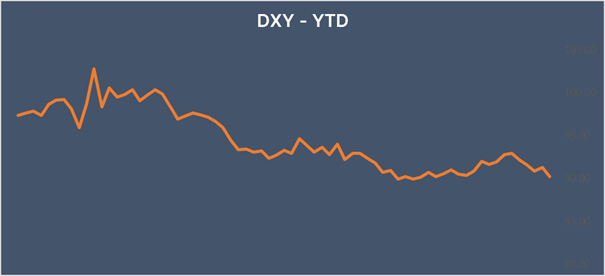

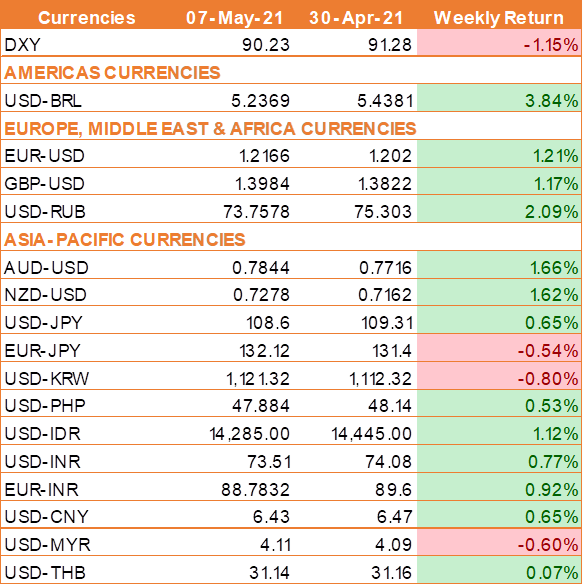

Synopsis – USD fell to its lowest level in more than two months on Friday after U.S. jobs data for April came in well below expectations, dampening hopes that a roaring economic recovery would spur higher rates.

USD traded sharply lower against all of the major currencies after the release of weak non-farm payrolls report. Market participants were expecting around 1 million jobs to be created during last month. However, to everyone’s surprise, only 266,000 jobs were created in April.

Job growth in March was revised lower as well, with the unemployment rate rising to 6.1% (it was expected to fall to 5.8%). The only good news was wage growth, which accelerated 0.7% against a forecast of zero growth.

Weak U.S. job data dampen the hopes that a roaring U.S. economic recovery would spur higher interest rates, which means U.S. interest rates will stay at ultra-low levels for quite a while and that is going to keep the pressure on the USD.

The closely watched ISM manufacturing PMI unexpectedly dropped sharply in April after a strong first quarter. The PMI came in at 60.7, down from March’s 64.7 and below the expectation of 65.

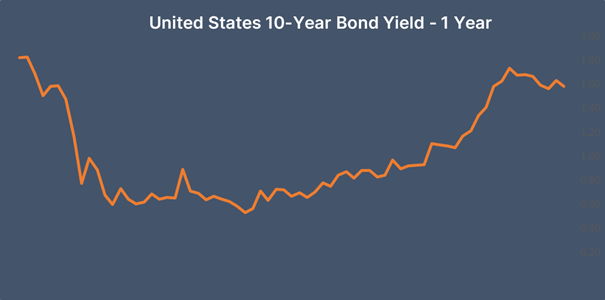

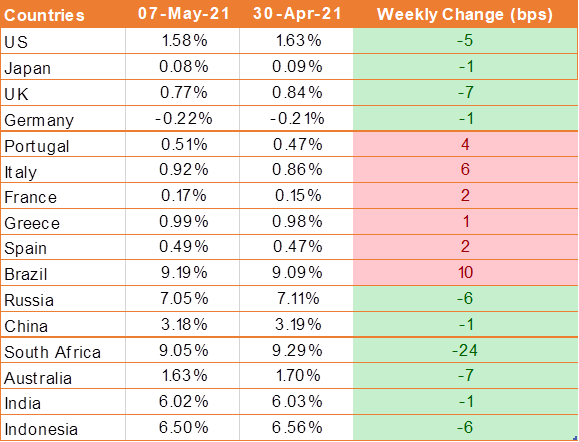

U.S. Treasury yields fell below 1.50% Friday, for the first time since early March, after a much weaker-than-expected monthly U.S. employment report, but then yields completely retraced their drop by the end of the session of Friday and ended the week at 1.58% down by 5 bps.

U.S. Treasury Secretary Janet Yellen said at a virtual meeting on Tuesday that “It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat. Even though the additional spending is relatively small relative to the size of the economy, it could cause some very modest increases in interest rates.”

Yellen later tried to row back on the significance of these remarks, but the mere mention of U.S. tightening spooked a market that has become so influenced by the Federal Reserve’s monetary stimulus.

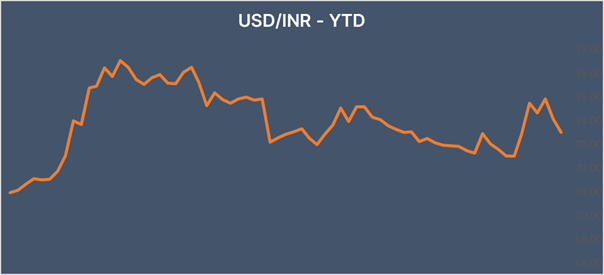

INR rises despite covid cases hitting fresh record

INR ended the week higher against USD largely due to USD broad weakness. However, the outlook for the INR remains weak as the covid crisis continues to impact the country. The International Monetary Fund warned that the recent surge in covid cases poses a downside risk to India’s economic outlook reports.

We would love to hear back from you. Please Click here to share your valuable feedback