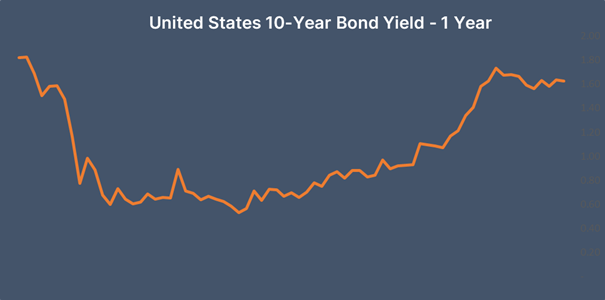

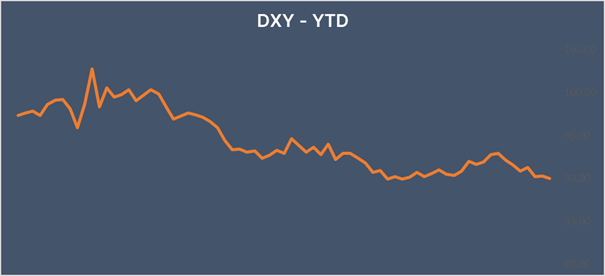

Synopsis – USD & UST yields fall even as market participants wrestle with the prospect of rising inflation.

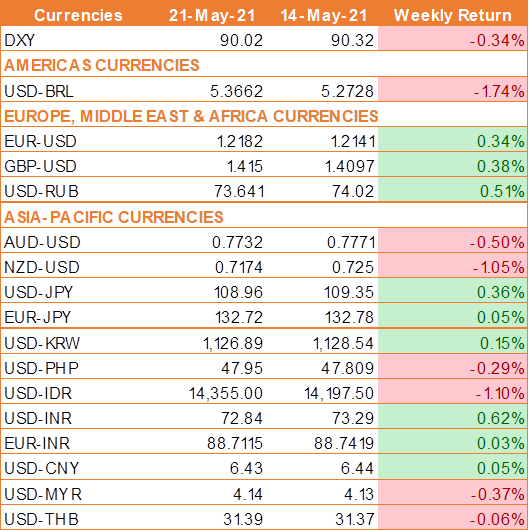

USD edged lower last week as fears over rising inflation and an earlier move by the Fed to taper its bond purchases eased. Additionally, the economic recovery from COVID-19 gave other currencies a boost against the USD.

Data this week continued to show that the US economic recovery is on the right track. US jobless claims fell to the lowest level since the pandemic. 444,000 U.S. citizens applied for unemployment benefits last week. This was down from 473,000 in the week before last.

In the minutes of the Federal Open Market Committee (FOMC)'s latest meeting, released on Wednesday, several policymakers suggested that the central bank start scaling back asset purchases “at some point” if the U.S. continues its economic recovery. This slight change of tone from the Fed boosted expectations that the Fed could move on interest rates sooner, lifting the USD.

The market participants were caught by surprise as Fed Chairman Jerome Powell and other Fed officials had reiterated earlier that the Fed would stick to its current dovish policy as any rising inflation would be temporary.

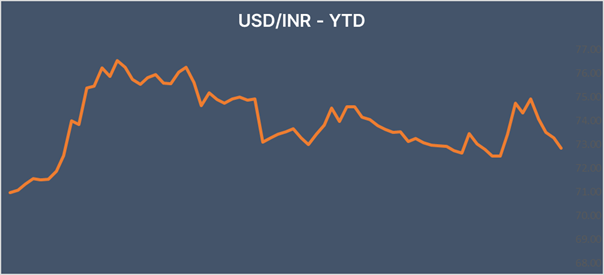

INR rises as domestic equities jump

INR trades higher last week as the equity market surged higher, helped by a rebound in financials and as new covid cases remained below 300,000 for a 5th consecutive day.

Net Foreign Direct Investment into the country hit a fresh high of USD 43,366 billion in the year ending March 2021 according to data from the Reserve Bank of India.

We would love to hear back from you. Please Click here to share your valuable feedback