Synopsis: RBI announced a Gsec acquisition program, G-SAP, for Rs 1 trillion for the current financial year quarter to help the market absorb government borrowing. This can lead to high inflation, hurting bond investors down the line.

RBI G-SAP and its effect on inflation

The government is scheduled to borrow Rs 12 trillion from the bond market this year and RBI is providing support to the borrowing by purchasing bonds through its G-SAP program. This is similar to the QE of the Fed and increases the balance sheet of the RBI as well as making the central bank one of the largest holders of government bonds.

The G-SAP program can help government borrow at lower levels of yields and fund higher fiscal deficit to push up growth in the economy. Along with growth, inflation too will pick up as demand for goods and services rise.

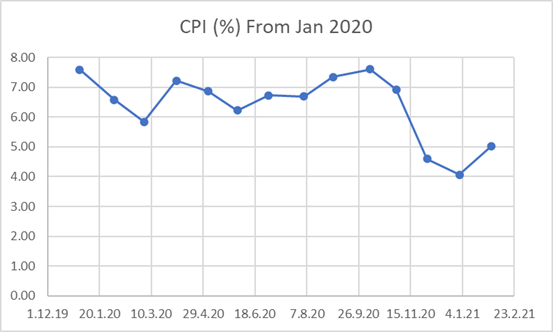

RBI is willling to tolerate inflation at levels of 6% to push up growth in the covid hit economy. However, inflation can rise sharply higher if demand shoots up without corresponding increase in supply leading to rising prices. Global factors too contribute to inflation with high commodity prices and other supply chain factors.

Current inflation scenario

Ultra-loose monetary policy stance across the world has led to a surge in liquidity in the markets, causing supply-demand mismatch for many commodity products. The climate change theme also played out to rise in demand for commodities that are used to build renewable energy infrastructure. Energy-based commodity prices over the past six months have increased by 55%, the increase in non-energy-based commodity prices is 20% causing inflationary pressures. Brazil's central bank hiked interest rates by 75bps as policymakers are concerned more with upside risks to inflation than downside risks to growth.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield came down by 14 bps to 6.02%. 5.77% 2030 yield decreased by 8 bps to 6.24%. 5-year benchmark bond, 5.22% 2025 yield declined by 5 bps to 5.54%. 6.57% 2033 yield lost 3 bps to 6.67%. On the other hand, long term paper 7.16% 2050 yield came down by 3 bps to 6.77%.

The spread of 10-year bond over 5-year bond (5.22% 2025) came down to 48 bps from 57 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 65 bps from 54 bps while 30-year benchmark over 10-year benchmark spread increased to 74 bps from 60 bps.

In the SDL auction conducted last week, average 10-year SDL yield came down to 6.75% from 6.85% previous week. Consequently, spread with G-sec benchmark stood at stable at 72 bps against 71 bps in previous week.

On weekly basis, 1-year OIS yield remained unchanged at 3.86% while 5-year OIS yield declined by 8 bps to 5.17%.

We would love to hear back from you. Please Click here to share your valuable feedback