Synopsis: SDL spreads over the government bond has risen from lows of below 50bps to over 80bps in the last few months indicating stickiness of yields at higher levels.

SDL yields and spreads to stay at higher levels

SDL yields have risen from lows of 6.4% to over 6.8% in the last few months while spreads have moved up by 30bps to 40bps. The higher SDL yields suggest that the market is not seeing the 10 year government bond yield go down to below 6% levels even as RBI is keeping a target of 6%.

RBI 6% target

RBI is implicitly signalling a 6% target yield on the 10 year government bond by devolving auctions on the underwriters or by rejecting bids in auctions. In the last auction held on the 28th of May, RBI devolved over 50% of the Rs 140 billion auction of the 5.85% 2030 bond on to the primary dealers at a yield of 5.99%. This indicates that RBI does not want the 10 year yield to cross 6%%. RBI in the previous auctions had rejected all bids for the same bond as it did not want to give the bond at over 6% yields to the market.

SDL yields and spreads come off from highs but stay well above lows

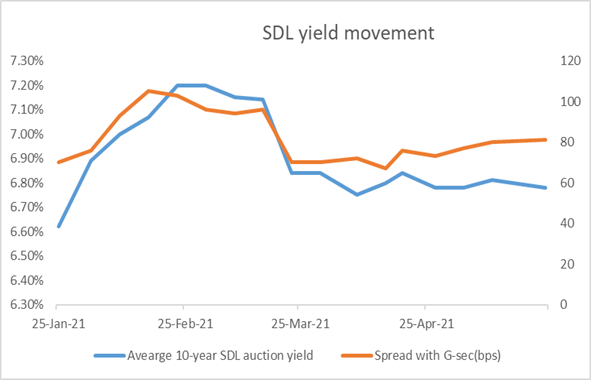

In post-budget scenario, State Development Loan (SDL) yield spiked during Feb 2021 driven by more than expected government borrowing and fiscal deficit. As of end of Feb 21, average SDL cut-off yield rose to 7.20% from 6.62% on 25th Jan 2021 in tandem with government bond yield movement.

However, SDL yield moderated during April & May driven by fall in government bond yields due to RBI’s various steps such as Operation Twist & G-SAP to keep bond yield at a lower level. As of 24th May 21, average SDL yield stood at 6.78% with a spread of 81bps as compared to 6.62% with 70 bps spread on 25th Jan 2021.

In a major boost to state finance, The Reserve Bank of India (RBI) has permitted the states to withdraw from the consolidated sinking fund to meet their redemption commitments. This could cover 45% of their payments for this fiscal. In addition to it, the central government decided to increase borrowing limits of states from 3% to 5% of GSDP for FY 21. States have borrowed Rs 0.59 billion so far in FY22.

During FY21, RBI had conducted first ever SDL OMO purchase auction to stabilize SDL yield. OMOs can be expected if situation requires. Also more fiscal incentives are likely to be announced by Union Government to mitigate financial burden on states in near future. Therefore, considering all these factors, it is likely that SDL yield will be in a range bound mode going ahead.

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 2 bps to 6% while the 5.77% 2030 yield increased by 2 bps to 6.17%. 5-year benchmark bond, 5.22% 2025 yield remained unchanged at 5.32%. 6.57% 2033 yield rose by 7 bps to 6.60%. Long-term paper 7.16% 2050 yield rose by 7 bps to 6.91%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 68 bps from 66 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 60 bps from 55 bps while 30-year benchmark over 10-year benchmark spread increased to 90 bps from 89 bps.

Average SDL auction cut-off stood at 6.78% with a spread of 81bps during auction conducted on 24th May 21,

On weekly basis, 1-year OIS yield remained unchanged at 3.73% while 5-year OIS yield decreased by 3 bps to 5.06%.

We would love to hear back from you. Please Click here to share your valuable feedback