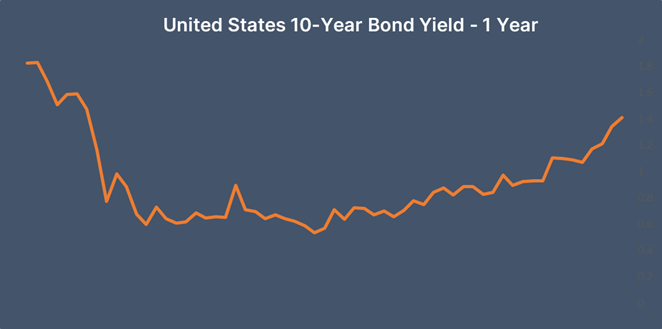

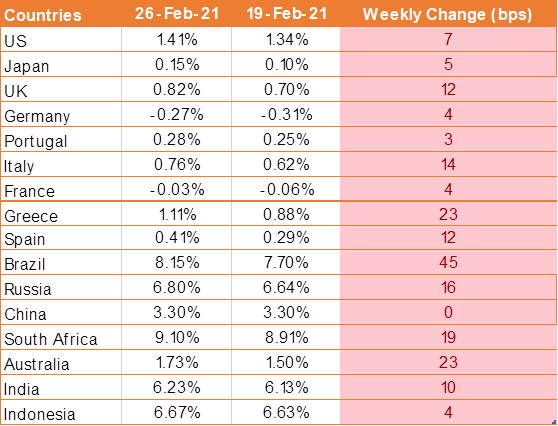

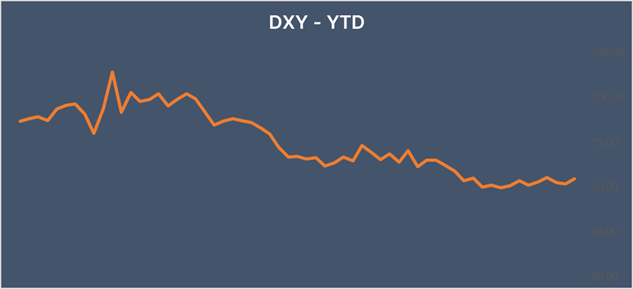

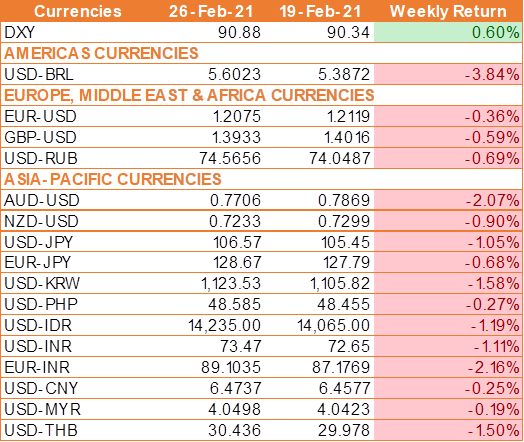

USD climbed last week, lifted by a sharp rise in U.S. Treasury yields, while riskier currencies were hit hard amid fears that central banks will have to tighten sooner than previously expected. The yield on the US 10 year treasury closed at 1.41%, its highest level since the start of the pandemic.

Global government bonds, and particularly U.S. Treasuries, have started to become the focal point of markets, as market participants now expect inflation to rise aggressively, as economies recover on the back of extreme levels of fiscal stimulus and very loose monetary policies.

However, federal reserve policymakers are shrugging off the surge in longer-term U.S. government bond yields, as a sign of growing optimism about the economy, which could pick up steam as more people are vaccinated against the coronavirus. The Fed Chair Jerome Powell repeated that the US interest rate will remain low for some time. He confirmed that the Federal Reserve will continue buying bonds to support the US economy.

Jerome Powell pointed out that the central bank’s goals of 2% inflation and strong employment were still some distance from being achieved.

Kansas City Fed President Esther George said that “ Much of this increase likely reflects growing optimism in the strength of the recovery and could be viewed as an encouraging sign of increasing growth expectations”. Atlanta Fed President Raphael Bostic, speaking in a separate online event, said bond yields remained comparatively low and that the central bank did not need to do anything at this time to address the uptick.

USD extends gain amid upbeat economic data

U.S. Personal income data rose 10% month on month in January while personal spending jumped 2.4% at the start of the year. The PCE figure, the Fed’s preferred measure of inflation, hit 1.5% beating expectations of 1.4%.

The upbeat data supported expectations that the US could see a solid economic recovery amid the rapid rollout of the covid vaccine and the Biden administration’s USD 1.9 trillion covid stimulus package.

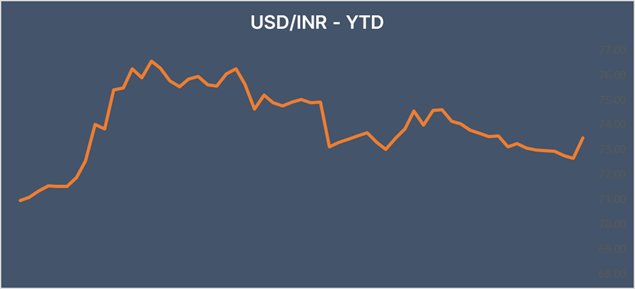

INR drops sharply as India GDP at +0.4% vs +0.5% exp.

India’s economy grew by 0.4% year on year in the October – December quarter. 0.4% growth was slightly less than the 0.5% expectation, which dragged down the INR. However, it is still a marked improvement from the 23.6% and 7.5% contraction that was seen in the April- June and July- September quarters respectively.

We would love to hear back from you. Please Click here to share your valuable feedback