Synopsis: 10-year G-sec yields will rise sharply in FY 22 starting April 2021, as bond markets factor in high inflationary pressures on the back of very high levels of fiscal deficit.

Fiscal deficit, inflation, and G-sec yield movements

G-Sec yield movement is the lead indicator of the economic outlook of the country, while macro-economic data published by the government is a lag indicator. Policymakers or economists or analysts views on economic outlook get factored-in the G-sec yield much before the actual economic data points are published. If the actual results deviate from the estimates, then markets would turn volatile as positions get changed.

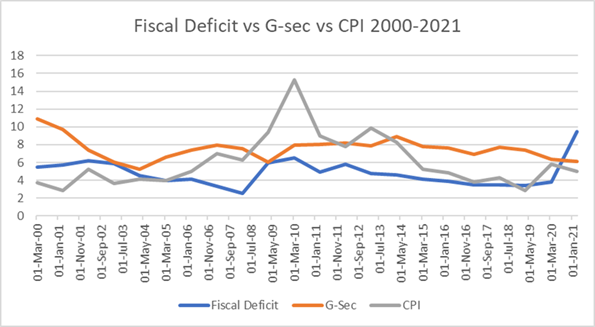

The 10-year G-sec is currently trading at 6.15% levels on an expectation of inflation to stay on the course of policymaker’s guidance of 4% with a bias of plus/minus 2% on either side, strong economic growth (given the low base), liquidity, and ultra-loose monetary policy. However, our study from the data we pulled out from 2000 to 2021 on Fiscal Deficit, inflation, and G-Sec yield movements has shown a positive correlation between Fiscal Deficit and inflation. The Fiscal Deficit soared to 9.5% for Fy21 while it has been set at 6.8% for Fy22, which could pose risks for higher inflation going forward.

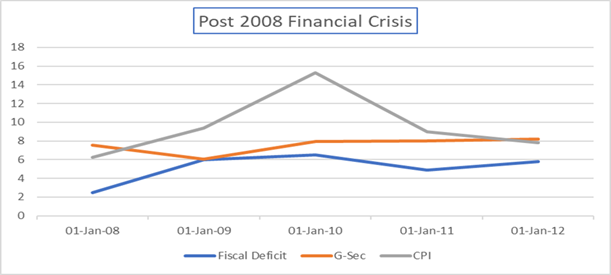

The above chart is self-explanatory in terms of the relation between Fiscal Deficit & Inflation and how it impacted G-sec (remember its a lead indicator hence it will not move in tandem with the other two). Data points during the 2008 financial crisis showed that higher Fiscal Deficit level is a recipe for high Inflation. Inflation had hit highs of 15.31% in 2010 while the Fiscal Deficit was at 6.5% during the same year.

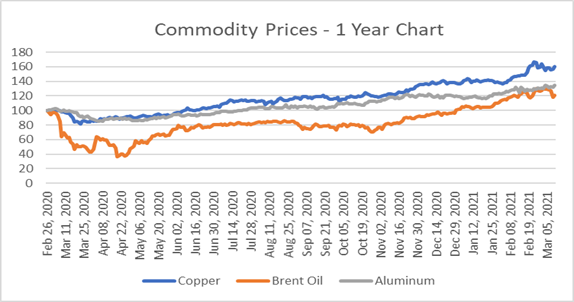

Higher commodity prices would add additional pressure on inflation since the end-user products get expensive due to higher input costs. Corporate earnings would witness a margin squeeze due to higher input costs resulting in lower earnings. A high inflationary pressure scenario would make policymakers raise interest rates much earlier than expected. Brazil's central bank hiked interest rates by 75bps as policymakers are concerned more with upside risks to inflation than downside risks to growth.

The borrowing levels of both the center and states are at the highest levels on record, and it is unlikely that borrowing levels will come down. Restrictions on economic activities are still imposed on certain parts of the country due to fears of the second Covid-19 wave. Going forward, 10-year G-sec yields could see an upward trajectory on the back of inflationary pressure, higher government borrowing, and on expectations of a sooner rate hike by RBI.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield came down by 7 bps to 6.12%. 5.77% 2030 yield decreased by 8 bps to 6.28%. 5-year benchmark bond, 5.22% 2025 yield declined by 10 bps to 5.56%. 6.57% 2033 yield lost 5 bps to 6.66%. Long term paper 7.16% 2050 yield came down by 11 bps to 6.81%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 56 bps from 53 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 54 bps from 52 bps while 30-year benchmark over 10-year benchmark spread remained unchanged at 64 bps.

In the SDL auction conducted last week, average 10-year SDL yield came down significantly to 6.85% from 7.15% during previous week. Consequently, spread with G-sec benchmark declined to 71 bps from 97 bps.

On weekly basis, 1-year OIS yield rose by 2 bps to 3.86% while 5-year OIS yield declined by 4 bps to 5.16%.

We would love to hear back from you. Please Click here to share your valuable feedback