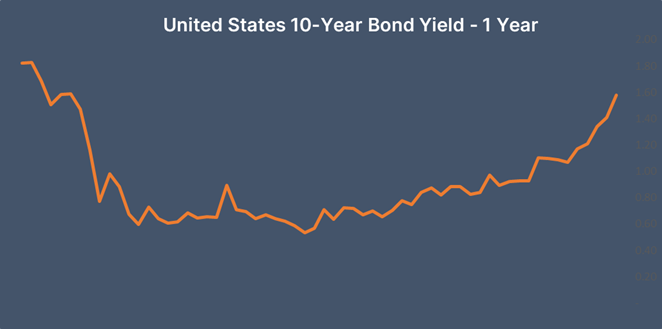

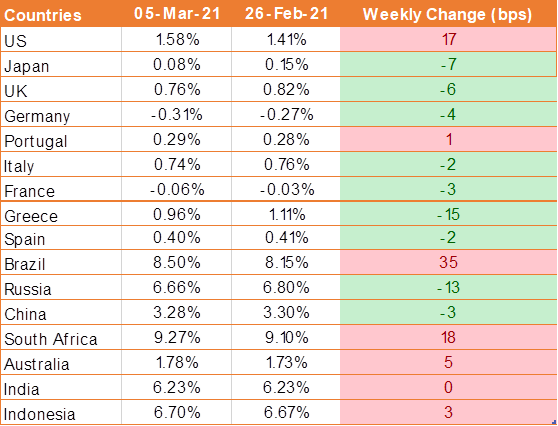

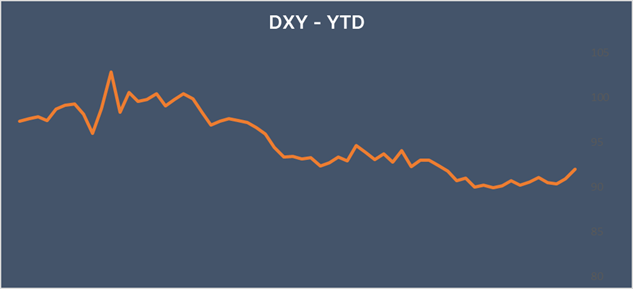

Synopsis – US government bond yields have been rising significantly due to high inflation expectations and this is strengthening the USD on the back of capital moving back to US bonds from other foreign currency assets. Reading time 6 minutes.

USD & UST yields jumped sharply higher after the February U.S. jobs report topped expectations. U.S. Labor Department reported that the U.S. added 379,000 jobs in February, much stronger than expectations of a 210,000 gain. The unemployment rate fell slightly to 6.2%. The jobs surge comes after the labor market’s recovery had turned sluggish in recent months.

Federal Reserve chairperson Jerome Powell on Thursday said that the central bank would not sit back and let the financial market conditions tighten but he suggested that the current rise in long-term bond yields is not worrisome for now. Powell also said that the Fed would be “patient” with higher inflation expected this year, saying it was likely to be transitory.

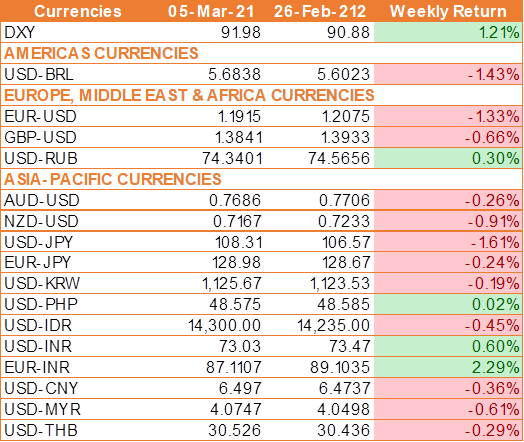

USD extended its gains against all of the major currencies last week, with USD/JPY rises to its strongest level since June 2020 and EUR/USD falling to its weakest since November. Progress on the stimulus deal will be the most important driver of USD flows in the coming week along with February’s consumer price report.

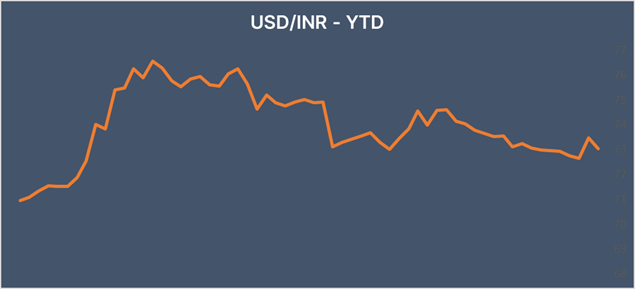

INR gains despite rising USD

INR ended the week higher against the USD despite a sharp fall seen on Friday as oil prices soared to the highest level in almost 14 months after OPEC defied market expectations and left oil output unchanged.

INR started the week on a higher note as the covid vaccine program in the country picked up. Boosting sentiment was news that Prime Minister Narendra Modi was administered the first dose of a homegrown covid vaccine, setting the scene and kicking off the country’s wider vaccination drive.

Activity in India’s dominant service sector expanded at its quickest pace in a year in February. The Nikkei/ IHS Markit Services PMI increased to 55.3 last month up from 52.8 in January. This was the highest level since pre-pandemic in February 2020.

According to the Reserve Bank of India, the country’s foreign exchange reserves increased by USD 169 million to USD 583.865 billion. Reserves has been steadily increasing and touched an all-time high of $590.185 billion for the week ending 29th January.

We would love to hear back from you. Please Click here to share your valuable feedback