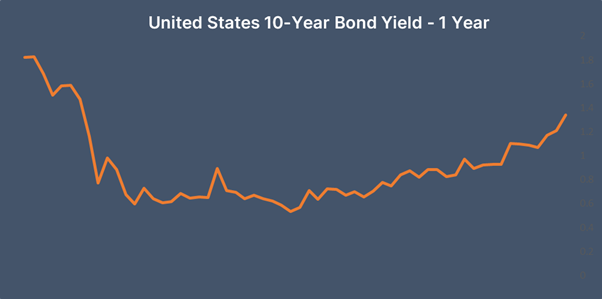

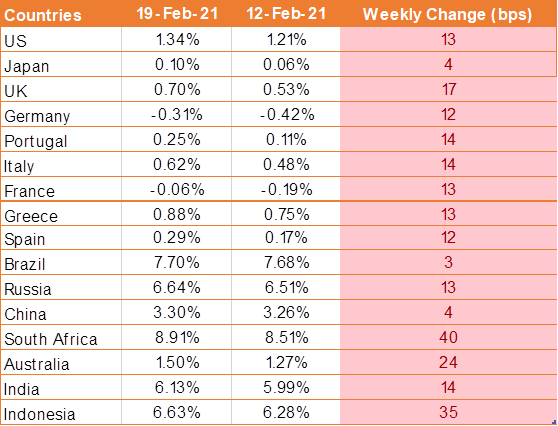

US 10 year Treasury yield rose to the highest level in a year this week to 1.34% amid concerns about the possibility of higher inflation as investors bet that the U.S. economy will gather strength in the coming months. Additionally, the market participants continue to assess the full impact of Joe Biden’s USD 1.9-trillion stimulus plan.

US retail sales surged in January by 5.3% month on month after falling -1% in December against the expectation of a rise of 1%, the sharp jump comes as millions of consumers received USD 600 stimulus checks. Spending gains were broad-based, with all categories recording gains. The data has boosted the inflation expectations among market participants, boosting expectations of tightening by the Federal Reserve.

However, the sharp surge in UST yields came on Friday after data released showed that the business activity in the U.S. private sector remained robust in February, and sales of previously owned homes rose last month.

The developed world’s bond yields and emerging markets’ equities are inversely correlated. Any spike in yields in the US often causes turbulence in the financial markets of the developing world. If the selloff in the US treasury continues then it could force investors who have piled investments into higher-yielding currencies in the developing world to exit.

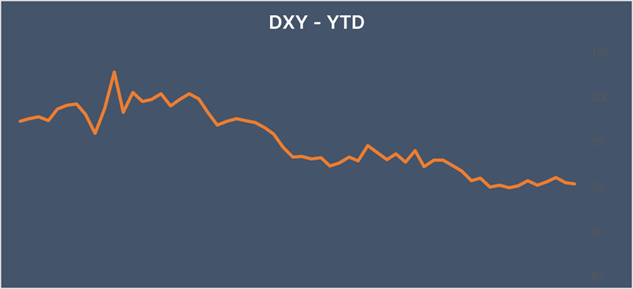

USD weakens on Yellen’s stimulus support

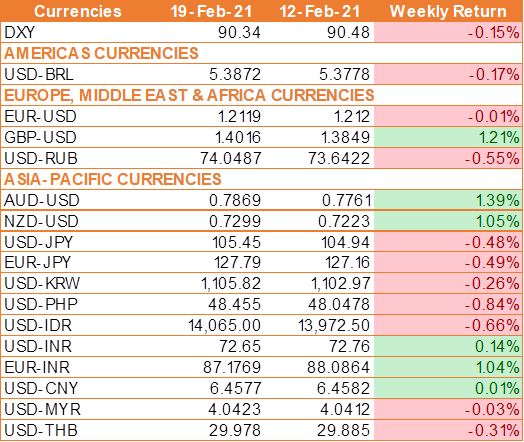

USD trades lower last week as US Treasury Secretary Janet Yellen highlighted the need for additional fiscal stimulus despite US retail sales printing significantly higher than the expectation. Instead, Janet Yellen cited the downbeat jobless claims numbers which highlight the weakness in the labor market.

US jobless claims unexpectedly jumped to 861,000, a four-week high as the US labor market recovery stumbled against the expectation of unemployment benefits to decline slightly from 793,000 the previous week to 765,000.

The data came following the latest FOMC meeting minutes which showed that the Fed was in no rush to start tapering support. Policymakers expect to take time for the Fed’s goals of higher inflation and a stronger labor market to be reached.

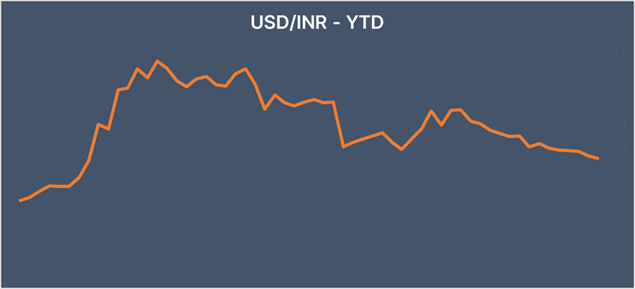

INR advances higher against the USD last week on the expectation that India’s GDP is likely to rebound back into growth territory in October – December 2020 period, compared to a year earlier. The Indian economy contracted by 25% in the June quarter and by 7.5% in the September quarter of the current fiscal year.

India’s factory output as measured by the Index of Industrial Production revealed growth of 1% in December. Industrial growth so far in the fiscal year 2020-21 (April – December) has contracted -13.5%.

Morgan Stanley has upwardly revised the Indian GDP growth forecast for FY22 to 12.1%, up from 10.1% previously. For FY23, it has revised the GDP higher to 6.7% up from 6.2%.

We would love to hear back from you. Please Click here to share your valuable feedback