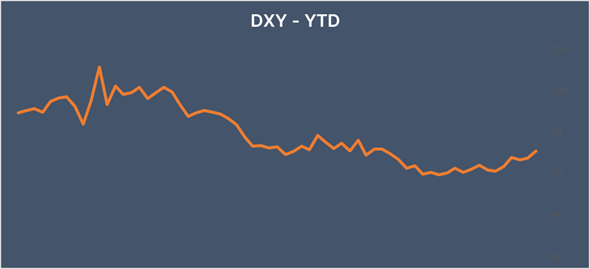

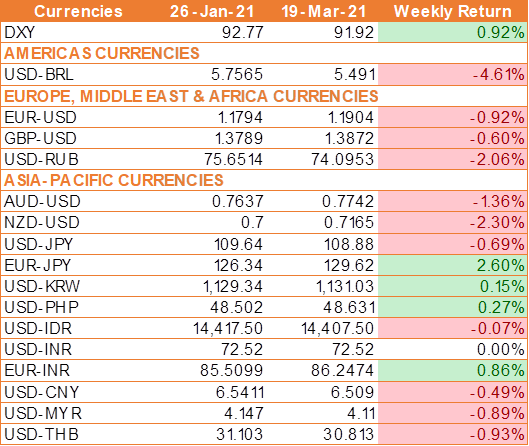

Synopsis – USD strengthened against all major currencies on economic recovery optimism by Powell & Yellen. President Biden boosted expectations of a strong US recovery as he pledges to accelerate the vaccine program.

USD traded higher against all of the major currencies last week drinving the DXY (USD Index) to its strongest level in four months as Fed speakers and US data indicates improving outlook for the US economy, underpinning the demand for the USD. President Biden has also pledged to accelerate the US vaccine rollout further boosting expectations of a strong US recovery.

Federal Reserve Chairman Jerome Powell told lawmakers on Tuesday that he doesn’t expect the USD 1.9 trillion stimulus package will lead to an unwelcome increase in inflation, but he emphasized that the central bank has tools to deal with rising price pressures if necessary.

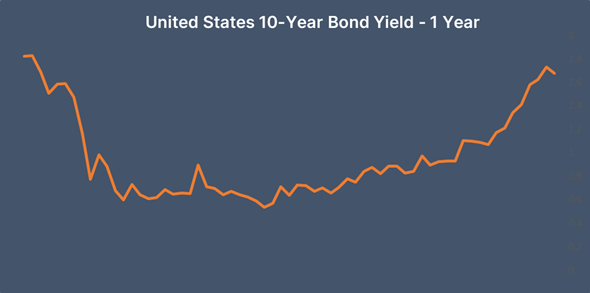

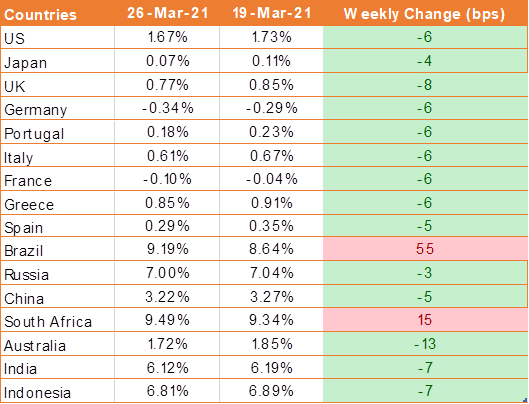

However, the fears of inflation continued to dominate the thoughts of bond traders as UST yields rose sharply on Friday but ended lower for the week as the bond market took a breather from the selling pressure seen across March.

The latest indication of the strength of the U.S. economic recovery came from Thursday’s weekly jobless claims data, which showed the number of people filing last week fell to a one-year low of 684,000 from the 781,000 claims filed during the previous week.

Personal spending dropped 1% against the expectation for a 0.7% decline. Personal incomes fell 7.1% against a -7.3% expectation and the University of Michigan consumer sentiment index was revised up to 84.9 from 83.6.

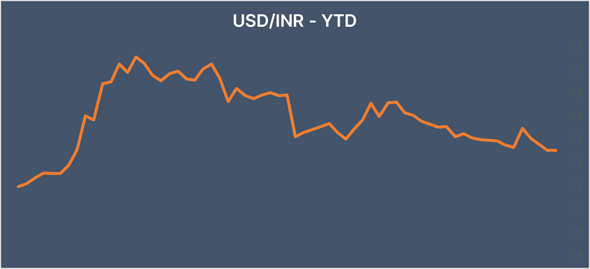

INR stayed clam despite global risk sentiment weakening

INR was steady against the USD last week as the appetite for riskier assets weakened across the globe after a potential outbreak of a third wave of COVID-19 in Europe led to concerns about slower economic recovery in the region. RBI has been buying USD in both spot and forward markets to prevent a sharp appreciation of the INR on the back of high capital flows over the past one year and this kept the INR from weakening even as USD strengthened against majors.

We would love to hear back from you. Please Click here to share your valuable feedback