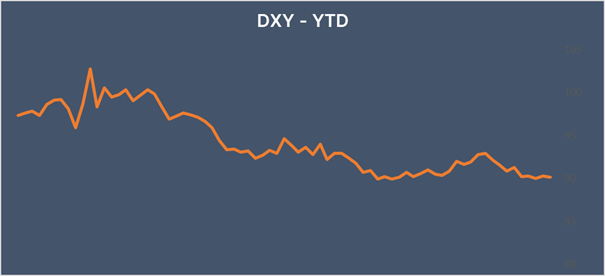

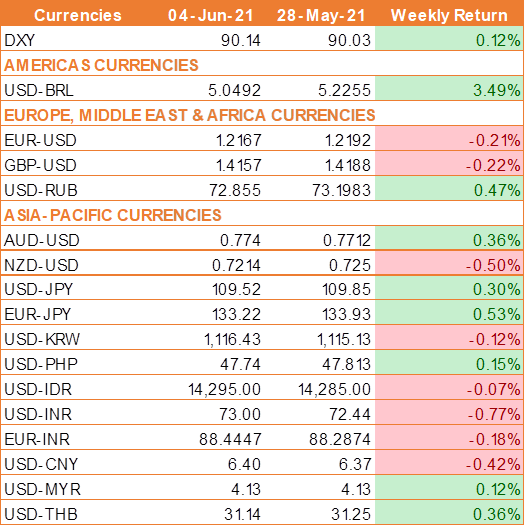

Synopsis – USD traded higher against major world currencies after the release of strong economic data reinforcing the signs that the world's largest economy was on its way to recovery from the COVID-19 pandemic.

U.S. jobs data dims hopes for Fed tightening

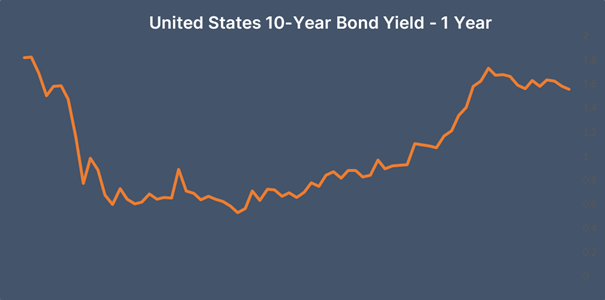

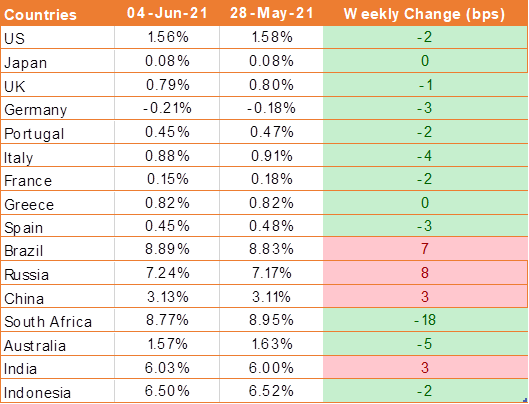

USD traded higher against major world currencies after the release of strong economic data reinforcing the signs that the world's largest economy was on its way to recovery from the COVID-19 pandemic. However, the U.S. monthly jobs report was a major disappointment driving USD to fall sharply against all of the major currencies in response as 10-year Treasury yields slipped by 7 bps to 1.56% on Friday.

The U.S., data released showed that the Core Personal Consumption Expenditure Price Index increased by 3.1% in April on yearly basis, above the 2.9% expectation and 1.9% in March. The index was also above the Fed’s 2% target and posted its largest annual gain since 1992.

U.S. initial jobless claims fell to 385,000 in the previous week. The number of claims recorded a fifth consecutive week of falls to a record low since the start of the COVID-19 pandemic in 2020.

U.S. nonfarm payroll data showed hiring increased in May as the pandemic eased, but not as much as expected, tempering expectations the Federal Reserve will tighten monetary policy soon.

Nonfarm payrolls increased by a solid 559,000 jobs last month, helped by higher COVID-19 vaccination rates, but that was below the expectation of 650,000 jobs added in May.

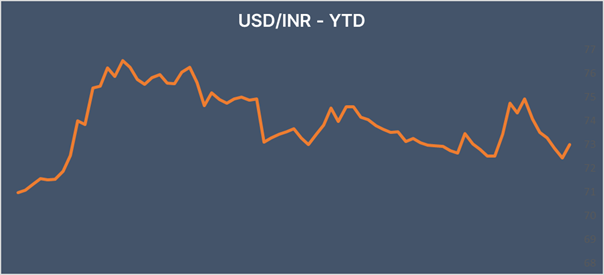

INR falls as RBI keeps interest rates on hold

INR traded lower last week after RBI kept interest rates on hold at record lows as expected. The central bank also announced additional bond purchases to support the economic recovery in India which stands at risk of being derailed by a fierce second wave of covid.

Hit hard by the Covid-19 crisis, India’s manufacturing sector observed the slowest rate of growth in 10 months. The latest figures from IHS Markit India Manufacturing Purchasing Managers’ Index (PMI) moved down from 55.5 in April to 50.8 in May.

We would love to hear back from you. Please Click here to share your valuable feedback