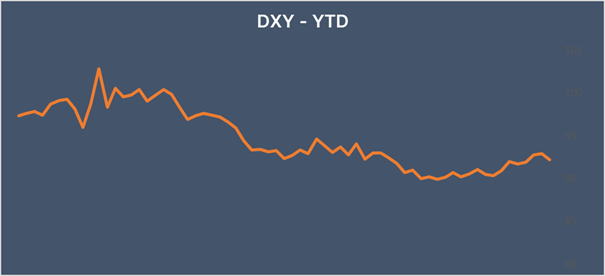

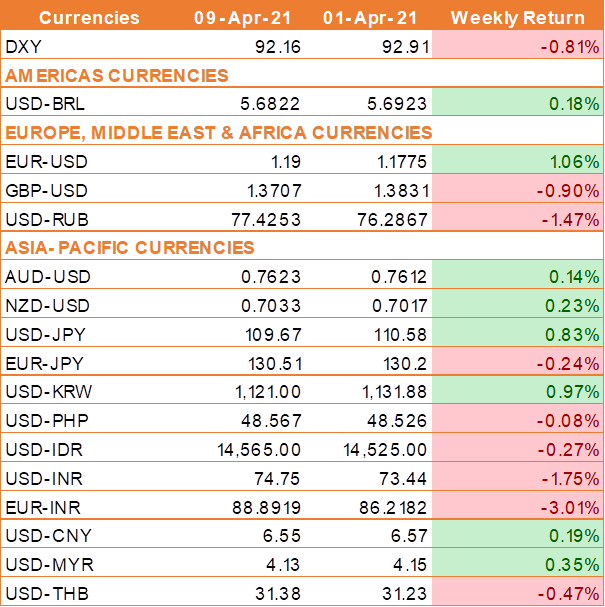

Synopsis – USD weakened as Fed stuck to its accommodative stance while acknowledging signs that the economic recovery in the US is picking up. INR extends losses on rising covid cases & dovish RBI.

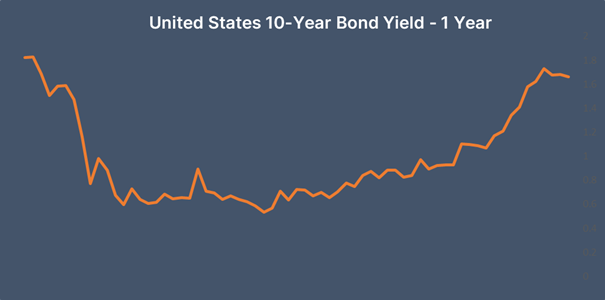

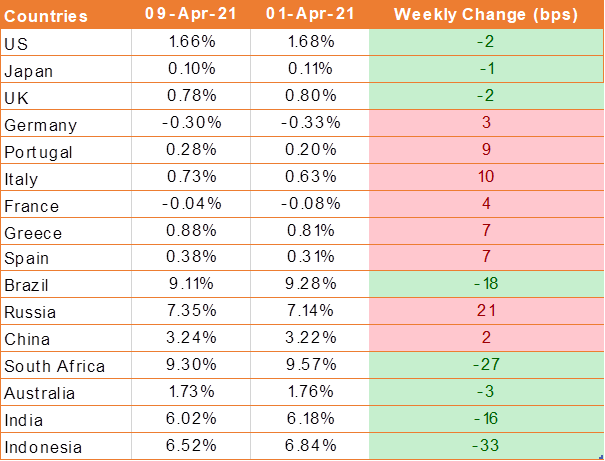

USD traded near its lowest level in more than two weeks against its major peers, tracking Treasury yields lower, after minutes of the Federal Reserve's March policy meeting offered no new catalysts to dictate market direction.

The minutes for the U.S. central bank’s last meeting showed that the officials remained cautious about the country’s economic recovery from the ravages of the coronavirus pandemic, even while acknowledging that the recovery was gathering steam, and committed to monetary policy support until a rebound was more secure.

However, the data released on Friday showed that the Producer Price Index (PPI) which measures inflation at the wholesale level surged 1% in March up from 0.5% recorded in February and well ahead of the 0.5% expectation. Annually, PPI inflation rose by 4.2% in March marking a significant jump up from 2.8% in February against the expectation of 3.5% growth. The data supports expectations of higher inflation as the US economy reopens.

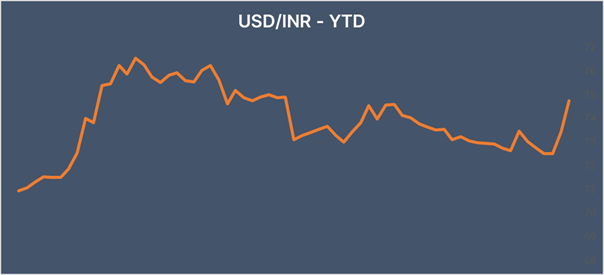

INR extends losses on rising covid cases & dovish RBI

INR continues to remain under pressure following the Reserve Bank of India’s unexpected dovish move on Wednesday. The RBI kept interest rates unchanged but committed to a massive bond-buying programme. The central bank’s accommodative stance comes as inflation remains elevated and resurgence in covid threatens to derail the fragile economic recovery.

The number of new daily covid cases hitting a fresh record high as several states struggled with the second wave of the outbreak whilst also complaining of vaccine shortages. Concerns are rising that the resurgence of covid could knock India’s recovery. Goldman Sachs has downgraded its economic outlook for the current quarter.

We would love to hear back from you. Please Click here to share your valuable feedback