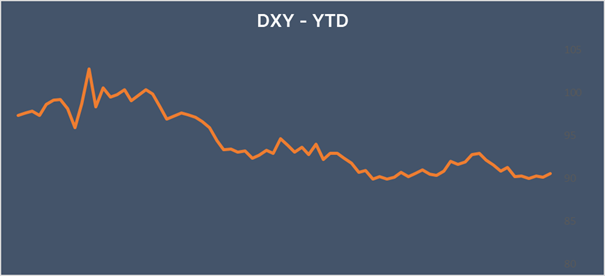

USD edges higher after selling off post CPI data

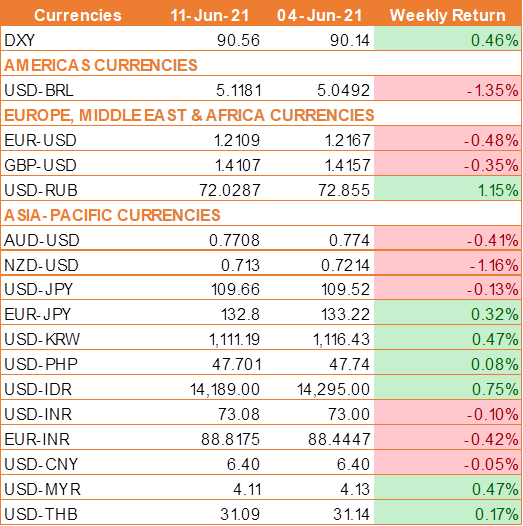

USD ended the week higher against all of the major currencies amid delayed reaction to Thursday’s inflation report. Stronger-than-expected consumer confidence also helped to boost demand for USD ahead of next week’s Federal Reserve monetary policy announcement. U.S. policy-makers have insisted that the increase in inflation is transitory, with disappointing consumer spending and labor market numbers discouraging taper talk next week.

Data released on Thursday saw the U.S. consumer price index jumping 5.0% year-on-year in May, the sharpest rise in 13 years, up 0.6% on the month, while core CPI, increased 3.8% year-on-year and 0.7% month-on-month in May.

The University of Michigan said its preliminary consumer sentiment index increased to 86.4 in the first half of this month from a final reading of 82.9 in May against the expectation for the index to rise to 84.

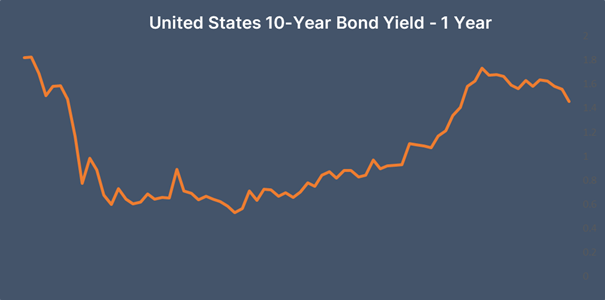

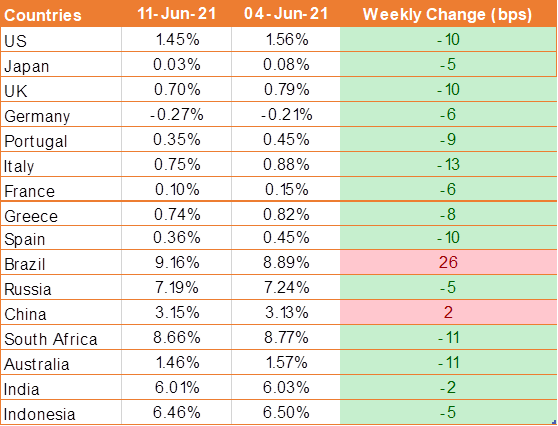

US 10 year benchmark bond yield fell by 10 bps last week as market participants have shaken off U.S. consumer-price data that showed that inflation over the past year escalated to a 13-year high of 5% from 4.2% in the prior month.

Another factor that may also be adding to the fall in yields is increased appetite for Treasurys among banks and money-market funds and fading expectations that the Biden administration will be able to quickly push forward its proposed large infrastructure spending package.

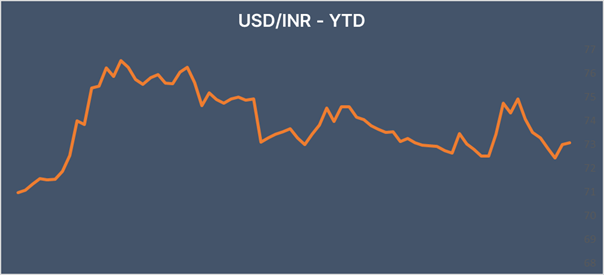

INR falls amid rising inflation expectation

INR ended lower last week against USD despite improving risk appetite as covid cases in the country fell. Rising oil prices acted as a drag on the INR. West Texas Intermediate jumped over USD 70 for the first time since 2018 on rising demand expectations. India’s CPI inflation is expected to rise to 5.3%, up from 4.29% in April.

We would love to hear back from you. Please Click here to share your valuable feedback