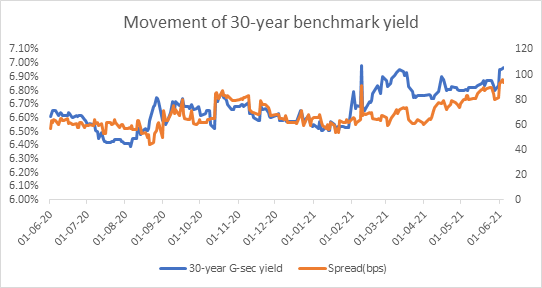

Synopsis: The spread of the 30 year bond yield over the 10 year bond yield has risen sharply over the last one year indicating that the market expects inflation to overshoot RBI’s estimates by a wide margin.

RBI has no control over the 30 year bond yield

The long bond yield is a very good indicator of the market’s inflation expectations, as the bond price is highly sensitive to changes in interest rates. The price of the bond falls steeply when interest rates rise and this usually happens when inflation goes out of control.

The 30 year government bond yield is close to 7% levels and has risen from lows even as RBI is keeping a lid on the 10 year bond yield at 6%. In its policy review on the 4th of June, RBI explicitly stated that it wants to keep the 10 year bond yield at 6% levels and believes that the level is in line with its inflation forecast of 5.1% for this fiscal year.

The 30 year bond is largely the domain of long term investors such as insurance companies and pension funds. Traders tend to be active in the 30 year segment when inflation is expected to fall and interest rates too fall, as prices rise sharply when interest rates fall. However, traders are shying away from the long bond as they believe that inflation and interest rates are bound to rise in the coming years.

Since 1st June 2020, 7.06% 2046 yield rose by 36 bps to 6.97% as of 4th June 2021 while its spread with 10-year benchmark rose to 94 bps from 57 bp during the above mentioned period.

Rise in commodity prices will drive inflation higher in the foreseeable future.

Commodity Price | 1-year change (%) |

Copper | 73% |

Aluminium | 54% |

Zinc | 49% |

Nickel | 39% |

Steel | 48% |

Brent Crude | 105% |

Government bonds, SDL and OIS yield movements.

During the week, 5.85% 2030 yield rose by 3 bps to 6.03% while the 5.77% 2030 yield increased by 3 bps to 6.20%. 5-year benchmark bond, 5.22% 2025 yield rose by 2 bps to 5.34%. However, 6.57% 2033 yield declined by 2 bps to 6.58%. Long-term paper 7.16% 2050 yield rose by 6 bps to 6.97%.

The spread of 10-year bond over 5-year bond (5.22% 2025) rose to 69 bps from 68 bps in previous week. The 15-year benchmark over 10-year benchmark spread declined to 55 bps from 60 bps while 30-year benchmark over 10-year benchmark spread increased to 94 bps from 90 bps.

Average 10-year SDL auction cut-off rose to 6.84% from 6.78% during previous week. Consequently, spread stood at 82 bps as compared to 81bps during previous week.

On weekly basis, 1-year OIS yield remained unchanged at 3.73% while 5-year OIS yield increased by 8 bps to 5.14%.

We would love to hear back from you. Please Click here to share your valuable feedback