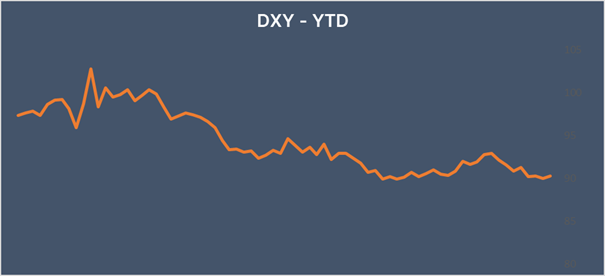

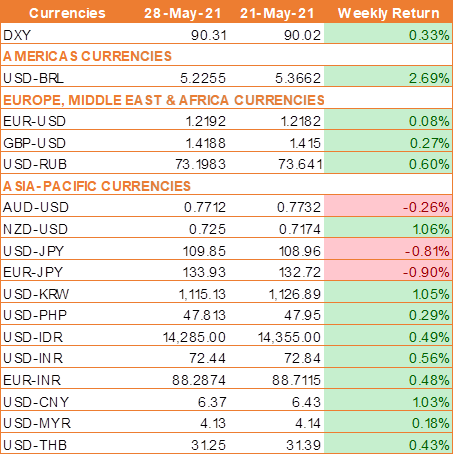

Synopsis – USD exhibited high volatility last week but managed to end the week higher, finding support from comments suggesting the Federal Reserve will soon have to discuss tapering its massive bond-buying program.

Fed to taper bond purchases

Earlier this week many Fed officials sought to downplay immediate concerns that rising inflationary pressures will force the central bank to tighten monetary policy sooner than its previous guidance would suggest.

However, USD received support on Wednesday when Randal Quarles, the Fed Vice Chairman for Supervision, stated that the central bank will need to start discussing shortly plans to reduce its bond purchases if the economy continues to show massive improvement as it emerges from the pandemic.

A key Fed inflation indicator (PCE) rose a faster-than-expected 3.1% in April. The core PCE index was expected to increase by 2.9% after rising 1.9% in March.

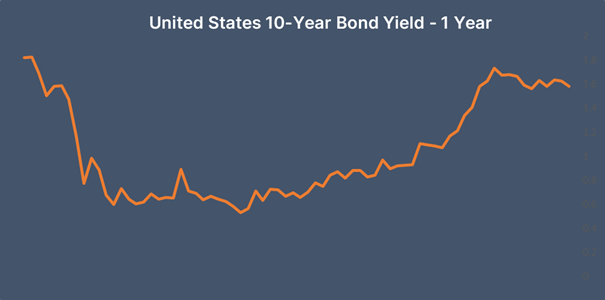

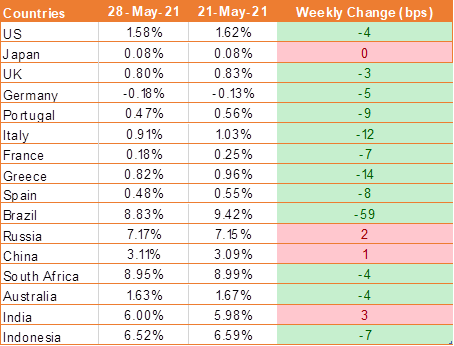

U.S. Treasury yield fell last week by 4 bps and is currently at 1.58% as the market largely shrugged off a rise in U.S. core inflation above the Federal Reserve's target. However, yield did rise last week amid expectations that President Biden will announce a USD 6 trillion increasing to Federal spending in the budget for 2022. The spending would come in addition to the USD 1 trillion infrastructure spend.

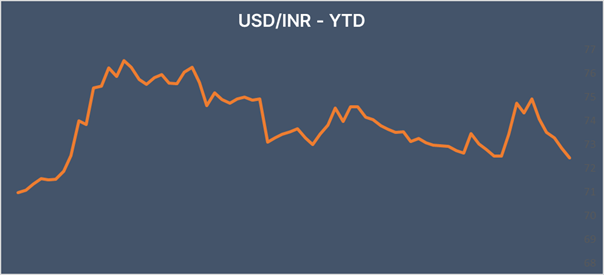

INR rises tracing equities higher even as RBI warns of bubble

INR traded higher last week as it continued to trace the equity market. Indian assets are being boosted by declining covid cases in India and optimism is building surrounding the easing of pandemic restrictions.

The central bank warned that the recent surge in domestic equities, despite an 8% contraction in FY21 GDP poses risks of a bubble. Separately the RBI noted that the revival in private consumption was key for the post covid recovery which depends on the speed at which the second wave can be brought under control.

We would love to hear back from you. Please Click here to share your valuable feedback