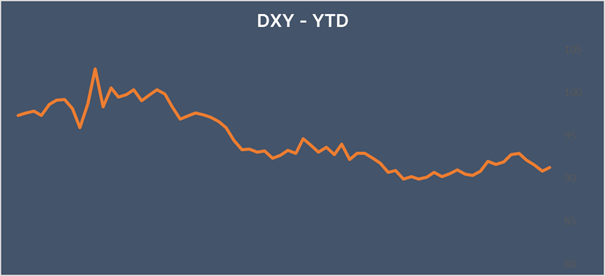

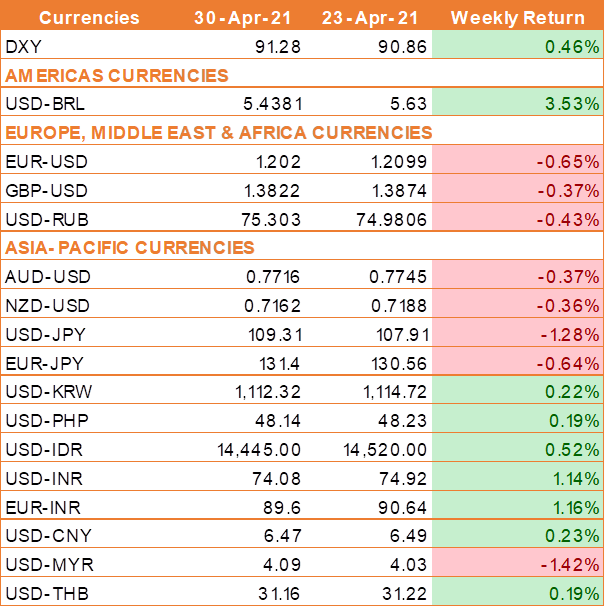

Synopsis – Month-end flows drove the USD higher against all of the major currencies despite the Federal Reserve’s insistence that more improvements are needed in inflation and employment before balance sheet changes can be considered.

USD managed to end the week higher against world currencies despite the Federal Reserve’s insistence that more improvements are needed in inflation and employment before balance sheet changes can be considered. However, the month-end flows drove the USD higher against all of the major currencies on Friday as market participants cannot ignore good economic data.

The data released on Thursday showed that the US economy grew at 6.4% in the first quarter of the year against the growth forecast of 6.1%. US consumer spending rebounded in March as households received additional stimulus checks from the Federal government. Consumer spending surged 4.2% in March after falling 1% in February. US jobless claims printed at 533,000, the lowest level since the start of the pandemic. These economic data indicate that the US economic recovery is well on track.

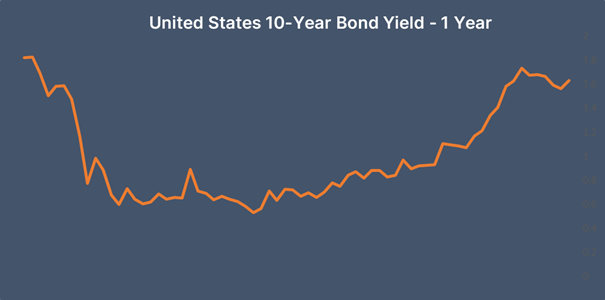

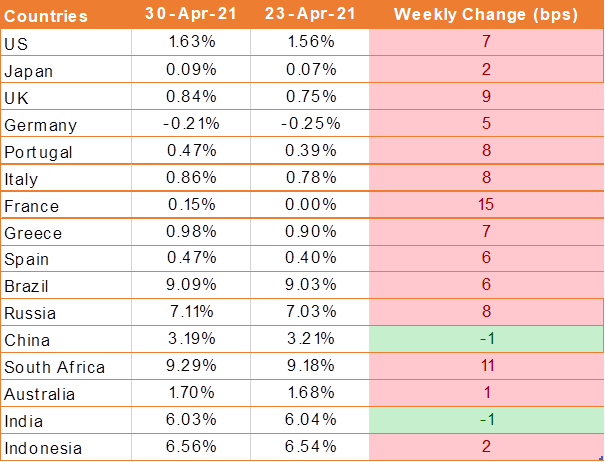

US 10 year benchmark yield rose by 7 bps to 1.63% as the Federal Reserve’s preferred inflation gauge of personal consumption expenditures was up 0.5% in March, taking it up 2.3% year-over-year. Personal incomes jumped 21.1%, marking its largest gain on record, while consumer spending surged 4.2%.

Dallas Fed President Robert Kaplan said the U.S. central bank should start talking about tapering its asset purchases, in contrast with Fed Chairman Jerome Powell’s comments that speculation about tapering was premature.

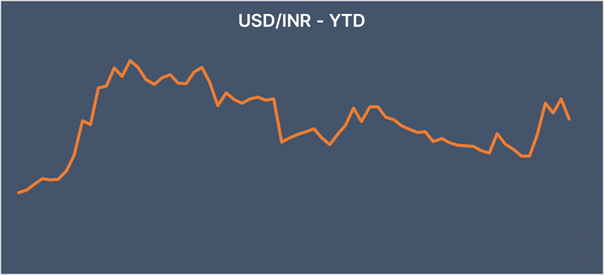

INR traces domestic equity market higher

Despite the dire situation the INR is rising against the USD, tracing the domestic equity market higher. Indian shares gain for a fourth straight day, climbing to the highest level since mid-March on the back of upbeat earnings reports.

We would love to hear back from you. Please Click here to share your valuable feedback