US inflation surge in May is prompting the Fed to raise market expectations of rate hikes. However, even with high inflation, rate hikes will start only in 2023. In the meanwhile, Fed will start to taper bond purchases soon before starting to raise rates.

RBI in its June policy has maintained an accommodative stance and has an implicit target of 6% for the 10 year bond yield. Given that a Fed taper could spark off market volatility and a continued rise in India’s inflation could spark off capital outflows, RBI may start to ease off its hold on the 10 year government bond.

US Fed meeting outcome

US FOMC maintained interest rates at 0% with indication of two increases by the end of 2023. In addition to it, US Fed kept the target range for its benchmark policy rate unchanged at zero to 0.25% and to continue asset purchases at a USD 120 billion monthly rate until substantial further progress have been seen on employment and inflation. The monetary committee is projecting US economy to grow at 7% for current fiscal year and raised its headline inflation expectation to 3.4% for 2021, a full percentage point higher than the March projection, but the post-meeting statement continued to say that inflation pressures are “transitory.”

Domestic Inflation surged to 6-month high

India's retail inflation climbed to a six-month high level at 6.30% on yearly basis in May 2021 from 4.23% in previous month. The rise has been driven by higher food, fuel and energy prices. In the same line, Consumer Food Price Index (CFPI) experienced a sharp rise to 5.01% in May 2021 against 1.96% in April 2021. Core inflation also rose to 6.6% in May 2021 from 5.4% in April 2021.

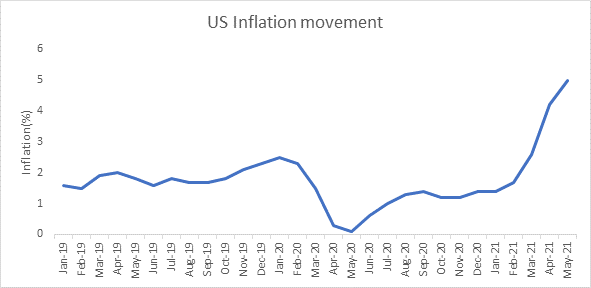

US CPI inflation surge in May 2021

US CPI inflation for May 2021 saw the largest jump in 13 years at 5.1% while core CPI came in at 3 decades high of 3.8%. Fed officials are still downplaying inflation spike but have started to talk of tapering bond purchases in view of inflation and economic recovery. US 10-year treasury yields are hovering at around 1.5%, up by 100 bps from lows seen in 2020.

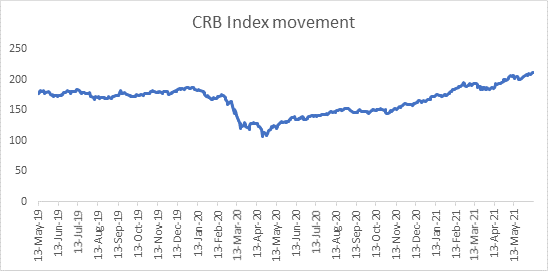

The guidance given by steel producers and their supply chain in recent times suggest that a commodity price boom will continue for a while. Other commodity producers too are bullish on commodity prices including agri commodities.

RBI 6% target on 10-year g-sec is misplaced if inflation spikes

RBI devolved around 70% of the Rs 140 billion 5.85% 2030 g-sec auction on to the primary dealers who underwrite the government bond auction at a yield of 5.99%. The last few auctions of this bonds has seen devolvement and even cancellation of the auction, as RBI firmly held its 6% target. The central bank is holding the 10 year bond yield, as it does not want to send signals that interest rates can rise in the economy.

Given an over optimistic 5.1% inflation forecast, RBI holding 10 year bond yield at 6% is a huge market risk. A sustained rise in commodity prices with a consumption and investment boom will cause inflation to spike and bond investors will be hurt badly as real returns, which are inflation adjusted, turn deeply negative.

Commodity Price | 1-year change (%) |

Copper | 80% |

Aluminium | 62% |

Zinc | 50% |

Nickel | 38% |

Steel | 48% |

Brent Crude | 90% |

We would love to hear back from you. Please Click here to share your valuable feedback