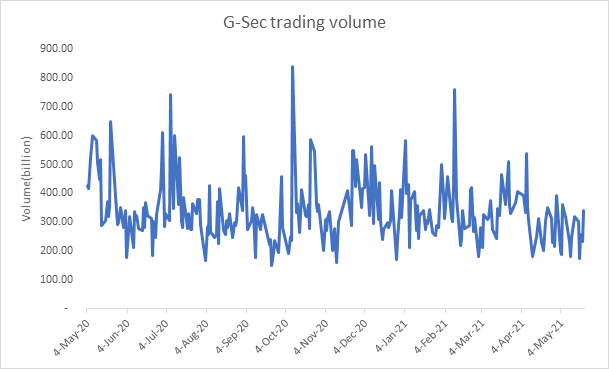

Synopsis: RBI dividend, GSAP, operation twist and bond switches have effectively pegged bond yields, leaving the bond market to almost stop trading.

Trading volumes in government bond market has thinned considerably on the increasingly stronger bond between the government and RBI. This leaves the market in a bind as the heavy supply of government bonds requires healthy market to offload positions for underwriters and traders.

Government, RBI bond

RBI is transferring Rs 991 billion to the government as dividend. This dividend forms part of budget for the government. RBI’s earnings largely come from the interest received from government bonds as well as interest from its foreign currency assets largely in deposits and foreign government bonds. Given that interest rates are close to 0% and even below 0% in US and Eurozone, RBI earns literally nothing from its foreign currency investments. Hence the dividend paid to the government is predominantly from its earnings from government bond investments.

RBI is buying Rs 1 trillion of bonds this quarter as part of its GSAP program and has already bought bonds worth Rs 600 billion. This bond buying is to help the government go through its borrowing program for the year without a sharp rise in interest costs.

The more bonds RBI purchases, the more dividend the government receives. Effectively the borrowing cost to the government is almost zero if RBI buys bonds. This is a cozy relationship between government and RBI.

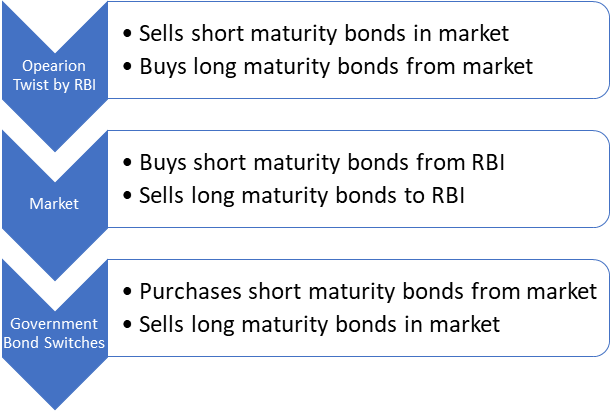

Government also does bond switches as it purchases short maturity bonds from the market and sells long maturity bonds. RBI conducts operation twist as it sells short maturity bonds and buys long maturity bonds from the market. In effect, the market buys short maturity bonds from RBI and sells it to the government and then buys long maturity bonds from government and sells to RBI.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield declined by 1 bps to 5.98% while the 5.77% 2030 yield decreased by 4 bps to 6.15%. 5-year benchmark bond, 5.22% 2025 yield declined by 6 bps to 5.32%. 6.57% 2033 yield came down by 9 bps to 6.53%. Long-term paper 7.16% 2050 yield declined by 1 bps to 6.84%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 66 bps from 61 bps in previous week. The 15-year benchmark over 10-year benchmark spread declined to 55 bps from 63 bps while 30-year benchmark over 10-year benchmark spread increased to 89 bps from 85 bps.

On weekly basis, 1-year OIS yield remained unchanged at 3.73% while 5-year OIS yield decreased by 2 bps to 5.09%.

We would love to hear back from you. Please Click here to share your valuable feedback