Synopsis: Rising inflation expectations, spiking UST yields and high government borrowing have taken up bond yields by 40bps to 80bps across the curve. A rate hike in April will send positive signals to the market that RBI is staying on top of inflation. Reading time 4 min

Government bond yields have risen across the curve despite RBI intervention through OMOs. This signifies that bond markets are nervous on the outcome of inflation going forward with core CPI inflation sticky at 5.8% and on the market impact of spiking UST yields that are trading at over a year high. Topping it all is the heavy supply of bonds from the centre and states, which the bond markets are finding difficult to absorb in uncertain economic conditions.

RBI needs to show that it is on top of inflation, and a rate hike in anticipation of higher inflation can actually help calm bond market nerves. The more the RBI delays rate hikes and inflation continues to spike, the more bond markets will stop trading government bonds, pushing up yields in the makret and making bond auctions face difficulty in going through.

A rate hike will push up the yield curve but it will also let the market decide on where to absrob the supply of bonds and market conditions can get back to normal.

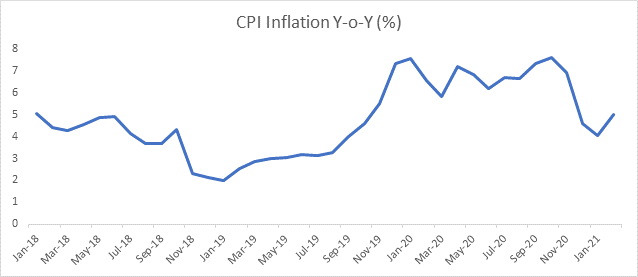

India’s retail inflation rose to 5.03% in Feb 21 as compared to 4.06% in the previous month, driven by higher food and crude prices. During the month, food inflation increased to 3.87% in February from 1.89% in the previous month. Core inflation stood at 5.8% in Feb 21 from 5.7% in Jan 21.

Domestic industrial production stood at -1.6% in Jan 21 as compared to growth of 1% in Dec 20 and 2% in Jan 20. During the month, the manufacturing sector output contracted by 2.0%, while the mining output contracted by 3.7%. On the other hand, electricity generation grew by 5.5% during the month.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield remained unchanged at 6.23%. 5.77% 2030 yield increased by 6 bps to 6.40%. 5-year benchmark bond, 5.22% 2025 yield increased by 6 bps to 5.77%. 6.57% 2033 yield rose by 6 bps to 6.72%. Long term paper 7.16% 2050 yield came down by 1 bps to 6.94%.

The spread of 10-year bond over 5-year bond (5.22% 2025) came down to 46 bps from 52 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 49 bps from 43 bps while 30-year benchmark over 10-year benchmark spread increased to 72 bps from 66 bps.

In the SDL auction conducted last week, average 10-year SDL yield stood at 7.16% from 7.20% during previous week. The spread with G-sec benchmark came down to 97 bps from 99 bps.

On weekly basis, 1-year OIS yield came down by 3 bps to 3.94% while 5-year OIS yield declined by 4 bps to 5.34%.

We would love to hear back from you. Please Click here to share your valuable feedback