Bond markets are increasingly worried about the inflationary effects of fiscal pump priming by governments and ultra loose monetary policy by central banks across the globle. Normally, governments want to borrow and spend and are not worried about inflation while central banks act against the government driven inflation. However, due to covid pandemic, central banks are encouraging governments to borrow and spend and also want inflation to rise.

Global bond yields have jumped, led by UST longer end yields on inflation fears as well as on the heavy supply of government bonds. India too has seen sharp rise in Gsec yields on the back of rising global bond yields. 10 year Gsec yields have risen by 35bps to levels of 6.20% over the last few months.

10 year government bond yields can rise to 7% levels in the coming months on the back of heavy government borrowing program of Rs 12 trillion, rising domestic inflation expectations as fuel prices and prices of other goods and services are rising sharply and a clear lack of demand for bonds at current levels, as seen by the high underwriting commissions and high levels of bids in terms of yields in the government bond auction.

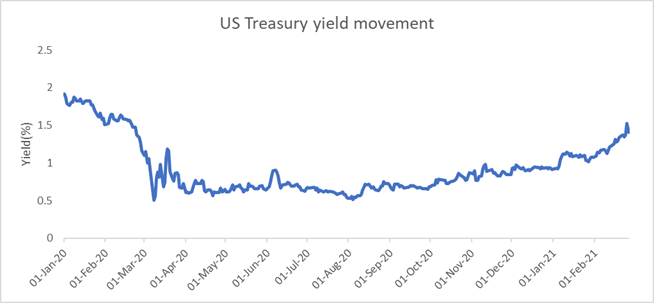

Spike in US Treasury yields

On 25th Feb, US Treasury 10-year yield touched 1.614%, which was the highest level since Feb. 14, 2020, causing concerns across the global markets. The rise in Treasury yields steepened the entire curve, with short-term and medium-term yields rising less than the long end yields. Factors like rising inflation, higher public debt and possibility of Fed rate hike fueled spike in yields.

US consume inflation stood at 1.4% in Jan 21 while average inflation came in at 1.2% for 2020. In order to mitigate economic downturn caused due to corona pandemic, US Govt has announced several stimulus pacakges that has caused uptrend in consumer inflation since Apr’20. Moreover, Fed Reserve has been continuing quantitative easing program to support economy. Considering these factors, there are speculations that Fed may rise interest rates prior to 2023 as announced in last meeting.

RBI Governor’s assurance to market

In an interview, RBI Governor has stated that the central bank is working to ensure an orderly evolution of the yield curve despite higher government borrowing for current as well as next fiscal year. He affirmed that RBI would continue to conduct OMOs and special OMOs in FY22, similar to the current fiscal year.

He assured that the central bank is using various tools to keep adequate liquidity in the current scenario and there will be no dearth of ample liquidity in the near future. Regarding inflation, he expected that it would not spike suddenly, and core inflation is likely to remains at 5-5.5%. He reiterated that inflation would remain under upper limit of 6% in near future.

Q3FY21 GDP growth rate

Domestic economy expanded by 0.4% in Q3FY21 as compared to -7.3%(revised) in previous quarter and 3.3% growth in Q3FY20. Moreover, as per second advance estimates, GDP is likely to contract by 8% in FY21.

Gross Fixed Capital Formation (GFCF) has improved substantially from a contraction of 46.4% in Q1 to a growth of 2.6% in Q3. Private Final Consumption Expenditure (PFCE) has recovered from a contraction of 26.2% in Q1 to a smaller contraction of 2.4% in Q3.

The gross value added (GVA) in Q3 2020-21 from the manufacturing sector grew by 1.6%, from a contraction of (-) 1.5% in Q2FY21. In the same line the electricity, gas, water supply & other utility services sector experienced a growth of 7.3% from a growth of 2.3% in Q2FY21.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 10 bps to 6.23%. 5.77% 2030 yield increased by 14 bps to 6.32%. 5-year benchmark bond, 5.22% 2025 yield increased by 10 bps to 5.66%. Long term paper 7.16% 2050 yield gained 8 bps to 6.87%.

The spread of 10-year bond over 5-year bond (5.22% 2025) stood unchanged at 57 bps as compared to previous week. The 15-year benchmark over 10-year benchmark spread came down by 8 bps to 34 bps from 42 bps while 30-year benchmark over 10-year benchmark spread rose by 2 bps to 67 bps from 65 bps.

In the SDL auction conducted last week, average 10-year SDL yield rose to 7.20% from 7.05% from previous week. Consequently, the spread with G-sec benchmark increased to 104 bps from 102 bps.

On weekly basis, 1-year OIS yield rose by 13 bps to 3.92% while 5-year OIS yield rose by 12 bps to 5.34%.

We would love to hear back from you. Please Click here to share your valuable feedback