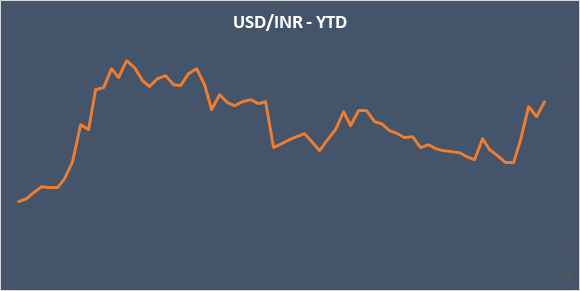

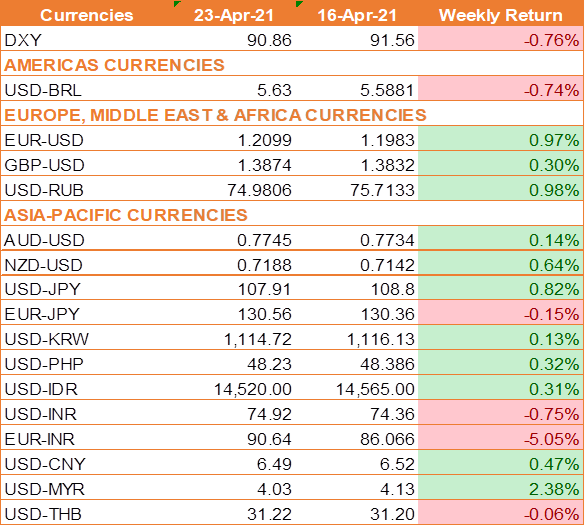

Synopsis- INR depreciated by 0.75% against the USD to touch multi month lows. Factors like surge in covid cases, rise in inflation and rise in oil prices have driven the INR to depreciate. Fear of economic disruption due to lockdown is looming on the back of second wave of corona pandemic.

FIIs may fear the bond market

RBI has been rejecting bids in the government bond auctions last week, a signal that it is not allowing the market to determine the yield curve. FIIs may take this as a sign of yields being kept down against macro fundamentals and may exit INR assets, driving the INR down.

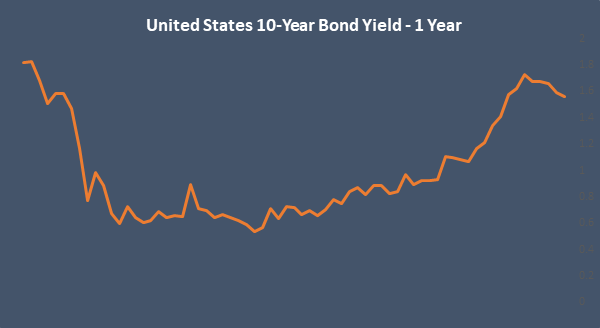

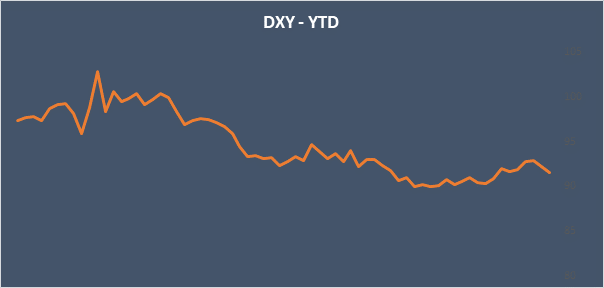

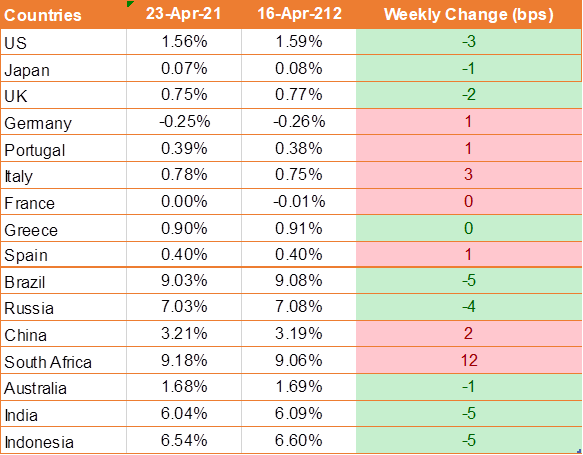

Globally, US 10 year treasury yield declined by 3 bps during last week. US Leading Econmic Index rose 1.3% in March. According to the U.S. Labor Department, Initial jobless claims fell to 574,000 last week from a revised 586,000 a week earlier. It is t1he second straight week with a significant drop in claims, which are now at their lowest level since mid-March 2020.

US President is also expected to deliver on corporate tax hikes, reversing parts of the Trump administration’s Tax Cuts and Jobs Act in 2017. This could in turn help put the brakes on rising inflation expectations, taking pressure off the Fed to normalize monetary policy. This move may keep US treasaury yield from rising too high.

We would love to hear back from you. Please Click here to share your valuable feedback