Synopsis – USD traded lower as inflation missed expectations and jobless claims dropped to the lowest level since the pandemic started. Attention has now turned to this week’s Fed FOMC monetary policy announcement. Reading time 4 minutes.

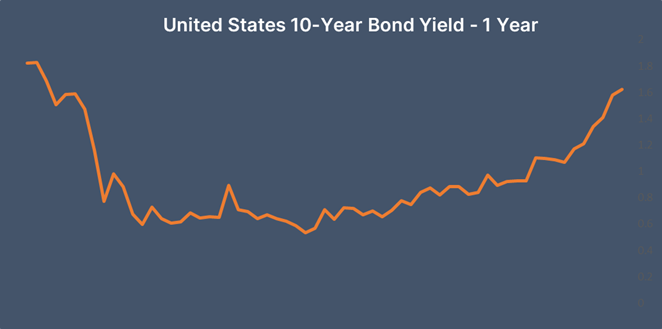

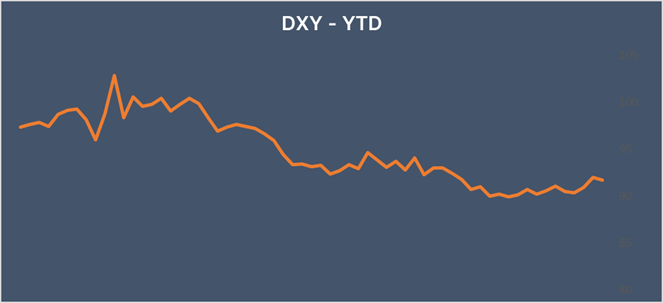

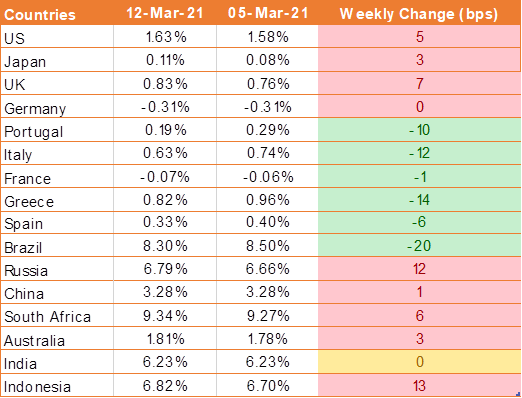

USD traded lower as inflation missed expectations and jobless claims dropped to the lowest level since the pandemic started. Further, a successful US 10 year bond auction also helped to calm the mood in the bond market pushing the USD lower. The demand in the auction was sufficient to drive down bond yields which had lifted the USD to multi-month highs in recent weeks.

US core inflation rose less than expected by 0.1% month on month in February. Core CPI rose 1.3% on an annual basis which was also short of expectation. The data has calmed runaway inflation expectations that had been building.

Data showed that 712,000 U.S. citizens signed up for unemployment benefits last week, this was below the expectation of 725,00. The data shows that the recovery in the labor market remains on the right track.

However, USD and UST yields rose on Friday after US President Biden signed off on the USD 1.9 trillion US stimulus package while also promising to vaccinate all adults in the U.S. by the 1st of May boosting expectations of a faster economic recovery.

Financial market participants attention has now shifted to the Federal Reserve’s monetary policy meeting due next week that could prove to be a "wildcard" for U.S. bonds yields, which have been driving up the USD.

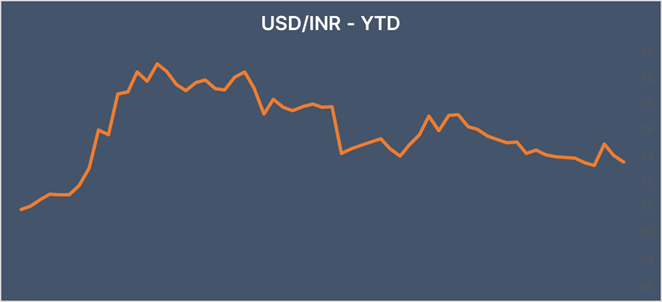

INR gains on risk-on trade

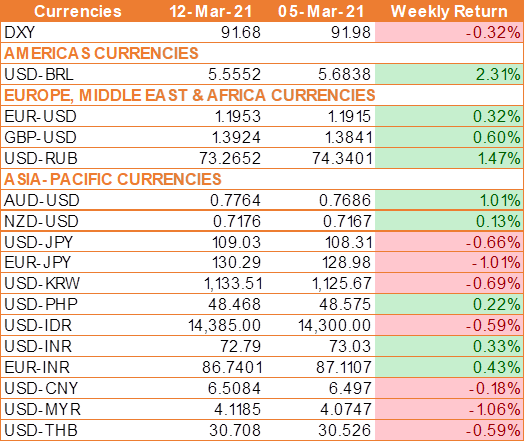

INR ended the week higher against the USD after Organisation for Economic Co-operation and Development (OECD) upwardly revises its growth forecasts for India. The OECD now predicts that the Indian economy will rebound sharply in FY22 by 12.6%. This would make it the fastest-growing economy in the world.

The OECD now expects India’s GDP to contract in FY21 by 7.4% compared to a contraction of 9.9% previously.

On the data front, India’s retail inflation accelerated to a 3 month high level of 5.03% in February as fuel prices increased. The reading is up from 4.06% in January and ahead of the expectation of 4.83%.

We would love to hear back from you. Please Click here to share your valuable feedback