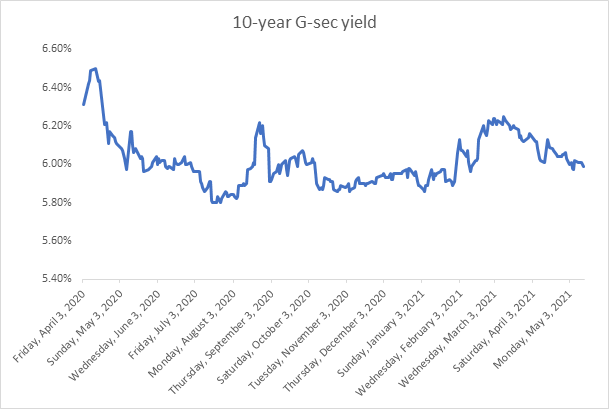

Synopsis: RBI rejected all bids for the 10year G-sec in last week’s bond auction, prompting market to ask “what is the right yield according to RBI?”

RBI rejects all auction bids, for the 3rd time this fiscal year

Much to the bond market’s surprise, RBI rejected all bids for the Rs 140 billion auction of 5.85% 2030 government bond, which is the benchmark 10 year bond. Normally at the beginning of the fiscal year, RBI auctions out a new 10 year bond, but this year, there has been no announcement of the new benchmark 10 year bond auction till date.

Bond market is being placed in a tight spot, as without a new 10 year bond, uncertainty on yield levels grow. RBI is spooking the market by rejection of bids and this adds to the uncertainty on yields.

So then, what is the right level of yield on the 10year bond?

Does RBI have a model that throws out the right level of yield on the 10year bond? Is it 6%, 5.9%, 5.8% or anywhere in between? It is definitely not over 6% given the rejection of bids in the auction of the 5.85% 2030 bond, which is trading at over 6%.

If a new bond maturing in 2031 is issued, which becomes the 10 year benchmark bond, what should be the yield. Will RBI reject all bids if yield is not right as per its model or will it work with a few large institutions to bid for the bond at a pre-determined level of yield?

If RBI has a 10year level in mind, it should explicitly say so and target the level through bond purchases. Bank of Japan targets the 10-year bond at 0% levels and makes purchases of the bond at that level.

Targeting a level can make the market play around the curve rather than worry of where the curve should be.

India’s consumer inflation eased to 4.29% on yearly basis in Apr’21 from 5.52% in March’21. The Consumer Food Price Index (CFPI) softened to 2.02% in the month of April from 4.87% in previous month.

Domestic industrial output expanded by 22.4% on yearly basis in March’21 as compared to -18.7% in March 20. Cumulatively, industrial output contracted by 8.6% in FY21.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield declined by 3 bps to 5.99%. On the other hand, 5.77% 2030 yield increased by 2 bps to 6.19%. 5-year benchmark bond, 5.22% 2025 yield rose by 4 bps to 5.38%. 6.57% 2033 yield moved up by 6 bps to 6.62%. Long-term paper 7.16% 2050 yield rose by 3 bps to 6.85%.

The spread of 10-year bond over 5-year bond (5.22% 2025) declined to 61 bps from 68 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 63 bps from 54 bps while 30-year benchmark over 10-year benchmark spread increased to 85 bps from 80 bps.

In the SDL auction conducted last week, average 10-year SDL yield rose to 6.80% from 6.78% in the previous week. Consequently, spread with G-sec benchmark rose to 79 bps from 77 bps.

On weekly basis, 1-year OIS yield rose by 2 bps to 3.73% while 5-year OIS yield increased by 11 bps to 5.11%.

We would love to hear back from you. Please Click here to share your valuable feedback