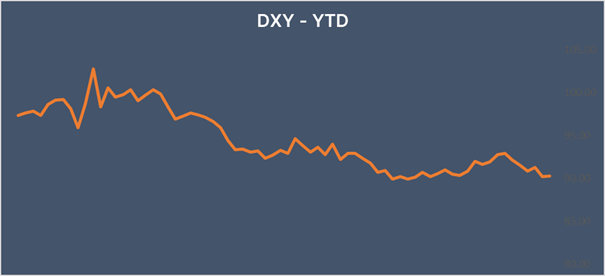

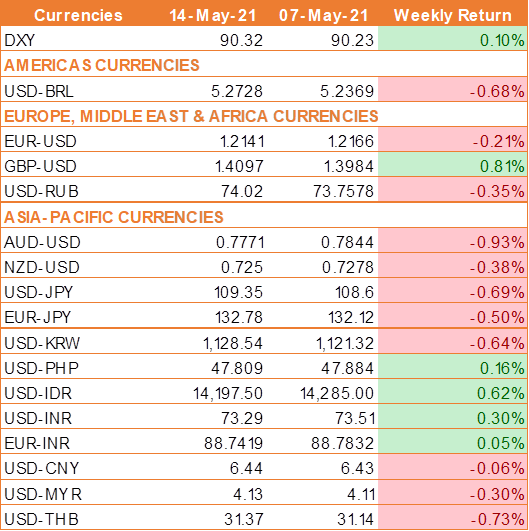

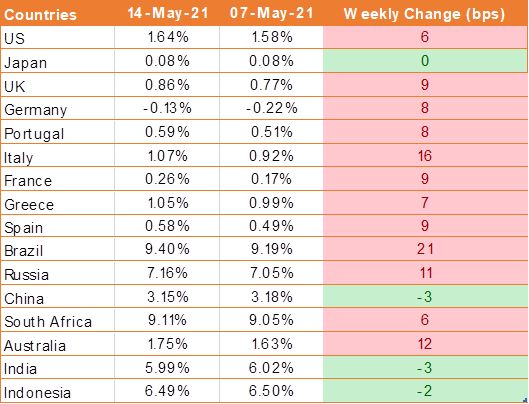

Synopsis – USD & UST yields rose sharply after the market reacted to the data which revealed that US inflation surged in April. INR ended the week lower against USD as retail inflation for April weakened to 4.29%.

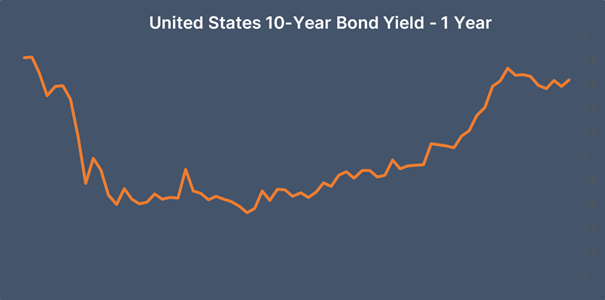

USD & UST yields rose sharply after the market reacted to the data which revealed that US inflation surged in April. Inflation, as measured by the consumer price index jumped 4.2% year on year. This was the highest CPI reading in 13 years. Market participants were expecting inflation to increase by 3.6%. Core inflation, which removes more volatile items such as food and fuel also surged higher to 3%.

The jump in inflation boosted market expectations that the Fed would move sooner to tighten monetary policy to prevent the economy from overheating.

Federal Reserve Vice Chairman Richard Clarida on Wednesday, after the CPI data was released, said that he was more worried about the health of the U.S. labor market than high inflation. He further said that the CPI data was a bit of a surprise but emphasized that he viewed the move as temporary.

However, inflation shock that started with higher than expected consumer price data on Wednesday subsided somewhat after retail sales data for April showed no growth after a big jump in March. The yield on the U.S. 10-year benchmark bond slipped to 1.63% after rising to 1.69% on Wednesday.

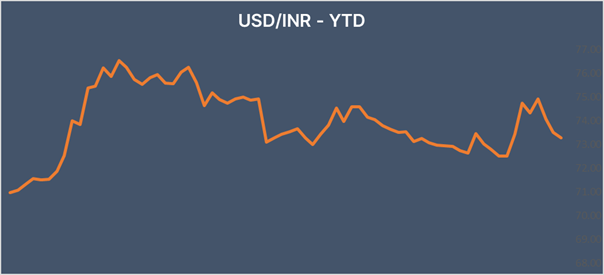

INR fell as retail inflation decline to 4.29% in April

INR ended the week lower against USD as retail inflation for April weakened to 4.29%. Meanwhile, the Index of Industrial production surged over 22% year on year in March thanks to the low comparison last year. The weaker inflation is likely to be well received by the central bank, enabling them to continue with supportive measures amid the ongoing covid crisis.

We would love to hear back from you. Please Click here to share your valuable feedback