Synopsis: RBI will keep rates low and liquidity high for covid relief to economy even as inflation spikes. Riskier fixed income products will find flavour.

Lockdowns to keep rates down even as inflation spikes

Surging corona virus cases across the country is forcing full lockdowns in many states, which will derail economic growth. Given the fresh wave of cases, RBI has announced new measures including cheap funding for health care infrastructure and bond markets are now inclined towards a long period of low rates and accommodative policy even if prospects of inflation spiking looms large.

Inflation has been trending well above 5% levels for a while and is expected to rise over the next few months. Seasonal factors such as monsoons will affect food supply while core inflation will be driven higher by high global commodity prices and disruption to supply chains on the back of lockdowns and restrictions.

Government fiscal deficit budgeted at 6.8% of GDP for this year is also a driving factor for inflation as government spending is largely inflationary in nature especially when there is disruptions in supply.

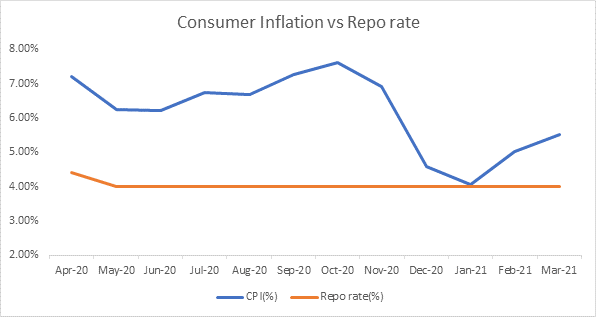

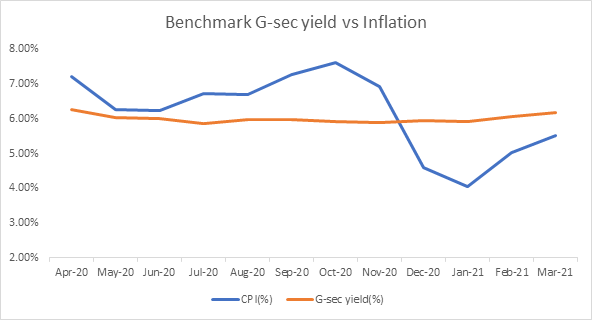

Real interest rates have been negative for a while going by repo rate to inflation spread and will stay negative for a while as repo rates are kept low. RBI is also keeping a tight lid on 10 year government bond yields, which is keeping real interest rates low to negative even at the 10year gsec level.

Riskier fixed income products to find flavour in the market

Given real negative interest rates, which means that returns on government bonds and fixed deposits are actually negative, markets will start to embrace riskier fixed income investments. This will include corporate bonds with relatively high credit spreads, structured bonds that can help junk rated issuers to raise debt and other such fixed income products. In one way, negative real interest rates are good for developing the corporate bond markets.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield declined by 1 bps to 6.02%. 5.77% 2030 yield decreased by 2 bps to 6.17%. 5-year benchmark bond, 5.22% 2025 yield came down by 4 bps to 5.34%. 6.57% 2033 yield remained unchanged at 6.56%. However, the long-term paper 7.16% 2050 yield rose by 1 bps to 6.82%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 68 bps from 65 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 54 bps from 53 bps while 30-year benchmark over 10-year benchmark spread increased to 80 bps from 77 bp.

In the SDL auction conducted last week, average 10-year SDL yield remained unchanged at 6.78% seen in the previous week. However, spread with G-sec benchmark rose to 77 bps from 73 bps.

On weekly basis, 1-year OIS yield came down by 4 bps to 3.71% while 5-year OIS yield declined by 18 bps to 5.00%.

We would love to hear back from you. Please Click here to share your valuable feedback