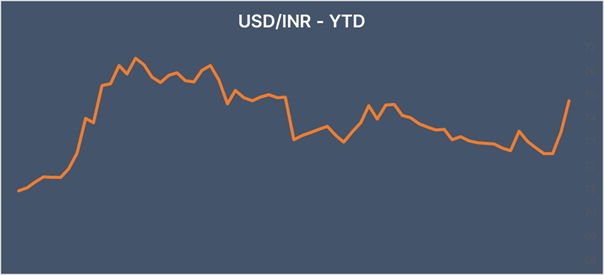

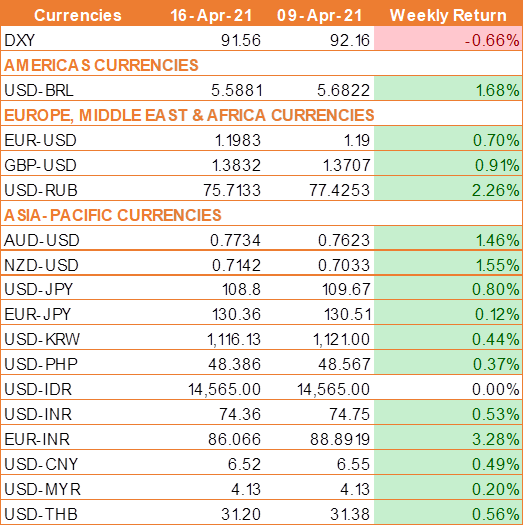

Synopsis – INR, which was on a very strong footing last year with heavy capital flows, low CAD and broad USD weakness is showing stress on inflation, fiscal deficit and surging covid cases. Will this be a long term trend?

INR weakens on data and surging covid cases

CPI inflation for March 2021 came in at 5.52% against 5.03% seen in February 2021. Higher inflation comes in at a time when India is reeling under a 2nd corona virus wave forcing lockdowns across the country. Growth will be hit on lockdowns and fiscal deficit could be higher than the budget target of 6.8% of GDP.

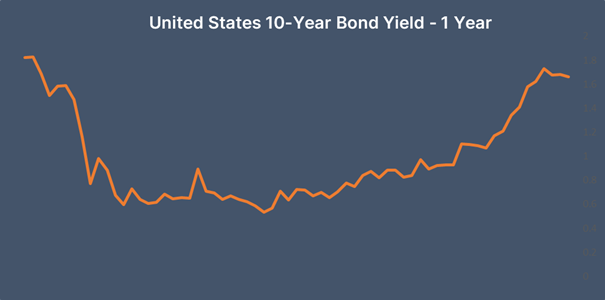

RBI had taken up fx reserves to a record of Rs 585 billion last year, as it absorbed capital flows but if capital flows reverse then the central bank may be forced to sell its reserves to prevent excessive volatility in the INR.

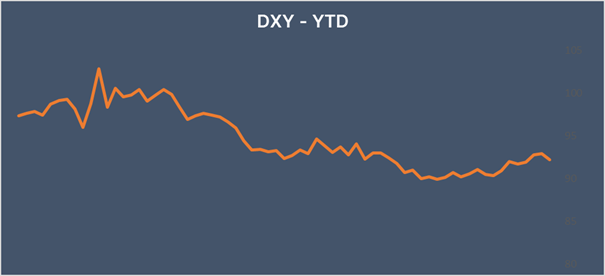

It is too early to tell whether the INR weakness is long term in nature, as globally and particular the US, there is high fiscal deficit, rising inflation expectations on central bank money printing and still uncertain growth. Many countries are in lockdown or going in or just coming out of lockdown.

India, with its largely domestic consumption economy, can still be one of the fastest growing economies in the world. Capital flows can continue to show strength and take the INR higher.

We would love to hear back from you. Please Click here to share your valuable feedback